As 2025 progresses, the Department for Work and Pensions (DWP) has sparked widespread speculation about potential changes to pensioner benefit assessments particularly those involving home ownership.

While no sweeping legislation has yet been passed, credible indications suggest the government is looking more closely at how property wealth affects eligibility for key benefits like Pension Credit and Housing Benefit.

These proposed reforms, especially the comprehensive assessment of home equity, could significantly impact retired homeowners particularly those in high-value property areas.

Alongside these proposals, a confirmed administrative merger of Pension Credit and Housing Benefit is scheduled for 2026, aiming to simplify the claims process for pensioners.

It’s essential for retirees and their families to understand what’s changing, what’s speculative, and how to prepare.

What Are the Latest DWP Home Ownership Rule Changes for Pensioners in 2025?

In 2025, the Department for Work and Pensions has not enacted new legislation that explicitly changes how property ownership affects benefits for pensioners.

However, recent updates and statements from government officials suggest a growing interest in reassessing how home ownership factors into eligibility for income-related benefits.

The potential changes focus on reviewing the financial value tied up in a pensioner’s property. This includes proposals to consider home equity as part of the eligibility criteria for benefits such as Pension Credit and Housing Benefit.

These developments stem from a wider push to improve fairness in how public funds are distributed among pensioners, especially between those who rent and those who own high-value properties.

The DWP has acknowledged that as property wealth among pensioners increases, particularly in certain parts of the country, there needs to be a more accurate way of determining who truly needs financial support.

The reforms being discussed aim to balance the need for social assistance with a more accurate reflection of available financial resources.

Although not yet implemented, the groundwork is being laid through policy papers and administrative preparations.

How Will Property Wealth Affect Pension Credit and Housing Benefit Eligibility?

The consideration of property wealth in benefit calculations is a topic gaining traction within policy circles.

Although no specific legislation has been passed as of 2025, strong indications suggest that the DWP is actively exploring how equity in residential property could play a larger role in determining a pensioner’s eligibility for means-tested benefits.

Current Approach to Property in Means Testing

At present, the value of a pensioner’s primary residence is typically excluded from means testing for Pension Credit and Housing Benefit.

This rule is based on the idea that the home is a basic necessity and not an accessible financial resource unless sold or monetised.

However, other properties such as second homes or rental properties are already considered part of a pensioner’s capital. In these cases, the equity or rental income generated directly affects benefit calculations.

This distinction is now under review as the government considers whether it still accurately reflects economic realities, especially in the context of rising property values across the UK.

Proposed Shift Towards Equity-Based Assessment

Under the proposed framework, property equity in a pensioner’s main residence may no longer be completely disregarded.

Instead, the DWP may apply a sliding scale or threshold system where a portion of the home’s value is counted once it exceeds a certain level.

Some ideas under consideration include:

- Setting a capital threshold, such as £250,000, above which part of the equity is assessed

- Applying a tapered reduction in benefit entitlement based on increasing equity levels

- Introducing a voluntary charge scheme, similar to deferred payment agreements in social care, allowing benefits to be paid against future home sale proceeds

While these options are still at consultation stages, they indicate a clear policy direction that aims to align property wealth with other forms of capital, like savings and investments.

Impact on Pension Credit Eligibility

If equity assessments are introduced, Pension Credit eligibility may be significantly affected for many pensioners who currently qualify due to low income but own relatively high-value properties.

Those likely to be impacted include:

- Pensioners who have paid off their mortgages

- Retired individuals living in high-demand urban areas

- Single homeowners with no dependants and large equity holdings

The result could be a reduction in eligible applicants, particularly in urban centres and affluent postcodes. Pensioners who previously qualified on income grounds may find themselves excluded under the revised rules.

Consequences for Housing Benefit Access

Similarly, Housing Benefit, which supports low-income tenants and some homeowners with service charges or rent, may be subject to tighter eligibility if property equity is assessed.

For example:

- A pensioner owning a leasehold flat with high equity but low monthly income might be required to draw on that equity or downsize rather than receive assistance

- Individuals with an empty home temporarily unoccupied may find the value assessed unless compelling circumstances apply

Housing Benefit reforms are likely to mirror any changes made to Pension Credit, especially after the administrative integration planned for 2026.

Are Homeowners in High-Value Areas Likely to Be Affected More?

The geographic location of a property plays a significant role in its market value. As the DWP considers incorporating property equity into benefit calculations, this naturally raises concerns among pensioners living in regions where house prices have increased substantially over the last two decades.

Disparities in Regional Property Values

Property prices across the UK vary significantly. While a pensioner in Northern England may own a home valued at £150,000, someone in a similar financial position in London may own a property worth over £500,000. This creates an inherent imbalance in how wealth is distributed geographically.

Regions with the highest average property values include:

- Greater London

- South East England

- Surrey, Hertfordshire, and other commuter towns

- Parts of Edinburgh and Aberdeen

These disparities have led to discussions around whether a flat national policy is fair or whether a location-based adjustment is more appropriate.

Potential for Location-Based Equity Assessments

The DWP may consider implementing regional thresholds or index-linked valuations to account for variations in house prices. This means that pensioners in high-value areas may face lower capital limits before their property equity begins to impact their benefits.

For example, a home valued at £350,000 in London might be treated differently from a home of the same value in Wales due to differences in local income averages and cost of living.

This location-sensitive approach could be implemented in the following ways:

- Tiered thresholds by postcode or council area

- Regionally adjusted equity caps

- Local authority discretion over hardship cases

Such measures aim to prevent unfair penalisation of pensioners simply due to their location, while still recognising that high equity often signals a higher capacity for financial independence.

Equity-Rich but Income-Poor Households

One of the main groups that could be affected by these changes is the equity-rich but income-poor segment of the pensioner population. These are individuals who live in valuable homes but have limited liquid income and no easy access to their wealth.

Common scenarios include:

- Long-time homeowners who bought property decades ago

- Pensioners who are asset-rich but cash-poor

- Widowed individuals who inherited homes but live on minimal state pensions

The reforms could force these individuals to consider options such as:

- Downsizing to access capital

- Equity release schemes

- Applying for deferred payment arrangements where benefits are recovered from their estate

The challenge for policymakers will be balancing the goal of fairness with compassion for pensioners whose property wealth is not easily converted into spendable income.

Risk of Unintended Consequences

Applying stricter benefit rules based on property values could have unintended consequences. These might include:

- Pensioners being forced to sell or remortgage their homes to maintain their standard of living

- Displacement from family homes in high-value areas

- Increased demand for social housing from pensioners unable to retain their current living arrangements

Such outcomes would run counter to the government’s objective of supporting stable, independent retirement living. Therefore, it is expected that any changes will come with protections for vulnerable individuals, such as those with health issues or no realistic way of accessing their equity.

What Is Changing in the Administration of Pension Credit and Housing Benefit by 2026?

In addition to rule changes being considered, a confirmed reform is the integration of administrative systems for Pension Credit and Housing Benefit.

Currently, these benefits are handled separately, often requiring duplicate information and different verification processes.

Starting in 2026, these benefits will be managed through a unified DWP system. This integration is designed to:

- Simplify the application and assessment process

- Ensure real-time data sharing between departments

- Improve the consistency of eligibility decisions

- Reduce administrative errors and delays

This change will likely make it easier for pensioners to access their entitlements but may also enable faster cross-referencing of property ownership, savings, and other assets.

The system aims to eliminate inefficiencies and help caseworkers make faster, more accurate decisions.

For pensioners, this means that once the integration takes effect, one application will cover multiple benefits, and updates to personal or financial information will be reflected across all connected services.

What Should Pensioners Report to the DWP About Their Property and Assets?

As part of their responsibility to maintain benefit eligibility, pensioners must notify the DWP of any significant changes to their financial situation. This includes changes related to property and other forms of capital.

Pensioners should report:

- Sale or transfer of their primary residence

- Purchase of additional property or land

- Receipt of an inheritance involving property

- Renting out part of their home or converting it into a rental property

- Substantial renovations that may increase property value

These reports are essential to ensure that benefit payments are accurate and in line with entitlement rules.

Failing to report changes can lead to overpayments, repayment demands, or disqualification from benefits.

The DWP may also request supporting documents such as:

- Property deeds

- Valuation reports

- Mortgage statements

- Tenancy agreements if a portion of the property is let

Why Is the DWP Introducing These Changes to Home Ownership Rules?

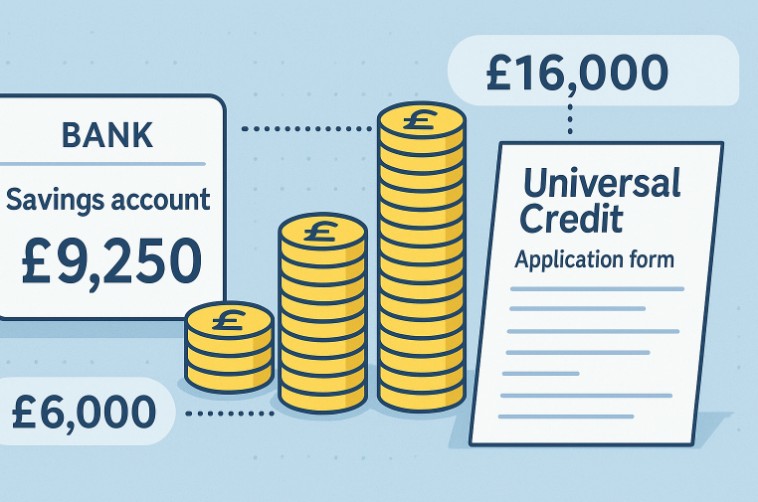

The rationale behind the proposed changes is to make the welfare system more reflective of actual wealth, rather than just income.

Currently, a pensioner with £10,000 in savings may be excluded from benefits, while another with £400,000 of equity in their home qualifies due to a lower income. This disparity is viewed by many policymakers as unfair.

The government is therefore exploring ways to improve fairness by ensuring that:

- Pensioners with substantial untapped wealth are encouraged to access it where feasible

- Resources are directed to those with no access to significant capital

- Benefits serve their original purpose of supporting those most in need

This shift is not intended to penalise pensioners but to ensure that benefit support is consistent and economically sustainable.

How Can Pensioners Prepare and Get Help with These Changes?

While many of these changes are still under consultation or preparation, pensioners can take proactive steps to prepare:

- Stay informed by following DWP updates and public policy briefings

- Review current property ownership and valuations

- Document all changes to assets and report them in a timely manner

- Contact advisory services for help understanding eligibility

Support services available to pensioners include:

- Citizens Advice: Offers free guidance on benefit entitlements and changes

- Local Authorities: Provide information on Housing Benefit and discretionary support

- Age UK: Helps pensioners understand how reforms may impact their financial situation

- DWP Helplines: Provide official information and application support

In cases where a pensioner owns property that is not realistically accessible as a financial asset, a discretionary review can be requested.

This allows the local authority to assess whether property equity should be excluded from means testing based on individual circumstances.

To better understand what can be included in these reviews, see the table below:

| Review Criteria | Example Scenario | Possible Outcome |

| Property is not generating income | Owned but unoccupied due to health reasons | May be excluded from asset assessment |

| Difficult to sell or rent | Located in a remote area or has legal issues | Partial or full exclusion possible |

| Occupied by dependent family member | Adult child with disability lives in the home | Could qualify for exemption |

These reviews are not guaranteed to exclude property from consideration but can provide an opportunity to present the full context of ownership and financial access.

Conclusion

While official legislation has yet to be finalised, it’s clear that the DWP is moving toward a more asset-sensitive benefit system.

Pensioners who own property particularly in higher-value regions—should stay vigilant about how their wealth may influence their entitlements in the near future.

The confirmed administrative overhaul set for 2026 will make it easier to claim benefits but may also increase scrutiny.

Pensioners should prepare by understanding current rules, reporting changes accurately, and seeking advice from reputable sources. As the welfare system continues to evolve, staying informed is the best protection.

FAQs

What is the DWP’s stance on pensioners owning multiple properties?

Owning multiple properties increases your overall asset base and is more likely to disqualify you from means-tested benefits like Pension Credit and Housing Benefit.

Will the value of my home affect my pension credit in 2025?

Not directly yet, but proposed changes could introduce equity-based assessments, particularly for high-value homes.

How do I report a change in my property to the DWP?

Changes can be reported online via GOV.UK, by calling the DWP, or through your local council if Housing Benefit is involved.

Can I be denied housing benefits if I own a home?

Yes, especially if your home is unoccupied or considered an asset capable of providing income or being sold.

What is a discretionary review and when should I request one?

A discretionary review lets you ask the council to exclude your property from benefit assessments if selling or accessing its value is not viable.

Are these rule changes confirmed or just rumours?

Only the administrative merger in 2026 is confirmed. Property equity assessments are still under review and not formally enacted.

How can I get trusted advice about these changes?

Contact Citizens Advice, Age UK, or your local council. Avoid relying on unofficial websites or social media rumours.