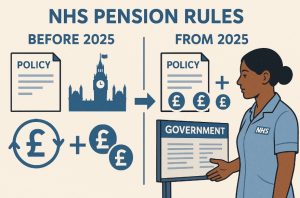

The NHS Pension Scheme will undergo significant updates from 1 April 2025, affecting how member contributions are calculated.

Under newly amended regulations, pensionable earnings thresholds will be uplifted in line with national pay adjustments.

These changes are part of a broader policy to ensure contribution rates remain fair and proportionate, particularly as wages increase through the Agenda for Change framework.

This article outlines the latest NHS pension scheme changes and how they impact contribution structures across income tiers.

What Are The Latest NHS Pension Scheme Changes In 2025?

In April 2025, the Department of Health and Social Care implemented an update to the NHS Pension Scheme through The National Health Service Pension Schemes (Member Contributions) (Amendment) Regulations 2025.

These amendments revised the pensionable earnings thresholds that determine how much members contribute to their pensions.

The changes were laid before Parliament in accordance with Section 22 of the Public Service Pensions Act 2013. This procedure is required when amending protected elements of the scheme such as contribution rates.

These protected provisions are in place until 31 March 2040, meaning any changes before then must be carefully justified and consulted on.

The changes take retrospective effect from 1 April 2025 and reflect an ongoing commitment to regularly update contribution bands in line with broader economic and employment conditions.

Why Were The Member Contribution Thresholds Uplifted?

The revised contribution thresholds aim to address the risk of NHS staff paying higher contribution rates simply because of standard pay increases.

When earnings rise due to centrally negotiated pay awards, members can unintentionally move into a higher contribution tier, even if their real income has not improved in relative terms.

To manage this, the government uses a dual indexation method known as the “better of” test. This approach determines the annual uplift by comparing:

- The Consumer Price Index (CPI) from the previous September

- The Agenda for Change (AfC) pay award for NHS staff in England

Whichever figure is higher determines the annual adjustment. For the 2025 scheme year, the CPI in September 2024 was 1.7%, while the AfC pay award was 3.6%. As a result, thresholds were increased by 3.6%.

This ensures that staff are not financially penalised for receiving government-sanctioned pay adjustments and maintains fairness across contribution tiers.

How Does The Contribution Structure Work Under The 2015 NHS Pension Scheme?

The NHS Pension Scheme transitioned to a Career Average Revalued Earnings (CARE) model with the implementation of the 2015 Regulations.

This marked a significant shift from the previous final salary schemes and was designed to ensure fairness, sustainability, and flexibility for all types of NHS employees.

Contribution Calculation Based On Actual Earnings

One of the most significant updates in the 2015 Scheme is that contributions are calculated based on actual pensionable earnings, rather than whole-time equivalent pay. This means:

- Full-time and part-time employees are assessed fairly

- Contribution rates reflect actual take-home income

- There is less distortion for members with multiple roles or varying hours

This method ensures that part-time staff are not disproportionately affected, and it maintains equity across the workforce.

Differentiation Between Officer And Practitioner Contributions

The scheme outlines two primary types of contributors:

- Officer Members: Typically salaried staff who receive a predictable income

- Practitioner Members: Often general practitioners or other medical professionals with fluctuating or fee-based incomes

Regulations 30 and 31 of the 2015 NHS Pension Scheme Regulations govern how these members’ contributions are assessed:

- Officer members pay a rate based on either current or previous year’s pensionable earnings, depending on individual circumstances

- Practitioner members have a separate rate table and are assessed according to their specific earnings type

This structured approach ensures consistency in contribution rates while accommodating the unique income structures across NHS roles.

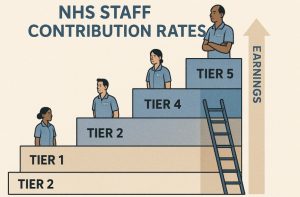

Tiered Contribution Rate System

Contribution rates increase as pensionable earnings rise. This progressive system supports affordability for lower-paid workers while maintaining the financial stability of the scheme.

The 2025 updated contribution bands show that:

- Members earning under £13,260 contribute 5.2%

- The highest earners contribute 12.5%

This tiered system was introduced to replace the flat-rate contribution models used previously and reflects broader public service pension reform principles.

Retrospective Adjustments And Scheme Year Boundaries

Contributions are assessed within defined scheme years, running from 1 April to 31 March. If thresholds are updated after the start of the year (as in 2025), changes are applied retrospectively to 1 April.

This ensures that:

- Members are treated consistently regardless of when pay changes occur

- Employers and payroll systems are aligned with the scheme regulations

- Policy changes remain effective and enforceable within the financial year

These administrative details are critical in ensuring smooth scheme operation and trust in its governance.

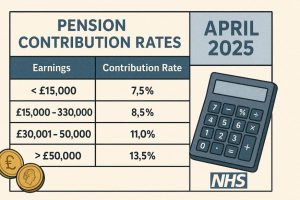

What Are The New NHS Pension Contribution Rates From April 2025?

The 2025 updates introduce new earnings thresholds for determining contribution rates. Below is the table showing the updated bands:

Contribution Rates Based on Actual Annual Pensionable Pay

| Pensionable Pay Range | Contribution Rate (%) |

| Up to £13,259 | 5.2% |

| £13,260 to £27,797 | 6.5% |

| £27,798 to £33,868 | 8.3% |

| £33,869 to £50,845 | 9.8% |

| £50,846 to £65,190 | 10.7% |

| £65,191 and above | 12.5% |

A few important clarifications:

- The lowest tier has not been uplifted because it aligns with the personal tax allowance, which remains frozen

- Members earning under £13,259 typically work part-time and may not receive income tax relief, which affects scheme affordability

- These changes are designed to protect lower earners while ensuring contribution levels remain proportionate for higher earners

In addition to the above structure, some members may have their contributions calculated using their previous year’s earnings. This applies particularly when there are variable earnings or long-term sickness absence.

Example Impact of 3.6% Threshold Uplift on Band Movement

| 2024 Threshold (Before Uplift) | 2025 Threshold (After 3.6% Uplift) |

| £27,797 | £28,797 |

| £33,868 | £35,089 |

| £50,845 | £52,678 |

This table illustrates how the uplift prevents members from moving into a higher band due solely to a routine salary increase.

How Were The Contribution Thresholds Consulted And Agreed Upon?

The adjustment of member contribution thresholds in 2025 followed a formal consultation and review process, as required under Section 22 of the Public Service Pensions Act 2013. This process was implemented due to the protected status of member contribution rates until 2040.

Involvement Of The Scheme Advisory Board (SAB)

The Department of Health and Social Care worked closely with the Scheme Advisory Board (SAB), which plays a central role in evaluating and advising on NHS Pension Scheme reforms.

The SAB is composed of:

- Employer representatives

- Trade union officials

- Pension and workforce specialists

This board ensures that a balance of perspectives is maintained when considering how pension scheme changes affect both members and the wider NHS system.

Public Consultation Process

A wide-reaching public consultation was first launched in October 2021 and closed in January 2022. It gathered 1,031 responses from various stakeholders, including:

- Individual NHS staff

- NHS employers

- Trade unions

- Professional organisations

Key results of this consultation included:

- 67% of respondents supported aligning threshold uplifts with centrally agreed pay awards

- 22% opposed the proposal

- 11% were neutral or did not respond to that specific question

The results showed strong support for regular updates to thresholds that reflect broader economic conditions.

Implementation Of The ‘Better Of’ Indexation Method

Following ongoing feedback, including from a second consultation between October 2023 and January 2024, the Department adopted a ‘better of’ approach for indexation. This was formally introduced in 2025.

This method uses the higher of:

- CPI inflation (from the previous September)

- Agenda for Change (AfC) pay award for England

This system was seen as both fair and predictable and was endorsed by the SAB during the consultation process.

Final Approval And Response To Stakeholder Feedback

The Department began the 2025/26 consultation in May 2025 after the AfC pay award was announced. The proposed thresholds were reviewed by the SAB, who responded by 6 June 2025 confirming that:

- The figures accurately reflected a 3.6% uplift

- The thresholds aligned with agreed policy intentions

- There were no identifiable equality risks requiring legal challenge

While the SAB did not perform a legal review of the draft regulations, their consensus indicated general support for the proposed implementation. Additional feedback unrelated to the immediate threshold changes was noted and set aside for future consideration.

This detailed and inclusive consultation process ensured that the 2025 changes were transparent, justified, and aligned with stakeholder expectations.

What Is The Potential Impact Of Not Implementing The Proposed Changes?

Failing to implement the uplifted thresholds would have resulted in some NHS employees paying disproportionately higher contributions.

This would have occurred without any real gain in their purchasing power or earnings, due simply to automatic band migration caused by nominal pay rises.

Additional risks include:

- Undermining the value and perception of national pay awards

- Damaging staff confidence in the fairness of the NHS Pension Scheme

- Contradicting government policy to protect members from threshold creep

Moreover, without these updates, the Department of Health and Social Care could face criticism over the transparency and responsiveness of pension governance, particularly during a period of heightened public focus on NHS working conditions.

How Does This Fit Into The Wider Context Of Public Service Pension Reforms?

The 2025 changes are part of a broader policy landscape shaped by the 2010 Independent Public Service Pensions Commission chaired by Lord Hutton. The resulting 2013 Public Service Pensions Act introduced:

- Career average pension models to replace final salary schemes

- Fixed protection periods until 2040 for key elements like contribution rates

- Enhanced procedural requirements for modifying protected features

These reforms were designed to ensure long-term sustainability and fairness across the public sector.

Annual revaluation and consultation, such as seen in the 2025 uplift, are mechanisms to keep the scheme responsive without undermining its core commitments.

The NHS Pension Scheme remains a key component of public sector reward structures, and maintaining its value and affordability through measured reforms is essential to long-term workforce planning.

Conclusion

The 2025 NHS pension scheme changes mark a continuation of government policy to maintain equitable member contribution rates.

By uplifting thresholds in line with the higher of CPI or Agenda for Change pay awards, the scheme ensures that members are not penalised for receiving routine salary increases.

Members should review their current earnings and consider how the new thresholds might affect their pension contributions from 1 April 2025.

For personalised information, the use of NHS pension calculators and consultation with pension advisors is strongly recommended.

FAQs

What is the reason for using the ‘better of’ approach for adjusting contribution thresholds?

The ‘better of’ approach ensures that thresholds rise fairly by applying the higher of inflation (CPI) or the Agenda for Change pay award, protecting members from unintended contribution increases.

Will all NHS pension scheme members be affected by the 2025 changes?

All active members of the NHS Pension Scheme whose contributions are determined by pensionable earnings will be affected. Retired or deferred members are not impacted.

Why was the lowest contribution threshold not increased?

The lowest threshold is tied to the personal allowance for income tax, which has been frozen. Maintaining this threshold helps support the affordability of pensions for the lowest-paid staff.

How does this affect part-time workers in the NHS?

Contribution rates are based on actual pensionable pay rather than full-time equivalent pay, ensuring that part-time staff pay contributions in proportion to their actual earnings.

Do these changes apply to Scotland, Wales, and Northern Ireland?

These changes apply to the NHS Pension Scheme in England. Separate arrangements may exist for devolved administrations.

What steps were taken to ensure fairness and consultation?

The Department of Health and Social Care worked closely with the Scheme Advisory Board, carried out public consultation, and reviewed equality impacts before finalising the changes.

Will the contribution thresholds change every year?

Yes, it is expected that thresholds will continue to be reviewed and adjusted annually using the ‘better of’ CPI or the AfC pay award to maintain fairness in member contributions.