Understanding when to stop submitting sick notes to Universal Credit is crucial for anyone managing a health condition while receiving benefits.

The Department for Work and Pensions (DWP) relies on accurate medical evidence to assess your ability to work, and sick notes, also known as fit notes, play a central role in this process.

Knowing exactly when you’re no longer required to provide them helps prevent unnecessary delays or issues with your Universal Credit claim.

What Is a Fit Note and Why Is It Needed for Universal Credit?

A fit note, also called a sick note or Statement of Fitness for Work, is issued by a qualified healthcare professional, usually a GP.

It outlines whether a person is unfit to work or may be fit for work with certain adjustments. In the context of Universal Credit, fit notes are essential when a health condition prevents a claimant from fulfilling work-related responsibilities.

When claiming Universal Credit due to illness or disability, fit notes serve as official medical evidence. The Department for Work and Pensions (DWP) uses this information to determine whether the claimant should be exempt from searching for work or reduced in their work-related commitments.

Submitting fit notes is done via the claimant’s online Universal Credit journal. A clear photo or scanned copy is uploaded, along with key details such as:

- The start and end date covered by the note

- Name and details of the healthcare professional who issued it

- Any work-related recommendations or conditions specified

Regular submission is vital to avoid gaps in entitlement or interruptions in payments.

How Long Do You Need to Provide Sick Notes When Claiming Universal Credit?

Fit notes are not required during the first seven calendar days of illness. This period allows for self-certification, where the claimant simply informs the DWP of their health condition and the effect it has on their ability to work.

After this seven-day period, fit notes become mandatory. They must be issued by a GP or approved medical practitioner. This ensures the DWP has professional evidence of the ongoing health condition.

As long as the health issue continues and no other decision has been made by the DWP, the claimant is responsible for keeping their fit notes up to date.

Each new fit note should be submitted before the previous one expires. Gaps between notes may result in missed or reduced payments unless adequately explained in the Universal Credit journal.

The general pattern for submitting fit notes is:

| Illness Duration | Action Required |

| 1–7 days | Self-certification, no fit note required |

| 8+ days | Fit note from GP must be provided |

| Ongoing illness | Submit fit notes regularly without gaps |

Claimants should maintain a record of all submitted fit notes and check their journal regularly to confirm acceptance by the DWP.

What Happens After 28 Days of Illness on Universal Credit?

If a claimant’s health condition continues for more than 28 consecutive days, the DWP may refer them for a Work Capability Assessment (WCA).

The purpose of the WCA is to assess how the health condition affects the individual’s ability to carry out work or engage in work-related activities.

A WCA typically consists of two parts:

- A questionnaire known as the UC50 form, which must be completed and returned

- A face-to-face or telephone assessment conducted by a healthcare professional working on behalf of the DWP

While awaiting the WCA and the resulting decision, the claimant must continue to provide fit notes. Failure to do so can result in the suspension of the health-related elements of Universal Credit.

The assessment categorises individuals into one of three outcomes:

- Fit for work

- Limited Capability for Work (LCW)

- Limited Capability for Work and Work-Related Activity (LCWRA)

Until this decision is confirmed, the claimant must maintain medical evidence through updated fit notes.

When Is It Safe to Stop Sending Sick Notes to the DWP?

It is only safe to stop sending fit notes to the Department for Work and Pensions (DWP) once you have received a formal decision regarding your Work Capability Assessment (WCA).

This decision confirms whether your health condition limits your ability to work and what category you fall into. Until then, continued submission of fit notes is essential to ensure that your Universal Credit payments remain active and correctly assessed.

How the DWP Communicates the Decision?

The DWP typically sends the outcome of the WCA through your online Universal Credit journal. This message will clearly state one of the following:

- You are fit for work: This means you are expected to actively look for work and engage in work-related activities. Fit notes are no longer required because your claim is no longer being assessed on health grounds.

- You have Limited Capability for Work (LCW): You are not currently required to look for work, but you might be asked to take steps to prepare for work in the future. Fit notes are no longer needed unless your condition changes significantly.

- You have Limited Capability for Work and Work-Related Activity (LCWRA): This is the highest level of support and means you are not required to work or prepare for work. Once this status is granted, you do not need to continue sending fit notes, unless you begin a new assessment process due to a change in your condition.

You must continue to provide fit notes up to the date the DWP issues this formal decision. Stopping prematurely, even if you feel better or believe a decision is close, may result in gaps in your entitlement, delays in your payments, or a change in your conditionality group without the proper assessment.

The Risk of Stopping Too Early

Some claimants make the mistake of assuming they no longer need to submit fit notes once the WCA has been completed, or after attending a health assessment.

However, the process is not complete until the DWP has formally recorded and shared its decision with you.

Here’s what may happen if you stop submitting fit notes too early:

- Your Universal Credit payment may be reduced: If the DWP believes you are no longer ill, they may place you back in a standard work group and reduce or stop your extra entitlements.

- You may be asked to fulfil job-seeking obligations: Without medical evidence, the DWP could require you to look for work or attend job centre meetings.

- Your claim might be delayed: Missing fit notes can cause administrative delays while your eligibility is re-evaluated.

Continuing Fit Notes Until Confirmation

To ensure there are no issues with your Universal Credit claim, the best practice is to:

- Keep submitting new fit notes as each previous note expires.

- Use your online journal to upload the fit note promptly.

- Monitor your journal for any messages or updates from the DWP.

- Do not rely on verbal confirmation from your work coach; wait for the official decision letter.

This ongoing documentation supports your claim and helps avoid unnecessary disruptions.

What Should You Expect After a Work Capability Assessment?

Once a claimant has reported a health condition, disability, or change in circumstances, they may be referred for a Work Capability Assessment (WCA).

This assessment helps the Department for Work and Pensions (DWP) determine the level of work-related activity a person is able to undertake, and whether they are entitled to additional Universal Credit support.

However, not everyone who reports a health condition will undergo a WCA. Claimants who earn more than £846 a month may not be referred for assessment. The decision to assess is based on both earnings and the nature of the reported condition.

Possible Outcomes of the Work Capability Assessment

Following the WCA, the DWP will send a decision that places the claimant into one of the following categories:

- Fit for work: The claimant is expected to actively search for employment appropriate to their condition. They will receive the standard Universal Credit allowance, with no health-related uplift.

- Limited Capability for Work (LCW): The claimant is not currently fit for employment but is expected to begin preparing for it. They may receive additional support and will be asked to complete tasks like preparing a CV or attending skills workshops.

- Limited Capability for Work and Work-Related Activity (LCWRA): The claimant is not expected to work or prepare for work. They may be eligible for an additional element in their Universal Credit payment.

Claimants placed in the LCW or LCWRA categories can still work if they feel able to. In such cases, they may be entitled to a work allowance, which is an amount they can earn before their Universal Credit payments begin to reduce.

Claimant Commitment and Reassessments

Each claimant must sign a Claimant Commitment. This outlines the responsibilities they must meet to continue receiving Universal Credit. The contents of the commitment depend on the individual’s WCA outcome and circumstances.

- Those found fit for work are expected to look for suitable jobs.

- Those in the LCW group must engage in preparatory activities.

- Those in the LCWRA group are not required to take any work-related steps.

Future reassessments may be required depending on changes in health or circumstances. However, if a claimant starts working and their condition remains stable, they may not need to undergo another WCA unless they report a significant change in their health status.

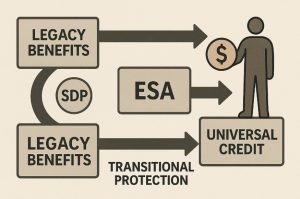

Can You Get a Transitional Protection Payment If You Receive the Severe Disability Premium?

Individuals who receive, or are entitled to, the Severe Disability Premium (SDP) may qualify for a transitional protection payment when moving to Universal Credit.

This extra support helps bridge the gap for those who would otherwise be financially worse off due to the transition from legacy benefits.

In many cases, transitional protection is applied automatically, though some individuals may need to take additional steps to ensure they receive it.

Eligibility Criteria for Transitional Protection

Claimants are generally eligible for the transitional protection payment if they meet the following requirements:

- They or their partner received, or were entitled to, Income Support, income-based Jobseeker’s Allowance (JSA), or income-related Employment and Support Allowance (ESA)

- They received, or were entitled to, the Severe Disability Premium (SDP) within the month before the first day of their Universal Credit claim

- They remained eligible for the SDP at the start of the Universal Credit claim

- They are not joining an existing Universal Credit claim

Couples receiving the higher rate of SDP must also meet additional criteria in the first month of their UC claim. Specifically, no one must be receiving Carer’s Allowance, Carer Support Payment, or the carer element of Universal Credit for supporting them or their partner.

Payment Amounts Based on Your Situation

The transitional protection payment varies depending on household status and whether the limited capability for work and work-related activity (LCWRA) element is included in the Universal Credit award.

Base Transitional Protection Payment Amounts

| Situation | Payment Amount |

| Single with LCWRA included | £143.37 |

| Single without LCWRA included | £340.50 |

| Couple, higher rate SDP | £483.88 |

| Couple, lower rate SDP + LCWRA included | £143.37 |

| Couple, lower rate SDP + LCWRA not included | £340.50 |

These figures reflect the protection amount designed to supplement your Universal Credit and ensure continuity of support during the transition.

Additional Payments for Disability Premiums

Some claimants may receive extra transitional protection if they qualified for other disability-related premiums just before their Universal Credit claim began. This includes the Enhanced Disability Premium, Disability Premium, and the Disabled Child Premium.

Additional Transitional Payments for Disability Premiums

| Premium Type | Single | Couple |

| Enhanced Disability Premium | £91.15 | £130.22 |

| Disability Premium | £186.64 | £266.94 |

These extra amounts are added to the base transitional protection where eligibility applies and the claimant is still entitled at the start of their UC claim.

Disabled Child Premium Add-on

If the Disabled Child Premium was part of your Income Support or income-based JSA before moving to Universal Credit, and your current UC includes the lower rate of the disabled child element, you may receive:

| Number of Qualifying Children | Additional Payment |

| 1 | £192.07 |

| 2 | £384.14 |

| Each additional child | +£192.07 per child |

These additional amounts are included only if you were entitled to the premium in the month before the start of your UC claim and remain eligible at the point of application.

How to Claim If Transitional Protection Is Not Applied Automatically?

In some cases, transitional protection is not added automatically. This typically happens if the original benefit claim was made in a partner’s name and the current Universal Credit claim is being made separately due to a change in relationship status.

If this applies:

- The new UC claim must be submitted within one month of separating from the partner

- The claimant must notify the DWP that they may be eligible for transitional protection

- Notification should be made as soon as possible, and no later than 13 months from the date of the claim

Contact can be made through the Universal Credit journal or by calling the Universal Credit helpline.

Changes That Can Affect Your Transitional Protection

Transitional protection is a temporary measure. It is gradually reduced by any increases in your Universal Credit award, except for increases related to childcare support. In certain situations, the protection ends completely.

Common scenarios that result in transitional protection ending include:

- Moving in with a partner or separating from one

- Earnings increasing above the transitional protection amount

- Earnings falling below the Administrative Earnings Threshold (AET) for more than three assessment periods

- £952 per month for individuals

- £1,534 per month for couples

- Ending your Universal Credit claim

If your claim ends temporarily (e.g., due to a short-term increase in earnings) but restarts within three months, you may be able to receive transitional protection again when the claim resumes.

Can You Stop Sending Sick Notes If You Return to Work or Recover?

In cases where a claimant’s health improves or they return to employment, the need for fit notes comes to an end. However, the DWP must be informed about this change in circumstances. Failure to report such changes may lead to overpayments or possible sanctions.

Before discontinuing the submission of fit notes, it’s advisable for the claimant to consult with their GP to ensure that they are medically fit to return to work. Once clearance is received and employment begins, the Universal Credit claim should be updated accordingly.

Recovery without returning to work may still require an updated assessment or a review of benefit eligibility, depending on the condition’s nature and duration.

Do You Need to Send Sick Notes During a Change in Circumstances?

Certain life events or changes in personal circumstances may impact the requirement to continue sending sick notes. These include:

- Transferring to a different benefit scheme such as Employment and Support Allowance (ESA)

- A change in household income or partner’s employment status

- Moving to a different region with local authority changes

- A switch to full-time education

If any of these changes make the claimant ineligible for Universal Credit, the need to send fit notes ceases. However, the claimant must proactively inform the DWP through the online journal or by contacting their work coach.

Failing to update the DWP can lead to complications in the claim or unnecessary requests for further medical evidence.

Can You Claim Universal Credit If You’re Nearing the End of Life?

Individuals who are nearing the end of life due to a terminal or life-limiting illness may be able to claim Universal Credit more quickly and at a higher rate under what is known as the ‘special rules for end of life’. This provision is designed to support those with serious health conditions and limited life expectancy by fast-tracking their claim and removing many of the usual administrative requirements.

Who Is Eligible?

To claim Universal Credit under the special rules for end of life, a person must typically meet the following conditions:

- Aged 16 or over, but below State Pension age

- Residing in the UK

- Have savings and investments totalling £16,000 or less

- A medical professional has indicated that they may have 12 months or less to live

Eligibility can be assessed even if the medical professional has not explicitly discussed prognosis with the claimant. If a conversation hasn’t taken place, the claimant can still request that their healthcare provider supports their claim through the special rules route.

How to Make a Claim Under Special Rules?

The first step is to ask a GP or another healthcare professional to complete form SR1, which confirms the medical condition and prognosis. This form may be:

- Handed directly to the claimant, or

- Sent by the healthcare professional to the Department for Work and Pensions (DWP)

Once this is done, the claimant should apply for Universal Credit online. During the application, they will be asked whether a medical professional has stated they might have 12 months or less to live. They will also have the option to request a telephone call from the Universal Credit team to assist with the claim.

Importantly, those claiming under these rules:

- Do not need to undergo a Work Capability Assessment

- Are not required to agree to a Claimant Commitment

This simplifies the process and ensures access to support without delay.

If You Are Already Receiving Universal Credit

Claimants already in receipt of Universal Credit who experience a change in their health condition can also apply under the special rules. The same process applies: they must obtain a completed SR1 form from their medical professional.

Will You Be Asked to Provide Sick Notes Again After a Review?

Even after a Work Capability Assessment has concluded, the DWP reserves the right to conduct periodic reviews. These reviews ensure that the health condition still justifies reduced work-related expectations.

In preparation for these reviews, the DWP may request:

- Updated fit notes covering a new assessment period

- Medical reports from your GP or specialist

- Evidence of treatment or rehabilitation plans

During a review, the same principle applies: continue sending fit notes until the DWP provides new instructions. If the review results in no change, the fit note requirement ends again. However, if a change is noted, such as a finding of improved health, the requirement may resume or shift based on new findings.

Conclusion

Understanding when to stop sending sick notes for Universal Credit is critical to maintaining uninterrupted support. You should continue to provide fit notes until you receive a decision from the DWP following your Work Capability Assessment.

If you’re returning to work or your circumstances change, notify the DWP immediately to ensure your Universal Credit claim reflects your new situation.

Remaining informed and proactive in your communication with the DWP will help keep your benefits on track and avoid unnecessary complications.

Frequently Asked Questions

What if I miss a fit note submission?

If you miss submitting a fit note, your Universal Credit payments could be affected. Submit it as soon as possible and update your journal to explain the delay.

Can I backdate a fit note for Universal Credit?

Yes, if your GP agrees, they can backdate a fit note. Inform the DWP about the backdating so your claim remains valid for the missing period.

How do I know if the DWP received my fit note?

Once submitted through your Universal Credit journal, you should receive a confirmation message. You can also message your work coach to confirm receipt.

Is a private doctor’s note valid for Universal Credit?

In most cases, the DWP prefers NHS-issued fit notes. Private notes may be accepted but should be discussed with your work coach first.

What happens if I disagree with the WCA decision?

You can request a mandatory reconsideration if you believe the decision is incorrect. Further appeals can be made to a tribunal if needed.

How long does it take to get a WCA decision?

It varies by case and region but typically takes 4–8 weeks after your assessment. Continue submitting fit notes during this period.

Do I need a new fit note every time my GP issues one?

Yes, you need to upload each new fit note before the previous one expires to keep your claim active.