The Department for Work and Pensions (DWP) uses official notice texts to communicate important updates about benefits, pensions, and welfare services.

While these messages are designed to be secure and reliable, fraudsters often send convincing imitations to steal personal or financial information.

Understanding how to recognise a genuine DWP official notice text is essential to avoid scams.

This guide outlines the key features of legitimate messages and the steps you can take to protect yourself from fraudulent contact.

What Is a DWP Official Notice Text?

A DWP official notice text is a form of communication used by the Department for Work and Pensions to provide updates, confirmations, or alerts to individuals about their benefits or other welfare-related matters.

It is part of the government’s digital contact strategy, aimed at delivering timely information directly to recipients’ mobile devices.

Unlike marketing or general service texts, these notices are official in nature and are structured to meet strict verification standards. They can be sent for a variety of reasons, including:

- Confirming receipt of a claim or application

- Providing updates on payment schedules or changes to accounts

- Requesting that recipients check their online benefit accounts for new information

These texts are important for ensuring individuals remain informed about their benefits, but they can also be mimicked by scammers. This is why understanding their structure is essential.

How Can You Tell If a DWP Text Message Is Genuine?

Spotting the difference between a legitimate DWP message and a fraudulent one can protect you from scams.

The DWP follows strict communication guidelines to ensure its texts are verifiable and secure. Here are the main checks you can make:

1. Verified Sender Name

A genuine DWP message will usually show the sender as “DWP”, “Department for Work and Pensions”, or another recognisable government identifier.

Scam messages may use random mobile numbers or names that closely imitate official ones.

2. Professional and Error-Free Language

Government messages are professionally written. Spelling mistakes, unusual grammar, or excessive punctuation are strong indicators of a scam. For example:

- Genuine: “We have received your Universal Credit claim. Please log in to your account for more details.”

- Scam: “We recieved you Universal Credit claim. Clik here for urgent payment!”

3. Links Only to Official Websites

If a link is included, it will lead to a GOV.UK domain (e.g., https://www.gov.uk/…). Scam messages often use lookalike domains such as .org.uk or .gov-uk.com to trick recipients. Always check the exact spelling of the link before clicking.

4. No Requests for Personal or Financial Information

The DWP will never ask you to send bank details, passwords, or security codes via text. If you receive a message asking for these, it is fraudulent.

5. Relevant and Specific Information

Legitimate messages are related to your existing claim or account. If you receive a message about a benefit or service you haven’t applied for, treat it with caution.

6. Cross-Check with Your Account or Letters

You can verify a message by logging into your Universal Credit journal or other DWP online service. If the message is genuine, the information will usually be reflected there.

By following these checks, you can significantly reduce the risk of falling victim to fraudulent text messages that appear to be from the DWP.

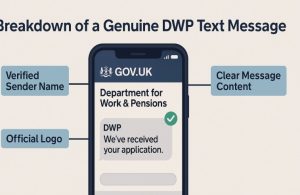

What Do Branded Government Text Messages Look Like?

Branded messages use Rich Communication Services (RCS), which allows departments to send texts that include verified sender information and official logos. This makes it easier for recipients to confirm authenticity.

If RCS is supported on a recipient’s device, they will see:

- The department’s official logo within the message

- The department name as the sender

- Verified sender information

If the device is not RCS-compatible, the message will appear as a standard text without the enhanced branding.

However, it should still maintain the same professional format and avoid requests for personal data.

What Links Can Appear in Official DWP or HMRC Messages?

In some cases, official DWP or HMRC messages include links, but they only ever lead to GOV.UK or secure webchat platforms. Such links are generally used to provide:

- Guidance on responding to a benefits or tax-related issue

- Instructions for checking the status of claims

- Access to secure online government services

Any link leading to an unknown domain, especially those offering refunds or asking for sensitive information, is a red flag.

Examples of Acceptable vs Suspicious Links

| Type of Link | Example | Safe? |

| GOV.UK page | www.gov.uk/universal-credit | Yes |

| HMRC webchat | www.tax.service.gov.uk/webchat | Yes |

| Unknown site | www.claim-your-refund-now.co.uk | No |

| Shortened link | bit.ly/xyz-benefit-claim | No |

When Does the DWP Send Text Messages?

The DWP sends messages at key points in the benefits process. Common scenarios include:

- Confirmation that a claim has been received

- Notifications about payment processing

- Updates on changes to account details

- Reminders to check Universal Credit journals for important notices

HMRC uses similar triggers, such as confirming receipt of forms, issuing cryptoasset tax reminders, or notifying about VAT repayment status updates.

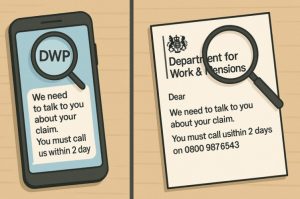

What Types of Messages Should Raise Suspicion?

Not every message claiming to be from the DWP is genuine. Signs that a message may be fraudulent include:

- Requests for sensitive personal or financial details

- Messages that contain spelling or grammatical errors

- Links to non-official websites

- Promises of refunds or benefit increases for providing personal details

These warning signs apply equally to HMRC communications.

How Does HMRC Handle Fraud Prevention Messages?

HMRC (Her Majesty’s Revenue and Customs) operates under strict communication policies to protect taxpayers from phishing scams and identity theft. Fraud prevention messages are carefully crafted to inform, not to solicit sensitive data.

Each category of message serves a specific purpose:

1. Cryptoassets Notifications

- HMRC may contact individuals who have traded in cryptoassets to remind them that crypto transactions are taxable.

- These messages only direct recipients to GOV.UK for accurate guidance on reporting crypto income and gains.

- They will never ask for wallet keys, account passwords, or bank details.

2. Self Assessment Penalty Appeals

- If you appeal against a Self Assessment penalty, HMRC might send a text confirming that your appeal has been reviewed.

- The message will include an estimated timeframe for the outcome.

- No direct links to third-party websites are ever included in these texts.

3. Self Assessment Refund Updates

- When a taxpayer requests a Self Assessment refund, HMRC may send a text confirming that the refund is being processed.

- The communication will outline the expected payment date.

- Messages will not request banking details legitimate refunds are processed through official HMRC systems.

4. VAT Repayment Notifications

- Between specific dates (such as 14 July 2025 to 15 August 2025), HMRC may send texts about VAT repayment updates.

- These will instruct the business to log in to their official business tax account to check the claim status.

- No direct links to login pages are provided to prevent phishing risks.

5. Compliance Check Surveys

- After a compliance check or a call to HMRC, taxpayers may receive an exit survey via text.

- These texts will not contain phone numbers or links to unofficial websites only to approved survey platforms.

Across all these scenarios, HMRC applies several fraud prevention safeguards:

- No Requests for Sensitive Data: HMRC never asks for passwords, PINs, bank details, or full security answers in a text message.

- Verified Sender Information: Branded messages may display the HMRC logo and “HM Revenue and Customs” as the sender.

- Link Policy: Links, if present, point exclusively to GOV.UK or official HMRC platforms.

- Phishing Reporting: All suspicious messages can be forwarded to 60599 or emailed to phishing@hmrc.gov.uk for investigation.

This systematic approach ensures that HMRC communications remain transparent, verifiable, and resistant to fraudulent imitation.

It also mirrors the DWP’s own fraud prevention principles, creating a consistent standard across UK government departments.

How Can You Report a Suspicious DWP or HMRC Text?

If a message seems suspicious, it is important to act quickly:

- Forward the text to 60599 (network charges may apply)

- Email the content or a screenshot to phishing@hmrc.gov.uk

- Submit a report via Action Fraud’s online service

Reporting these incidents helps government departments track and take down fraudulent campaigns.

What Is the Difference Between DWP Texts and DWP Letters?

Texts are used for quick communication, while letters are reserved for formal or sensitive matters.

A DWP letter is delivered via post and contains official branding, reference numbers, and detailed explanations of decisions.

In contrast, a text is brief and directs recipients to secure online portals for further information.

Conclusion

Scam texts are becoming increasingly sophisticated, often imitating official DWP or HMRC messages.

By understanding the characteristics of a genuine DWP official notice text and following government guidance on fraud prevention, you can protect yourself from identity theft, financial loss, and other consequences of fraud. Staying informed is the first step towards staying secure.

Frequently Asked Questions

How do I know if a DWP text message is real?

Genuine messages come from verified senders, contain no spelling errors, and only link to official GOV.UK pages.

Can the DWP ask for my bank details by text?

No. The DWP will never request bank details or passwords via text message.

What should I do if I click on a suspicious link in a text?

Report the message to 60599 and phishing@hmrc.gov.uk, and contact your bank immediately if you entered any details.

Why does the DWP use text messages instead of letters?

Texts are used for quick communication, but sensitive matters are still sent via official letters.

Do HMRC and DWP share the same fraud prevention policies?

Both departments follow similar guidelines, ensuring all messages are secure, verified, and free from personal data requests.

What is Rich Communication Services (RCS) in government texts?

RCS allows departments to send branded messages with logos and verified sender information for added authenticity.

Can I block suspicious government texts?

You can block numbers that send suspicious texts, but you should also report them to the proper authorities.