Understanding the relationship between different types of benefits can be confusing, especially when it comes to Universal Credit and Personal Independence Payment (PIP).

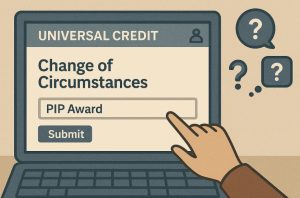

A commonly asked question is whether individuals receiving PIP must inform the Department for Work and Pensions (DWP) or Universal Credit about this benefit.

This blog will answer that question in detail and explain how these benefits interact, if at all.

Do I Need to Report My PIP Award to Universal Credit?

Generally, you do not need to inform Universal Credit of a PIP award. Because PIP is not considered income and has no direct impact on the Universal Credit payment, reporting it is not a required step in maintaining your claim.

The DWP already manages both benefits and has access to cross-departmental information. If you receive both, they are processed independently, and the PIP award will not be reflected in your Universal Credit statements or online journal.

There are, however, a few cases where communication with Universal Credit might still be relevant:

- If your health condition has changed significantly and you want to request a Work Capability Assessment

- If your PIP award leads to other forms of entitlement (e.g. Carer’s Element if someone cares for you)

What Is the Difference Between Universal Credit and PIP?

Universal Credit (UC) and Personal Independence Payment (PIP) are two key benefits available through the UK welfare system.

Though both can be claimed at the same time, they serve entirely different purposes and are assessed using separate criteria.

Understanding how they differ can help claimants manage expectations and ensure they’re receiving the correct entitlements.

Universal Credit is a means-tested benefit aimed at supporting individuals and families with low or no income. It’s designed to simplify the welfare system by combining multiple older benefits into a single monthly payment.

On the other hand, PIP provides financial support for people with long-term physical or mental health conditions or disabilities that significantly impact daily living or mobility. Importantly, PIP is not means-tested, so it does not take into account your income or savings.

Key Purposes of Each Benefit

- Universal Credit is intended to help with general living costs such as rent, food, and utilities.

- PIP is intended to cover additional costs that arise due to disability or health conditions, such as personal care, transport, and support with mobility.

Eligibility Overview

- Universal Credit is generally for individuals aged 18 or over (with some exceptions) who are on a low income or unemployed. To qualify, savings must usually be below £16,000.

- PIP is available to individuals aged 16 or over who have a long-term condition that affects their ability to carry out everyday tasks or move around. Income and savings are not relevant to eligibility.

How They Are Assessed?

- Universal Credit assessments focus on your financial circumstances. Payment amounts are reduced based on income or savings above certain thresholds.

- PIP uses a functional assessment that awards points based on how much support a person needs with tasks such as washing, dressing, preparing food, or travelling.

Universal Credit vs. PIP

| Feature | Universal Credit (UC) | Personal Independence Payment (PIP) |

| Purpose | Living costs for those on low income | Extra costs of disability or health conditions |

| Means-tested | Yes | No |

| Affected by income/savings | Yes (savings limit: £16,000) | No |

| Age eligibility | 18+ (with some exceptions) | 16+ |

| Payment frequency | Monthly | Every four weeks |

| Health-related element | LCW/LCWRA if unable to work | Daily Living and Mobility components |

| Based on medical assessment | Only for LCW/LCWRA | Yes – points-based health assessment |

| Can be claimed together | Yes | Yes |

Universal Credit in Detail

Universal Credit provides a single monthly payment that replaces six former benefits, including:

- Income-based Jobseeker’s Allowance

- Income Support

- Housing Benefit

- Working Tax Credit

- Child Tax Credit

- Employment and Support Allowance (income-related)

Depending on circumstances, Universal Credit can include elements to support:

- Housing costs

- Childcare costs

- Limited capability for work or work-related activity (LCW/LCWRA) if the individual has a health condition that restricts their ability to work

The LCWRA element adds extra financial support for individuals who have been medically assessed and deemed unable to carry out any form of work or work preparation activities.

Important notes about UC eligibility:

- You must be ordinarily resident in the UK.

- Your savings must be below £16,000 (combined if you live with a partner).

- The amount you receive may change if your circumstances do—such as starting work or increasing your earnings.

Personal Independence Payment in Detail

PIP is specifically designed for individuals with disabilities or long-term health conditions. It helps with the additional financial burden these conditions may create.

PIP is made up of two components:

- Daily Living Component: for those who need help with everyday tasks like preparing food, managing medication, or communicating.

- Mobility Component: for those who have difficulty moving around or planning and following journeys.

Each component is paid at either a standard or enhanced rate depending on how much help the person needs.

Key facts about PIP:

- Your condition must have lasted (or be expected to last) at least 12 months.

- The benefit is awarded based on how your condition affects your life, not on the condition itself.

- You must undergo an assessment conducted by a health professional and score enough points based on your answers and medical evidence.

When You Might Be Eligible for Both?

It is not uncommon for individuals to receive both Universal Credit and PIP at the same time. For example:

- A person with a disability that prevents them from working might receive Universal Credit as a base-level income support and PIP to cover disability-related expenses.

- If assessed as having limited capability for work due to a health condition, the claimant may also receive the LCWRA element within their UC payment.

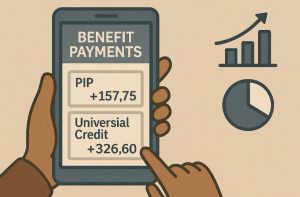

In such cases, PIP does not reduce the amount of Universal Credit you receive. On the contrary, having a PIP award may sometimes contribute towards being considered for additional elements within UC, though the two are still assessed independently.

Does PIP Count as Income for Universal Credit?

PIP does not count as income when calculating a person’s entitlement to Universal Credit. This is because PIP is designed to help with the additional costs of disability and is not classified as financial income for assessment purposes.

The Universal Credit system focuses on evaluating:

- Income from employment or self-employment

- Savings and capital over £6,000

- Certain other benefit payments that are considered means-tested

Since PIP is non-means-tested and tax-free, it is excluded from the financial assessment. As a result, individuals receiving PIP will not see any reduction in their Universal Credit due to the PIP payments.

Will Receiving PIP Affect My Universal Credit Payments?

Receiving PIP does not reduce the standard Universal Credit payment. In fact, in certain cases, being awarded PIP may result in additional entitlements under Universal Credit.

This typically happens when the individual qualifies for:

- The Limited Capability for Work (LCW)

- The Limited Capability for Work and Work-Related Activity (LCWRA)

These elements are part of Universal Credit and are assessed separately through a Work Capability Assessment (WCA). However, having a PIP award can support the case for LCWRA entitlement, especially when daily living or mobility components indicate a severe disability or health condition.

Additional Elements Possibly Triggered by PIP

| PIP Component | Related UC Impact |

| Daily Living (Standard) | May support eligibility for LCW |

| Daily Living (Enhanced) | May support eligibility for LCWRA |

| Mobility (Standard/Enhanced) | May lead to exemption from work-related activity |

This overlap does not mean the benefits are linked financially, but rather that evidence used for one benefit may support entitlement to components of another.

Is PIP Considered a Change in Circumstances for UC?

A new PIP award itself does not count as a change in circumstances that needs to be reported under Universal Credit rules. The benefits are independent of one another, and receiving PIP does not alter your eligibility or calculation for UC.

However, the health condition that qualified you for PIP may be relevant to Universal Credit. If your health situation has worsened or changed since your last Universal Credit assessment, that change should be reported. Doing so could potentially lead to a Work Capability Assessment and increase your overall entitlement through additional elements.

Key changes to report include:

- Significant deterioration in a health condition

- A new diagnosis that affects your ability to work

- Medical evidence that shows a long-term condition has developed

How Does the DWP Handle Overlapping Benefits Like PIP and Universal Credit?

Although both benefits are handled by the DWP, they are assessed separately and do not directly impact one another in most circumstances.

The systems used to administer PIP and Universal Credit can cross-reference relevant information such as National Insurance numbers, dates of birth, and residential addresses. This allows internal updates without the need for the claimant to manually report their PIP award to their Universal Credit caseworker.

However, the existence of both claims does not imply a functional overlap. Each benefit is considered on its own merits.

Should I Record My PIP Payments in My Universal Credit Journal?

Claimants do not need to log PIP payments in their Universal Credit journal. The online journal is primarily intended for:

- Reporting income or employment status changes

- Recording job search activities

- Communicating with a work coach

- Uploading documents for evidence

Since PIP is excluded from Universal Credit calculations and is not treated as income, including it in your journal is unnecessary. Doing so may even cause confusion or delays if your caseworker misinterprets the entry.

What Happens If I Also Receive a Work Capability Assessment?

If you are receiving both PIP and Universal Credit and have been referred for a Work Capability Assessment, the outcome of the PIP claim might indirectly support your case.

For example:

- A PIP award indicating significant mobility difficulties may help establish limited capability for work-related activity.

- Supporting medical evidence used in a PIP assessment can also be relevant in a Universal Credit health assessment.

However, these assessments are not interchangeable. You must still complete the appropriate forms and attend any scheduled appointments for the Work Capability Assessment.

In some cases, individuals with severe disability under PIP may be fast-tracked into receiving additional Universal Credit elements without needing a new assessment, but this is handled on a case-by-case basis.

Are There Exceptions Where I Must Tell UC About PIP?

While PIP is generally not reportable to Universal Credit, there are exceptional situations where it may be relevant:

- If you are applying for an additional element under Universal Credit, such as Carer’s Element

- If a local council or housing authority requires confirmation of your PIP award for support with council tax or discretionary housing payments

- If you are applying for childcare support and your circumstances change significantly due to your disability

In most cases, though, no action is required on the claimant’s part. The DWP already holds relevant records, and additional declarations are not necessary unless you are seeking specific extra entitlements.

How Does PIP Provide Additional Financial Support While on Universal Credit?

PIP is intended to help with the extra costs associated with disability or long-term illness, offering financial support that complements other benefits like Universal Credit.

Because it is not means-tested, it is available regardless of employment status or other income sources.

This makes PIP particularly valuable for individuals who:

- Have extra transport costs due to mobility issues

- Require assistance with personal care

- Need to modify their homes

- Spend more on heating or dietary requirements due to health

For those also on Universal Credit, receiving PIP can increase overall financial stability. While UC covers essential living costs, PIP addresses the additional, often overlooked, expenses linked to disability.

Conclusion

To summarise: there is no requirement to inform Universal Credit if you start receiving Personal Independence Payment. The two benefits are assessed independently, and PIP does not count as income when calculating Universal Credit entitlement.

Understanding the clear distinction between these benefits can reduce unnecessary worry and help you manage your claims more effectively. However, if your health situation changes or you believe your needs have increased, it’s worth reviewing your entitlements and seeking advice.

FAQs

What is the main difference between PIP and Universal Credit?

PIP supports individuals with disabilities or long-term conditions, while Universal Credit is a means-tested benefit for those with low income or out of work.

Will getting PIP increase my Universal Credit amount?

It can in some cases. For example, if your health condition qualifies you for additional Universal Credit components like LCWRA.

Do I need to tell DWP if I get both PIP and Universal Credit?

No, they are aware of both claims through their internal systems. Manual reporting is not typically required unless other circumstances change.

Is PIP included in the Universal Credit payment calculation?

No. PIP is a non-means-tested benefit and does not affect the amount of Universal Credit you receive.

Can I get both PIP and Universal Credit at the same time?

Yes, many people receive both benefits. They are designed to support different needs and do not overlap financially.

Should I update my Universal Credit journal when awarded PIP?

There is no need to update your journal with PIP details. It has no bearing on your payment calculations.

How do I know if PIP affects my housing benefit?

While PIP itself doesn’t affect housing benefit, certain PIP awards can increase your entitlement to support with housing under Universal Credit.