Universal Credit is not stopping in 2025, but it is undergoing major changes as it replaces older legacy benefits like tax credits and income-related ESA.

Many people are receiving Migration Notices from the Department for Work and Pensions, requiring them to switch to Universal Credit by a set deadline.

This transition has caused confusion, with some believing Universal Credit is ending. This article provides the latest DWP updates to clarify what’s changing and what claimants need to know.

What Is Universal Credit and Why Was It Introduced?

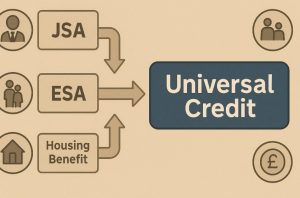

Universal Credit is a welfare reform introduced by the UK government to simplify the benefits system.

Before Universal Credit, individuals needing support had to apply for multiple separate benefits, each with its own application process, eligibility criteria, and payment schedule. This often led to confusion, delays, and inefficiencies.

Universal Credit was developed to replace six major income-related benefits:

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Income Support

- Child Tax Credit

- Working Tax Credit

- Housing Benefit

The aim of this system is to provide a more streamlined and modern approach to financial support. It uses a single digital application and is paid monthly, similar to a salary, to encourage budgeting skills and a smoother transition into work.

For those who are employed but on low income, Universal Credit adjusts automatically based on earnings, which helps make work financially beneficial.

Additionally, Universal Credit was designed to reduce fraud and administrative costs by using a centralised, real-time income tracking system in partnership with HMRC and employers.

Is Universal Credit Actually Stopping in 2025?

There is no government plan to stop Universal Credit in 2025. On the contrary, Universal Credit is undergoing a complete national rollout that will be completed by the end of 2025.

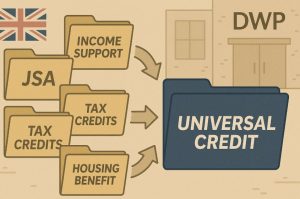

The Department for Work and Pensions (DWP) is using a phased strategy called “managed migration” to move claimants from older legacy benefits onto Universal Credit.

This process is aimed at closing down outdated systems and consolidating all income-based support into a single platform. When claimants receive a Migration Notice from the DWP, it signals the closure of their current benefit claim and requires them to move to Universal Credit.

This timeline was delayed during the COVID-19 pandemic but has since resumed. The goal remains to have nearly all eligible claimants on Universal Credit by December 2025.

Which Legacy Benefits Are Being Replaced by Universal Credit?

Universal Credit is replacing six major legacy benefits that were previously claimed separately by people depending on their income, employment status, family situation, or disability.

These older benefits were often difficult to manage, as they involved different application processes, payment schedules, and eligibility rules.

This complexity frequently led to delays, overlapping claims, and confusion among claimants.

The Department for Work and Pensions introduced Universal Credit to create a more streamlined and centralised system.

By merging multiple benefits into a single monthly payment, Universal Credit aims to simplify support for people who are unemployed, on a low income, or unable to work.

Here are the six legacy benefits being replaced:

- Income-Based Jobseeker’s Allowance (JSA): This benefit was designed for people actively seeking work but with little or no income. Under Universal Credit, support for jobseekers is included, along with personalised work coach support and job search responsibilities.

- Income-Related Employment and Support Allowance (ESA): ESA supported people who had limited capability to work due to illness or disability. Universal Credit includes similar provisions for claimants with health conditions, although the structure is different, particularly for new claimants from 2026 onward.

- Income Support: Provided for people on a low income who did not have to sign on as jobseekers, such as carers or lone parents with young children. Universal Credit now offers a tailored approach based on personal circumstances, including exemptions from job search requirements.

- Child Tax Credit: Given to families with children to help with the cost of raising them. In Universal Credit, child elements are built into the monthly payment, and support varies depending on the number of children and whether they have disabilities.

- Working Tax Credit: Helped top up the earnings of those in low-paid work. This is now part of Universal Credit’s income tapering system, where payments adjust in real time depending on how much a person earns.

- Housing Benefit: Assisted renters with housing costs. For most claimants, housing support is now included in the Universal Credit payment and paid directly to the tenant, although exceptions exist for certain vulnerable individuals and those in supported or temporary accommodation.

Key Comparison Table

| Legacy Benefit | Main Purpose | Included in Universal Credit? | Payment Type |

| Income-based JSA | Support for jobseekers | Yes | Monthly within UC |

| Income-related ESA | Illness/disability support | Yes | Monthly within UC |

| Income Support | Support for non-jobseekers | Yes | Monthly within UC |

| Child Tax Credit | Child-related financial support | Yes | Monthly within UC |

| Working Tax Credit | Top-up for low-income workers | Yes | Monthly within UC |

| Housing Benefit | Rent support | Yes (except certain cases) | Monthly within UC |

What This Means for Claimants?

If you are currently receiving one or more of these legacy benefits, you will eventually need to transition to Universal Credit.

This typically happens after receiving a Migration Notice from the DWP, which gives you a deadline to make your Universal Credit claim. After this point, your legacy benefits will stop.

It’s important to note that:

- You cannot make a new claim for these legacy benefits. All new applications for financial support must go through Universal Credit.

- Once you move to Universal Credit, you cannot return to the legacy system, even if your entitlement is lower.

- Some transitional protection may apply to help maintain your income when switching, especially if the move is managed by the DWP rather than initiated voluntarily.

The move to Universal Credit is a significant shift, aiming to create a more modern and responsive benefits system. While the structure is more streamlined, it’s essential for claimants to understand how the transition affects their specific situation and entitlements.

Why Are People Saying Universal Credit Is Ending?

The misconception that Universal Credit is stopping stems from the way the migration process is communicated and the broader confusion around benefit reform.

Several factors have contributed to the misunderstanding:

- The wording in Migration Notices can be confusing. When people read that their current benefits will stop, they may think Universal Credit itself is being discontinued, not understanding that Universal Credit is replacing what they already receive.

- Social media posts and news headlines often use sensational language to draw attention. This can spread misinformation quickly, especially among vulnerable or less digitally-literate groups.

- Some people have been affected by the reduction or restructuring of specific elements within Universal Credit. For example, changes to the health and disability element have sparked concern and speculation about the system’s future.

It’s important to note that these are internal policy changes, not an end to the system itself. Universal Credit is intended to be the UK’s long-term solution for means-tested support.

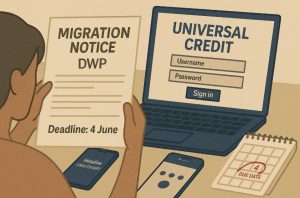

What Should You Do If You Get a Universal Credit Migration Notice?

If you receive a Migration Notice from the DWP, it means you are required to switch from your current legacy benefit to Universal Credit. This is not optional. You must take action before the deadline stated in the letter.

Here is what you need to do:

- Submit a Universal Credit claim by the deadline mentioned in your Migration Notice. If you fail to do so, your existing benefit payments will end.

- Contact the DWP if you need more time. Extensions may be granted if you have a valid reason such as illness, bereavement, or lack of internet access.

- Get help if needed. Organisations like Citizens Advice offer support with the online claim process.

Acting quickly ensures that you won’t experience a break in your financial support. Delaying or ignoring the letter may result in significant hardship, especially if you rely heavily on that income.

What Changes Are Happening to Universal Credit from 2025 Onwards?

Although Universal Credit as a system is continuing, there are changes planned within its structure. The DWP and UK Government have announced several updates that will take effect between 2025 and 2030.

Notable upcoming changes include:

- From April 2026, new claimants who are assessed as having limited capability for work and work-related activity (LCWRA) will receive a reduced health and disability element, which is expected to be halved.

- The basic standard allowance will be increased annually above inflation until the end of the decade, improving financial outcomes for most recipients.

- Additional work support will be introduced for those working part-time. Claimants may face increased expectations to look for more hours or higher wages if their income falls below the new thresholds.

- Enhanced digital services and automation will be rolled out to speed up claims and reduce processing delays.

These reforms are part of a wider strategy to encourage employment, reduce dependency, and modernise the welfare system.

How Does Universal Credit Affect You If You’re on Tax Credits or ESA?

If you currently receive tax credits, income-related ESA, or any other legacy benefit, you will eventually be required to move to Universal Credit. This will typically happen after receiving a Migration Notice from the DWP.

The impact of this transition varies depending on individual circumstances. Some people may see an increase in payments, while others may face a reduction.

To address this, the DWP provides transitional protection to ensure that claimants are not financially worse off immediately after moving to Universal Credit.

| Circumstance | Before Migration (Tax Credits / ESA) | After Switching to Universal Credit | Outcome |

| Single parent, 2 children | £230 per week in combined benefits | £940 per month | Slight increase due to childcare support |

| Disabled adult on ESA | £145 per week | £514 per month | New claimants post-2026 may see reduced disability element |

| Couple on Working Tax Credit | £280 per week | £1,120 per month | Payment adjusted based on earnings |

This table provides illustrative figures, and actual amounts depend on household size, earnings, rent, and health conditions.

Transitional protection is not permanent. It gradually erodes over time, particularly if there are changes in your circumstances such as a new job, partner, or child.

What Help Is Available If You’re Struggling with the Switch?

Several forms of support are available for people who may find the migration process difficult. The transition from legacy benefits to Universal Credit can be confusing, especially for those who have relied on the older system for many years.

Support services include:

- DWP’s Migration Notice Helpline: Offers direct support for those needing clarification or help submitting their claims.

- Citizens Advice Help to Claim Service: Provides step-by-step guidance online, over the phone, or face-to-face.

- Local authority support: In some regions, councils offer digital assistance or home visits to those with limited mobility or internet access.

- Welfare Rights Services: Often available through charities or housing associations to help interpret notices and complete online applications.

Additionally, if you are digitally excluded or have complex needs, the DWP may provide alternative arrangements such as phone-based claims or support from a case manager.

Getting help early in the process can prevent missed deadlines and reduce stress. The Universal Credit claim window usually provides several weeks to act, giving claimants time to seek advice and prepare their documents.

Should You Be Concerned About the Future of Universal Credit?

Despite ongoing changes, Universal Credit is not expected to be removed or scrapped. The system has been integrated across the UK and continues to receive both financial and legislative support from the government.

Universal Credit has replaced millions of legacy benefit claims and is now the default system for new applicants.

While policies within the system can change based on economic needs or political decisions, the structure itself is designed to last long term.

It is possible that future governments may revise the rules around conditionality, payment levels, or disability support.

However, the infrastructure and investment already made into Universal Credit make it highly unlikely that it will be dismantled in the near future.

Understanding how it works and staying informed about updates can help claimants make the most of the system and avoid disruption.

Conclusion

Universal Credit is here to stay, serving as the UK’s primary means-tested benefit system. While older benefits are ending and policy updates are affecting new claimants, Universal Credit itself is not stopping.

Understanding how and when to switch, especially if you receive a Migration Notice, is essential to avoid losing financial support.

Staying informed about ongoing changes will help claimants navigate the system and ensure continuity in their benefits during and after the 2025 transition period.

FAQs

Will I automatically be moved to Universal Credit?

No, you must actively claim Universal Credit when you receive a Migration Notice. Failure to do so could result in the loss of payments.

What happens if I miss the Migration Notice deadline?

Your legacy benefits will stop, and you may lose income until you submit a new claim. Extensions can be granted in specific circumstances.

Are there any benefits I can’t get under Universal Credit?

Yes, some extra elements available under legacy benefits are not included in UC, especially for new health-related claims starting from April 2026.

Can I appeal a Universal Credit decision?

Yes, you can request a mandatory reconsideration and, if necessary, appeal the decision through a tribunal.

How much will Universal Credit increase in 2026 and beyond?

Standard allowances are expected to rise annually above inflation until 2029/2030 as part of government reforms.

Will I lose money when I switch to Universal Credit?

Not necessarily. Some receive more, others less. Transitional protection may help you maintain your income at the point of migration.

Is Universal Credit affected by the next General Election?

While political shifts may influence benefit rules, Universal Credit is deeply embedded in the system and unlikely to be abolished.