For many UK homeowners facing financial difficulties, the question arises: can you get Housing Benefit if you have a mortgage? The short answer is no Housing Benefit is not designed for homeowners.

However, there is alternative support in place. If you’re struggling to cover mortgage interest payments, the government offers a scheme called Support for Mortgage Interest (SMI).

This blog explores the details of SMI, eligibility conditions, what costs are covered, and how you can apply. It also covers the lesser-known ways homeowners can receive help through Universal Credit, such as service charge support.

Why Doesn’t Housing Benefit Cover Mortgage Payments?

Housing Benefit is a form of financial support provided by local authorities to assist individuals who rent their homes.

The benefit is intended to contribute towards rental payments and is primarily geared towards tenants in both social and private housing.

For homeowners, the system works differently. Owning a home is considered an asset, and therefore, the government does not offer Housing Benefit to pay down a mortgage. Instead, limited support is available through other schemes.

There is a fundamental policy distinction between supporting rental payments and supporting mortgage ownership. This is why mortgage costs are excluded from Housing Benefit eligibility.

Who Is Eligible For Housing Benefit In The UK?

Although Housing Benefit is gradually being phased out in favour of Universal Credit, it is still possible to make a new claim under specific circumstances. Eligibility for Housing Benefit largely depends on your age, housing situation, and existing benefit status.

When You Can Make A New Claim?

You can only make a new claim for Housing Benefit if one of the following applies:

- You have reached State Pension age

- You live in supported, sheltered, or temporary housing

If neither condition applies, you must apply for Universal Credit instead, even if you are on a low income or unemployed.

If You’ve Reached State Pension Age

If you are a single person who has reached State Pension age, you are eligible to make a new claim for Housing Benefit.

Couples must meet stricter criteria:

- Both partners must have reached State Pension age

- Or, one partner has reached State Pension age and the couple began receiving Pension Credit before 15 May 2019

- Or, you are living in supported, sheltered, or temporary housing

Those with an existing Housing Benefit claim made before 15 May 2019 will not lose eligibility if they’ve reached State Pension age, even if their partner is younger. However, if your Housing Benefit stops for any reason and you no longer meet the eligibility requirements, you cannot restart the claim.

If You’re Living In Supported, Sheltered Or Temporary Housing

You may still claim Housing Benefit if you live in:

- Temporary accommodation provided by your council, such as a bed and breakfast

- A refuge for survivors of domestic abuse

- Supported or sheltered housing that includes care, support, or supervision

If your housing does not provide care or support, you must apply for Universal Credit for housing cost assistance. In all cases, Universal Credit may still help with other living expenses not covered by Housing Benefit.

Circumstances That May Disqualify You

There are several conditions under which you may not be eligible to claim Housing Benefit:

- You have savings over £16,000 (unless receiving the Guarantee Credit of Pension Credit)

- You are paying a mortgage on your own home (you may instead apply for Support for Mortgage Interest)

- You live with a close relative in their home

- You are already receiving Universal Credit (unless in supported or temporary accommodation)

- Your partner already receives Housing Benefit

- You are a full-time student (with limited exceptions)

- You are an EEA jobseeker, an asylum seeker, or under immigration control with no access to public funds

- You are a Crown Tenant

- You’ve reached State Pension age, but your partner has not, unless you had an existing claim before 15 May 2019

In all other situations, Universal Credit is now the standard means-tested benefit for covering housing costs for working-age individuals and those not meeting Housing Benefit criteria.

What Is Support For Mortgage Interest (SMI)?

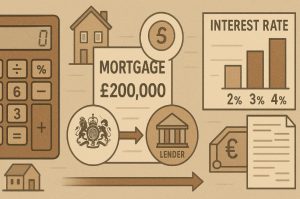

Support for Mortgage Interest (SMI) is a government-provided loan that helps homeowners in the UK who are on certain benefits pay the interest on their mortgage. It does not cover capital repayments or other costs like insurance or arrears.

The scheme is intended to offer temporary financial relief for homeowners who are unemployed, ill, or on a low income and are receiving specific income-related benefits. The money is paid directly to the lender rather than to the homeowner.

SMI is a loan that will need to be repaid with interest. The repayment typically occurs when the home is sold or ownership is transferred.

Who Is Eligible For Support For Mortgage Interest?

Eligibility for SMI is restricted to those receiving qualifying income-related benefits.

These benefits include:

- Universal Credit (after 3 consecutive months of receiving it)

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Pension Credit

Other eligibility conditions apply:

- The property must be owned by the claimant or their partner

- It must be their main and permanent residence

- They must be responsible for the mortgage or a qualifying home improvement loan

People receiving other forms of income, such as Statutory Sick Pay or tax rebates, may not qualify.

Additionally, the benefit must have been claimed for a set period, such as 3 months for Universal Credit or 13 weeks for other benefits (except for Pension Credit, which has no waiting period).

How Much Support For Mortgage Interest Can You Receive?

The amount offered through SMI is not based on the actual interest rate of your mortgage but on a standard interest rate set by the government. This rate is reviewed regularly and may differ from your lender’s rate.

The government will pay interest on up to £200,000 of your mortgage or eligible loan. For those on Pension Credit, the limit may be £100,000 depending on when the loan started.

The loan is paid directly to your lender and continues only while you are receiving the qualifying benefit.

Comparison Of SMI Limits And Waiting Periods

| Qualifying Benefit | Waiting Period | Maximum Eligible Loan |

| Universal Credit | 3 Months | £200,000 |

| Income Support / ESA / JSA | 13 Weeks | £200,000 |

| Pension Credit | None | £100,000 – £200,000 |

Can You Get Help With Service Charges If You Have A Mortgage?

Homeowners living in leasehold or shared ownership properties may be entitled to help with service charges under Universal Credit. This applies to individuals who have been on Universal Credit for at least 9 consecutive months.

Eligible service charges typically include costs related to communal maintenance and essential property services. These charges must be considered a necessary condition of occupying the property.

Examples Of Eligible And Ineligible Service Charges

| Eligible Charges | Ineligible Charges |

| Communal lift maintenance | Charges covered by employer benefits |

| Shared area repairs | Statutory Maternity/Paternity Pay |

| Window cleaning (upper floors) | Tax refunds |

| Refuse collection services | Self-employment income |

Eligibility is restricted further if the individual is receiving income through:

- Employment or self-employment

- Statutory Sick Pay

- Tax refunds

- Statutory parental-related payments

These income sources disqualify applicants from receiving help with service charges through Universal Credit, even if they meet other criteria.

What Are The Alternatives If You’re Struggling With Mortgage Payments?

If you’re a homeowner in the UK and finding it difficult to keep up with your mortgage payments, there are several alternative options available beyond Support for Mortgage Interest (SMI).

While SMI can be a useful tool for those receiving qualifying benefits, it is not suitable for everyone. In such cases, exploring other forms of financial relief, lender support, and third-party advice can help prevent missed payments or potential repossession.

Contacting Your Mortgage Lender

The first and most important step is to speak to your mortgage lender as soon as financial difficulties arise. Most lenders in the UK are regulated and required to treat borrowers in financial distress fairly.

Open communication may allow you to access temporary solutions such as:

- Payment holidays, which pause your mortgage repayments for a short time

- Reduced monthly payments through extended mortgage terms or temporary interest-only arrangements

- Rearranging your mortgage structure, such as switching to a more affordable fixed or variable rate

These options are usually subject to affordability assessments and may affect the overall interest you pay. However, they can provide essential breathing space while you stabilise your finances.

Applying For A Mortgage Payment Holiday

A mortgage payment holiday allows you to take a break from payments for a set period. Although not universally available, many lenders offer this option during periods of hardship or national crises (such as during the COVID-19 pandemic). It’s crucial to understand:

- Interest continues to accrue during the holiday

- Payments may increase after the holiday ends to make up the shortfall

- Your credit report could reflect the payment break, depending on the lender

This option is best suited for short-term income disruptions rather than ongoing financial problems.

Switching To Interest-Only Payments

Some lenders may allow you to switch your mortgage to interest-only repayments for a limited time. This reduces your monthly outgoings as you’re not paying down the loan principal.

- This is typically offered for a short term, often 6–12 months

- You must eventually return to capital repayment to avoid long-term debt accumulation

- It may require a reassessment of your financial circumstances

Interest-only options are useful when income is temporarily reduced but expected to return to normal levels.

Seeking Free Debt Advice

Several reputable organisations in the UK offer free and impartial debt advice for homeowners facing financial pressure:

- Citizens Advice

- StepChange Debt Charity

- National Debtline

- MoneyHelper (formerly Money Advice Service)

These organisations can help you:

- Review your financial situation

- Create a realistic household budget

- Prioritise payments

- Understand your legal rights

- Explore formal debt solutions like Debt Management Plans or Individual Voluntary Arrangements (IVAs)

Independent advice can be particularly useful when considering more serious measures, such as selling your home or entering insolvency.

Local Authority Assistance And Hardship Funds

Local councils across the UK often operate Discretionary Housing Payments (DHPs) and Local Welfare Assistance Schemes that may be able to offer short-term support to those struggling with housing costs.

Although primarily aimed at renters, some councils may extend discretionary support to low-income homeowners in specific circumstances, such as:

- Avoiding homelessness

- Temporary income disruptions due to illness or family breakdown

- Emergencies, including loss of employment or bereavement

To apply, you will need to contact your local authority and provide evidence of your income, mortgage commitments, and current hardship.

Selling And Downsizing As A Last Resort

If your financial situation is unlikely to improve in the foreseeable future, selling your property and downsizing to a more affordable home could be a viable option.

While this is a significant and often emotional decision, it can help avoid repossession and clear your existing mortgage debt.

This route should only be considered after seeking professional financial advice, as it may involve:

- Early repayment charges from your mortgage lender

- Legal and moving costs

- The need for temporary accommodation during the sale process

If you’re unable to sell on the open market, you might explore voluntary sale schemes or speak to housing associations that offer buy-back arrangements in specific situations.

How Do You Apply For SMI And Related Support?

Applying for SMI begins when you are already receiving a qualifying benefit. The Department for Work and Pensions (DWP) usually sends out an SMI loan offer once you meet the waiting period requirement.

The application process involves:

- Accepting the SMI offer sent by DWP

- Providing mortgage and property details

- Agreeing to the terms of the loan

- Having the loan paid directly to your lender

Support is only extended while you remain eligible, and you must inform DWP of any changes in your income or living situation. Failure to do so can lead to overpayments, which may be recovered.

Can Universal Credit Help With Owning A Home?

Although Universal Credit does not assist directly with mortgage repayments, it can help with service charges, as discussed. Homeowners in shared ownership or leasehold arrangements may find this support helpful in offsetting other housing-related costs.

Additionally, Universal Credit provides a consistent source of income for other living expenses, which may help homeowners manage their finances better during times of hardship.

However, it is essential to differentiate between housing support through Universal Credit and mortgage support, as they are assessed and provided under different policies.

What Should Homeowners On Benefits Consider Financially?

Homeowners receiving SMI or similar support must be aware of the financial implications:

- SMI is a loan that accrues interest over time

- The loan must be repaid when the home is sold or transferred

- The total amount repayable will depend on how long you received support and the amount paid

Long-term financial planning is essential. Homeowners should evaluate whether accepting SMI fits within their future plans, especially if they anticipate selling or refinancing the property.

It is advisable to seek independent financial advice or use services like Citizens Advice to understand the full impact of taking out an SMI loan.

Conclusion

To conclude, Housing Benefit is not available to UK homeowners with mortgages. However, the Support for Mortgage Interest (SMI) scheme offers a critical lifeline by covering mortgage interest costs through a repayable loan.

Homeowners receiving Universal Credit or other income-based benefits may also qualify for service charge support, especially if they live in leasehold or shared ownership homes.

Navigating the benefits system can be complex, but understanding what’s available ensures you don’t miss out on vital support during financially challenging times.

Frequently Asked Questions

What is the waiting period for SMI when claiming Universal Credit?

You must be receiving Universal Credit for 3 continuous months before you become eligible for SMI.

Does SMI cover both mortgage capital and interest?

No, SMI only covers the interest on your mortgage or eligible home improvement loans.

Is Support for Mortgage Interest (SMI) free?

No, SMI is a loan. It must be repaid with interest when you sell or transfer ownership of your home.

Can I receive SMI if I own my home outright?

No, SMI is only for homeowners with an active mortgage or a qualifying home improvement loan.

Does Universal Credit pay service charges for homeowners?

Yes, under strict conditions, Universal Credit can help with service charges if you own a leasehold property and have been on UC for at least 9 months.

What happens to the SMI loan if I die?

The loan is usually repaid from your estate when the home is sold or transferred, unless passed on to a surviving spouse with an agreement in place.

Can I decline the SMI loan offer?

Yes, accepting SMI is voluntary. If you decline, you’ll need to make mortgage interest payments yourself.