Personal Independence Payment (PIP) is a benefit designed to help people manage extra costs related to long-term health conditions or disabilities.

But what happens when someone reaches State Pension age? Does PIP stop at pension age, or are there provisions for continuing support?

In this guide, we break down the rules, exceptions, and options available to individuals approaching or already past State Pension age in the UK.

What Happens to PIP When You Reach State Pension Age?

For those already receiving Personal Independence Payment (PIP), reaching State Pension age does not automatically affect their benefit entitlement. In fact, the Department for Work and Pensions (DWP) generally allows existing claims to continue.

Once a person reaches State Pension age, their PIP award often transitions into an indefinite award. This means the claim remains valid without a fixed end date.

However, these awards are not completely permanent. They are subject to periodic review, typically once every ten years, to confirm ongoing eligibility.

It’s important to understand that the continuation of PIP depends on whether the person had an active claim before reaching pension age. New applications are generally not permitted after that point.

You can check your exact State Pension age on the official government portal, which helps clarify when certain rules start to apply.

Can You Still Receive PIP After Turning 66?

Once someone turns 66, they move past the State Pension age in the UK, and this significantly affects the eligibility criteria for PIP. In most cases, individuals cannot make a new PIP claim after reaching this age.

There are, however, some exceptions that apply:

- If the claimant had a previous PIP award that ended within the last 12 months, they may still be able to make a new claim.

- If they are currently receiving Disability Living Allowance (DLA), or if their DLA claim ended within the last year, they might be eligible to apply for PIP.

Another key restriction applies to those born before 9 April 1948. Individuals in this category are not permitted to apply for PIP, regardless of their health status or circumstances.

These rules are particularly relevant for those experiencing new or worsening health conditions after pension age. Instead of PIP, many individuals in this situation are advised to explore Attendance Allowance.

Who Can Make a New PIP Claim After State Pension Age?

Under normal circumstances, individuals cannot make a new claim for Personal Independence Payment (PIP) after they have reached State Pension age, which is currently 66 in the UK.

However, the Department for Work and Pensions (DWP) has outlined specific exceptions to this rule that allow certain people to submit a new claim even after passing the age threshold.

These exceptions are important because they ensure that people who had been receiving disability support before retirement—or whose condition has developed from a previous issue are not unfairly excluded from assistance.

Situations Where a New PIP Claim May Be Allowed

You may be able to start a new PIP claim after State Pension age if either of the following applies:

- You had a previous PIP award that ended within the last 12 months, and the condition is the same or related.

- You are currently receiving Disability Living Allowance (DLA), or your DLA award ended less than a year ago, and you were born on or after 9 April 1948.

These scenarios are considered exceptions because they build on a history of disability-related benefit entitlement. The DWP’s approach is to support continuity of care for individuals who were already within the system but experienced a temporary interruption or transition in their claims.

Medical Condition Requirements for New Claims

It’s not just the timing of your previous benefit that matters. The medical condition you are claiming for must also meet certain criteria:

- The condition must be the same as the one you claimed for in your last PIP application, or

- The condition must have developed directly from the one you previously claimed for

This requirement ensures that new claims are only allowed for linked health conditions. The reasoning is that someone who previously had a recognised disability should not be penalised if their condition has worsened or evolved into another related issue.

Example Scenario:

If a person had a PIP claim for rheumatoid arthritis that ended 8 months ago, and they are now experiencing mobility limitations due to joint damage from the same condition, they could potentially make a new claim, even if they are now over State Pension age.

Similarly, if someone was receiving DLA for chronic obstructive pulmonary disease (COPD) and their condition has worsened, leading to severe fatigue or reduced lung function, they may be able to move from DLA to PIP even after turning 66, provided they meet the criteria.

Restriction Based on Date of Birth

The cut-off date of 9 April 1948 is significant. If you were born before this date, you are not eligible to make a new PIP claim under any circumstances, even if you meet all the other criteria.

This is because those born before this date were already at or past retirement age when PIP was introduced in 2013, and the DWP opted not to transition these individuals into the PIP system.

Instead, individuals in this age group are encouraged to apply for Attendance Allowance, which is specifically designed for people over State Pension age who need help with personal care due to disability or illness.

Restrictions on Mobility Component

If you do qualify to make a new PIP claim after reaching State Pension age, there are further limitations—particularly concerning the mobility component of PIP:

- You cannot begin receiving the mobility component if it was not part of your last PIP award.

- If you only received the standard rate of the mobility component in your last claim, you cannot upgrade to the enhanced rate, even if your condition has significantly worsened.

This rule is often misunderstood and can be frustrating for claimants whose physical condition deteriorates after retirement. However, the DWP policy treats the point of State Pension age as a cut-off for certain escalations in benefit rates.

When to Consider Attendance Allowance Instead?

For those who are unable to make a new PIP claim, especially if they were not previously on PIP or DLA, Attendance Allowance may be a more appropriate benefit to explore. Although it does not offer a mobility component, it can provide essential financial support for:

- Daily personal care needs

- Supervision or monitoring due to medical conditions

- Non-mobility related disabilities such as dementia, arthritis, or vision loss

Attendance Allowance also has fewer review requirements and can be granted on a long-term basis, making it a more stable option for older claimants.

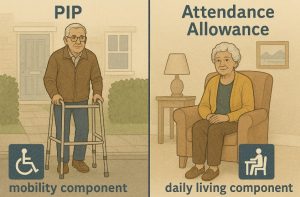

How Does PIP Compare to Attendance Allowance?

For individuals over State Pension age who are no longer eligible for PIP, Attendance Allowance becomes the primary alternative. This benefit is designed for older adults who require help with personal care or supervision due to illness or disability.

The key difference between the two benefits is that Attendance Allowance does not include a mobility component. This is a significant drawback for those with physical disabilities or reduced mobility.

Here is a detailed comparison of both benefits:

| Criteria | PIP | Attendance Allowance |

| Eligibility Age | 16 to State Pension Age | Over State Pension Age |

| Can New Claims Be Made? | Yes, before reaching pension age | Yes, after reaching pension age |

| Daily Living Support | Included | Included |

| Mobility Support | Included | Not included |

| Reassessments | Regular | Rare |

| Amount Based On | Severity of need | Severity of care required |

People eligible for Attendance Allowance may still need support for mobility. However, they will need to explore local authority schemes or community-based services to cover those needs since this allowance doesn’t offer specific funding for transport or moving assistance.

Does Reaching Pension Age Affect Your Current PIP Payments?

If a person is already receiving PIP when they reach State Pension age, their payments typically continue unaffected. The transition involves a few administrative changes, but the benefit amount and components generally stay the same.

The DWP typically reviews these awards less frequently after pension age, especially if the health condition is expected to remain the same or deteriorate slowly. These are often referred to as light-touch reviews and occur approximately every ten years.

However, some limitations come into play regarding benefit adjustments:

- If a person was not receiving the mobility component before turning 66, they cannot start receiving it after that age.

- If a person was receiving the standard mobility component, they cannot upgrade to the enhanced rate, even if their condition worsens.

This is due to the eligibility framework freezing certain elements of PIP at the point of reaching State Pension age.

What Should You Do If Your PIP Is Due for Review After Pension Age?

When a PIP review is due after a claimant has passed State Pension age, the DWP assesses whether the condition has changed significantly. For many individuals, especially those with long-term, stable conditions, the review is simplified.

Important points to keep in mind during a post-pension-age PIP review:

- The claimant should report any changes in condition to the DWP, even if they believe it won’t affect their benefit.

- They will not be eligible to start receiving the mobility component if they weren’t already getting it before turning 66.

- Those on the standard rate of mobility cannot increase to the enhanced rate.

If a claimant does report a worsening condition, it may lead to a reassessment of their daily living component, but not the mobility component, due to restrictions outlined in DWP guidance.

The rules are designed to maintain benefit stability in retirement while still recognising serious deteriorations in health.

Are There Any Other Disability Benefits for People Over Pension Age?

Aside from Attendance Allowance, pensioners may be eligible for other forms of support that can supplement or replace PIP. Some of the commonly accessed benefits include:

- Carer’s Allowance: For those who provide at least 35 hours of care per week to someone receiving a qualifying disability benefit.

- Pension Credit: An income-related benefit that can include additional amounts for disabilities.

- Housing Benefit: For help with rent, depending on income and circumstances.

- Council Tax Reduction: Offered by local councils to reduce council tax bills for people on low income or with disabilities.

These benefits are often means-tested or based on specific personal circumstances. Unlike PIP, which is non-means-tested, most of these supports require an evaluation of household income and savings.

Here’s a second table highlighting some of these benefits:

| Benefit Name | Who Can Apply | Type of Support | Additional Notes |

| Attendance Allowance | Over State Pension age | Daily living costs | No mobility component |

| Carer’s Allowance | People caring for a disabled adult | Financial support for carers | Must provide 35+ hours of care weekly |

| Pension Credit | Pensioners on low income | Income top-up | Includes disability premium if eligible |

| Housing Benefit | Pensioners in rented accommodation | Help with rent | Means-tested |

| Council Tax Reduction | Low-income or disabled pensioners | Lower council tax bills | Apply via local council |

By exploring all available options, older individuals can ensure they receive the financial support they’re entitled to, even if PIP is no longer accessible.

How Can You Make Sure You Continue Receiving Support After Pension Age?

To ensure continuity of support, it’s crucial to stay informed about your entitlements and take the right steps when needed. While PIP rules become more rigid post-retirement, understanding the broader benefits landscape can help prevent income gaps.

Here are a few essential actions:

- Review your benefit situation annually to ensure all entitlements are in place.

- Keep medical documentation up to date in case of reviews or new claims.

- Consult support organisations like Citizens Advice or Age UK for guidance tailored to your personal situation.

In many cases, individuals may be able to combine non-means-tested and means-tested benefits, provided they meet eligibility criteria. This layered support system helps ensure that vulnerable older adults can maintain their quality of life after retirement.

Conclusion

So, does PIP stop at pension age? The answer is: not necessarily. If you’re already receiving PIP when you reach State Pension age, your payments will usually continue.

However, new claims after State Pension age are heavily restricted, and many people may need to consider Attendance Allowance instead.

Understanding these rules is key to ensuring continued support and avoiding any disruption in benefits. As policies may change, always check with reliable sources or speak to an adviser.

Frequently Asked Questions

Can I claim both PIP and Attendance Allowance?

No, you can only claim one of these benefits at a time. If you’re over State Pension age and already claiming PIP, you cannot claim Attendance Allowance as well.

What if I was already receiving PIP before reaching pension age?

Your PIP will generally continue as long as you remain eligible. The award may become indefinite and be reviewed less frequently.

Do PIP rates change when I turn 66?

PIP rates remain the same when you turn 66, but eligibility for increased components (like enhanced mobility) may become limited.

Is there a mobility component in Attendance Allowance?

No. Attendance Allowance only includes a daily living component, not a mobility element.

Will the DWP review my case differently once I retire?

Yes, reviews are typically less frequent and may be lighter in scope, particularly for indefinite awards.

Can I switch from Attendance Allowance to PIP?

Only if you’re under State Pension age. Once you’re over the age threshold, new PIP claims are generally not allowed unless specific criteria are met.

Where can I get advice on claiming PIP after retirement?

Organisations like Citizens Advice, Age UK, and Turn2Us offer free and expert guidance on benefit claims and eligibility.