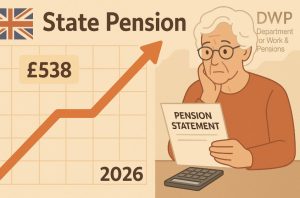

The UK government has confirmed a significant uplift in the state pension set for April 2026, with pensioners expected to gain an annual boost of £538.

This update, delivered through the Department for Work and Pensions (DWP), comes at a time when the cost of living remains a pressing concern for many older Britons.

Understanding how this increase works and who stands to benefit is essential for anyone planning their retirement or already receiving pension payments.

What Is the DWP 2026 State Pension Increase and Why Does It Matter?

The Department for Work and Pensions (DWP) has announced a projected state pension increase in 2026, which will result in pensioners receiving up to £538 more per year.

The full new state pension is set to rise from £221.20 to approximately £227.55 per week, based on current economic forecasts.

This matters significantly for pensioners who rely on this income for their daily living. With inflation remaining relatively high and the cost of essentials rising, the increase offers some relief.

The rise is part of the government’s ongoing commitment to uphold the triple lock policy, which ensures pensioners’ income maintains its real-world value.

Individuals receiving both the basic and the new state pension will see benefits, provided they meet contribution and eligibility requirements.

For many households, this increase could offset other rising costs such as energy bills and food prices.

How Does the Triple Lock Guarantee Affect the 2026 Pension Rise?

The triple lock system is a government policy that ensures the state pension increases every year by whichever is highest among the following:

- Consumer Prices Index (CPI) inflation

- Average earnings growth

- A guaranteed minimum of 2.5%

The 2026 increase will be based on data available by September 2025. Analysts predict a rise of around 2.87%, depending on inflation trends and wage growth over the next year.

In 2025, the pension rose by 8.5% due to strong wage growth, demonstrating how volatile these increases can be depending on economic conditions.

Here is how the triple lock functions in practice:

| Factor | 2025 Value (Example) | 2026 Forecast (Example) |

| CPI Inflation | 6.7% | 2.9% |

| Average Earnings Growth | 8.5% | 3.1% |

| Minimum Rate | 2.5% | 2.5% |

| Applied Increase | 8.5% (2025) | 2.87% (2026 forecast) |

The applied increase each year depends on which figure is highest. If inflation cools down in 2025, the increase for 2026 may be lower than previous years, but it will still ensure some growth in pension income.

Who Will Benefit from the 2026 State Pension Boost?

The 2026 state pension increase is set to benefit millions of UK pensioners. However, the actual value each individual receives will depend on their state pension type, their National Insurance (NI) contribution record, and whether they qualify for additional pension-related benefits or top-ups.

Groups that will benefit

- Recipients of the Full New State Pension: Individuals who reached state pension age on or after 6 April 2016 and have made at least 35 years of qualifying National Insurance contributions will receive the full new state pension. In 2026, their weekly payments are forecast to increase from £221.20 to approximately £227.55.

- Recipients of the Basic State Pension: Pensioners who reached state pension age before 6 April 2016 are covered under the basic state pension system. They require 30 qualifying years of NI contributions for the full amount, and their 2026 weekly pension is expected to increase from £169.50 to around £173.30. Those who were entitled to the Additional State Pension (like SERPS or State Second Pension) may receive more, depending on their earnings and contribution history.

- People with Partial Contributions: Those with less than the full number of qualifying NI years will still see an increase, but their total pension amount will be proportionally lower. For instance, someone with 20 qualifying years will receive a percentage of the full pension. This increase will apply proportionately.

- Claimants of Pension Credit: Pensioners with low income may be eligible for Pension Credit, a means-tested benefit that supplements their income. When the state pension increases, the threshold for Pension Credit also typically rises, helping more pensioners qualify or receive slightly more financial support. This is especially important for individuals who rely on both pension and additional benefits to cover essential expenses.

- Women and Carers with Gaps in Contributions: Many women and informal carers may have gaps in their NI record due to taking time off work to raise children or provide unpaid care. The state pension system now includes credits for such individuals, helping them build qualifying years. If they meet the minimum requirement, they too will benefit from the increase.

- Deferred State Pension Claimants: Some people choose to defer their pension claim past state pension age. This can lead to a higher weekly rate when they eventually claim. Anyone deferring in 2026 will benefit from the new rates, which form the basis for calculating their increased pension entitlement.

- Individuals Living Abroad (in Certain Countries): UK pensioners living abroad in countries with a reciprocal social security agreement (such as those in the EEA, Switzerland, or countries with bilateral agreements like the USA or New Zealand) often receive the annual pension uprating. However, pensioners in other countries such as Australia, Canada, and New Zealand without such agreements may not receive the increase.

The 2026 pension boost has wide-reaching implications for the financial security of retirees. With inflation still impacting household budgets, the increase provides some relief and better aligns pension income with the cost of living. However, understanding your entitlement—whether under the basic or new scheme—is essential to knowing how much you will benefit.

When Will the £538 State Pension Increase Take Effect?

The increase is scheduled to come into effect in April 2026, coinciding with the beginning of the new tax year. It will be applied automatically to eligible recipients and reflected in their weekly payments.

The expected increases are detailed in the table below:

| Pension Type | Current Weekly Rate (2025) | Forecast Weekly Rate (2026) | Estimated Annual Increase |

| Full New State Pension | £221.20 | £227.55 | £329.80 |

| Basic State Pension | £169.50 | £173.30 | £197.60 |

| Average Additional Benefits | – | – | £538.00 |

These figures are based on preliminary forecasts and could shift depending on inflation and earnings data released in September 2025. Payment dates and amounts will be confirmed by the DWP closer to the implementation period.

Why Is the State Pension Increasing in 2026?

The main reason for the increase is to maintain the purchasing power of pensions amid rising living costs. The triple lock policy ensures that pensions do not lag behind economic changes, particularly inflation.

Several contributing factors include:

- Ongoing cost of living pressures in the UK

- Higher prices for food, utilities, and housing

- Wage growth across multiple sectors

- Government commitment to protect vulnerable demographics, including older citizens

Over the past few years, the triple lock has come under scrutiny due to its cost to the Treasury. However, it remains a cornerstone of pension policy and is currently backed by the government through at least 2026.

Although some critics argue that it places a financial strain on public finances, supporters maintain it is essential for maintaining pensioners’ quality of life.

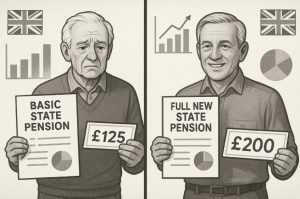

What Are the Key Differences Between the Full and Basic State Pension in 2026?’

The UK state pension system is divided into two primary types: the Basic State Pension and the New State Pension.

The system you fall under depends on your date of birth and when you reached state pension age.

While both are designed to provide financial support in retirement, they differ significantly in terms of eligibility, payment amounts, and contribution requirements.

1. Retirement Date and System Eligibility

- Basic State Pension: Applies to individuals who reached state pension age before 6 April 2016.

- New State Pension: Applies to individuals who reached state pension age on or after 6 April 2016.

This cut-off date is crucial. If you reached pension age even one day before 6 April 2016, you fall under the old system, which has different rules.

2. Weekly Pension Amounts (2026 Forecast)

The state pension is adjusted annually, usually in line with the triple lock mechanism. The amounts for 2026 are forecasted as follows:

| Feature | Basic State Pension | New State Pension |

| Weekly Amount (2025) | £169.50 | £221.20 |

| Forecasted Weekly (2026) | £173.30 | £227.55 |

| Annual Total (Est.) | £9,011.60 | £11,837.00 |

| Difference per Year | – | Approx. £1,825.40 more |

The New State Pension is significantly higher, primarily due to its design to simplify the previous system and increase fairness.

3. National Insurance Requirements

- Basic State Pension: Requires 30 qualifying years of NI contributions or credits for the full amount. Those with fewer years receive a proportionate pension.

- New State Pension: Requires 35 qualifying years of NI contributions for the full amount. A minimum of 10 years is required to receive anything at all.

For example, someone with 25 qualifying years under the new scheme would receive roughly 25/35ths of the full pension amount.

4. Additional Pension Benefits

- Basic State Pension: May be supplemented by the Additional State Pension (also known as SERPS or the State Second Pension). This means some individuals on the basic system may receive a higher total income than the basic pension alone.

- New State Pension: Has no additional pension. The full amount is designed to be a flat-rate payment, simplifying the system and removing dependency on earnings-related top-ups.

5. Inheritable and Widowed Benefits

- Basic State Pension: May be partly inheritable by a spouse or civil partner after death. Some widowed pensioners can receive increases based on their partner’s NI record.

- New State Pension: Generally non-inheritable, though there are limited transitional protections for people who built up certain entitlements before 6 April 2016.

6. Deferral Options

Both pensions can be deferred, meaning you delay claiming in exchange for higher future payments. However, the increase rate differs:

- Under the basic state pension, deferring increases your pension by about 1% for every 5 weeks deferred (equivalent to 10.4% per year).

- Under the new state pension, the rate is slightly lower approximately 1% every 9 weeks, or around 5.8% annually.

Summary Comparison Table

| Criteria | Basic State Pension | New State Pension |

| Retirement Age Criteria | Before 6 April 2016 | On or after 6 April 2016 |

| Full Weekly Pension (2026) | £173.30 (forecast) | £227.55 (forecast) |

| NI Years for Full Pension | 30 years | 35 years |

| Minimum NI Years Required | At least 1 year (for part) | At least 10 years |

| Additional Pension Available | Yes (SERPS, State Second) | No |

| Widowed/Inheritable Rights | Partially | Rarely |

| Can Be Deferred? | Yes | Yes |

| Deferral Increase Rate | 10.4% per year | 5.8% per year |

Understanding these differences is vital for retirement planning. Individuals approaching state pension age should check which system they fall under and verify their National Insurance record to estimate their future income accurately. The GOV.UK pension forecast tool offers a simple way to do this.

How Should Pensioners Prepare for the Upcoming Changes?

As the 2026 pension increase approaches, pensioners should consider how it affects their financial plans. Although the change is automatic for most, it is beneficial to review one’s personal situation.

Key actions include:

- Reviewing your National Insurance record to ensure maximum eligibility

- Using the state pension forecast tool on GOV.UK to get a personalised estimate

- Assessing eligibility for Pension Credit, Housing Benefit or Council Tax Support

- Monitoring inflation and interest rate trends to gauge overall impact on household budgets

- Seeking advice from trusted financial advisers or free services like Age UK and Citizens Advice

Understanding these changes well in advance helps ensure pensioners are not caught off guard and can make informed decisions regarding their finances in 2026.

Could There Be Any Changes or Delays to the 2026 Pension Increase?

While the DWP and current government policy point toward the increase taking place as planned, there are always factors that could potentially alter the final implementation.

These include:

- Shifts in the political landscape, such as a general election

- Future government budget reviews that may reprioritise public spending

- Lower-than-expected inflation or earnings data

- Broader economic instability that may affect national fiscal policy

It’s worth remembering that the triple lock was temporarily suspended during the COVID-19 pandemic in 2021 due to exceptional wage growth figures. Although unlikely in the current climate, a similar suspension or modification could occur if justified by circumstances.

Pensioners are advised to follow DWP updates and verify changes on the official GOV.UK website for the most accurate and up-to-date information.

Conclusion

The DWP 2026 state pension increase signals a continued effort by the UK government to support pensioners during a time of rising living costs.

The projected £538 annual boost will make a meaningful difference for many, especially those relying heavily on their state pension as their main source of income.

While the increase is positive, pensioners should remain informed and proactive—checking forecasts, confirming eligibility, and planning for the long term. The upcoming rise reinforces the importance of a robust pension system that evolves with the economic landscape.

FAQs About the DWP 2026 State Pension Increase

Will the triple lock still be in place in 2026?

The government has reaffirmed its commitment to the triple lock up to 2026, though it may be reviewed beyond that depending on economic and political factors.

Can I still receive the full state pension if I have gaps in my NI record?

You can still receive a partial pension, and in some cases, it’s possible to buy extra National Insurance years to boost your entitlement.

Will Pension Credit increase alongside the state pension?

Historically, Pension Credit thresholds are adjusted in line with state pension increases, but exact figures are announced each year by the DWP.

Do overseas pensioners receive this increase?

It depends on the country. Pensioners in countries with a reciprocal social security agreement with the UK typically receive increases, while others may not.

How do I know if I’m on the basic or new state pension?

This depends on your retirement date. Those who reached state pension age before April 6, 2016 are on the basic system, while those after are on the new system.

Is the state pension taxable?

Yes, it is considered taxable income. If your total income exceeds the personal allowance, you may be liable for income tax on your pension.

How do I update my personal details with the DWP?

You can update your information by contacting the DWP directly or via your online GOV.UK account under the pensions and benefits section.