For individuals nearing retirement in the UK, a common concern arises: can someone who has never paid National Insurance (NI) still receive a State Pension?.

While National Insurance contributions play a central role in qualifying for a pension, there are specific exceptions and alternatives worth exploring.

This guide offers an in-depth look at how the UK pension system works, who qualifies, and what options are available for those with no or limited NI history.

What Is The UK State Pension And How Does It Work?

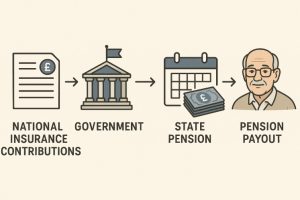

The State Pension is a regular payment provided by the UK Government to individuals who have reached State Pension age and have a qualifying National Insurance record.

This benefit is intended to offer financial stability in retirement. There are two main types of State Pension:

- The Basic State Pension, which applies to those who reached State Pension age before 6 April 2016

- The New State Pension, which applies to individuals who reached State Pension age on or after 6 April 2016

The New State Pension is based entirely on the individual’s National Insurance record. As of the 2025/26 tax year, the full New State Pension is £230.30 per week. Payments are issued every four weeks and continue throughout retirement.

Do You Need To Pay National Insurance To Get A State Pension?

To qualify for any form of State Pension, National Insurance contributions or credits are generally required.

These contributions help fund public services and benefits such as pensions, unemployment assistance, and parental support.

A person needs at least 10 qualifying years of contributions or credits to receive any State Pension.

These years do not have to be consecutive and can include time spent receiving benefits that provide automatic NI credits.

For instance, credits may be awarded if a person has:

- Claimed Carer’s Allowance

- Received Jobseeker’s Allowance or Universal Credit

- Been on Statutory Sick Pay for extended periods

Those who haven’t paid any National Insurance and have not received any credits will not qualify for the State Pension under current rules.

How Many Qualifying Years Of National Insurance Are Required?

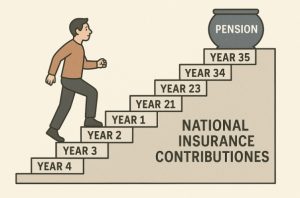

The number of qualifying years determines how much State Pension one can receive. To receive the full New State Pension, 35 qualifying years are required. If a person has fewer years, their pension will be calculated on a proportional basis.

| National Insurance Years | Weekly Pension Amount (Approximate) |

| 10 Years | £65.80 |

| 20 Years | £131.60 |

| 35 Years | £230.30 (Full Pension) |

Less than 10 years on a National Insurance record typically results in no entitlement to the State Pension. However, individuals may choose to fill gaps by paying voluntary contributions.

Can You Get A Pension If You’ve Never Paid National Insurance?

While unusual, it is not impossible for someone who has never worked or paid NI to still qualify for the State Pension if they have accumulated enough credits.

These credits can be received through government support schemes or caring responsibilities.

Some people in this situation include:

- Stay-at-home parents who claimed Child Benefit

- Carers looking after disabled or ill relatives

- Unemployed individuals on means-tested benefits

Such credits are recorded by HMRC and can count toward the minimum 10 qualifying years.

What Are Your Options If You Don’t Qualify For The State Pension?

Not qualifying for the State Pension can be a worrying situation, especially for those approaching or already past retirement age.

However, there are several options available for individuals who do not meet the minimum requirement of 10 qualifying years of National Insurance contributions.

These options vary depending on individual circumstances such as age, income, benefit history, and ability to make up for contribution gaps. The following are key routes to explore:

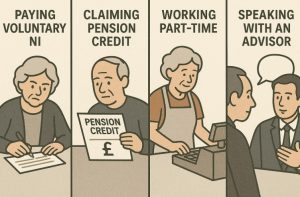

1. Voluntary National Insurance Contributions

If your shortfall is due to gaps in employment or time spent abroad, you may be able to purchase extra years by making voluntary Class 3 National Insurance contributions. This is often the most direct way to increase your pension entitlement.

- You can usually pay for up to six previous tax years

- The cost in 2025/26 is approximately £17.45 per week

- Payments are made through HMRC and can be arranged online or by post

It’s crucial to first request a State Pension forecast to determine if paying voluntary contributions will result in a meaningful increase to your future pension payments.

In some cases, especially if you are close to the 10-year threshold, just a few years of payments could qualify you for a partial State Pension.

2. Claiming Pension Credit

If you do not qualify for the State Pension or are only eligible for a small amount, Pension Credit may offer essential financial support. It is a means-tested benefit designed to help those over State Pension age on low incomes.

There are two parts:

- Guarantee Credit: Tops up your income to a minimum level. For 2025/26, this is around £218.15 per week for a single person and £332.50 for couples.

- Savings Credit: Available for those who saved for retirement and reached pension age before 6 April 2016.

Pension Credit may also entitle you to additional benefits, such as:

- Free NHS prescriptions and dental care

- A free TV licence (for over-75s)

- Housing Benefit or help with rent

- Council Tax Reduction

You can apply online via the GOV.UK website, by phone, or by using a paper form.

3. Receiving National Insurance Credits

If your lack of qualifying years is due to periods when you were not working but were caring for others or receiving state benefits, you may already have received NI credits without realising it.

Credits are automatically awarded in cases such as:

- Claiming Carer’s Allowance

- Receiving Child Benefit for a child under 12

- Being on Jobseeker’s Allowance, Incapacity Benefit, or Employment and Support Allowance (ESA)

You can check if these credits appear in your NI record and contact HMRC to request a review or update if any eligible periods are missing.

4. Deferring Your Pension Claim

If you are not eligible now but expect to gain entitlement in the near future by continuing to work or paying contributions, you may choose to defer your pension claim.

Delaying your claim can sometimes result in increased weekly payments when you eventually start receiving it.

- For every nine weeks you defer, your pension increases by 1%

- This equates to an increase of approximately 8% per year

While this option won’t help those with no contributions at all, it can be useful for individuals who are just short of the required number of qualifying years.

5. Working Longer Or Part-Time

Continuing to work, even part-time, can help you earn additional qualifying years if your income exceeds the lower earnings limit for National Insurance contributions. In 2025/26, this is around £123 per week.

By remaining in employment or self-employment, individuals can:

- Accumulate additional qualifying years

- Delay drawing on private pension savings

- Improve their financial position in retirement

This option is often suitable for those who are physically able to work and wish to enhance their financial security later in life.

6. Exploring International Agreements

If you’ve spent time living or working abroad, especially in EU/EEA countries or countries with reciprocal social security agreements with the UK (such as Canada, New Zealand, or certain Commonwealth countries), you may be able to combine your foreign contributions with your UK NI record to qualify for a State Pension.

These agreements allow periods of insurance, work, or residence in another country to be taken into account when calculating entitlement to a UK State Pension.

Contact the International Pension Centre to assess your eligibility under international agreements.

Who Is Eligible For Pension Credit In The UK?

Pension Credit provides financial assistance to people over State Pension age with low income.

It is not based on National Insurance contributions and is means-tested. There are two components:

- Guarantee Credit: Ensures a minimum income level

- Savings Credit: Rewards people who have made modest savings for retirement

Eligibility requires:

- Being a UK resident

- Having income below the threshold set for the current tax year

- Meeting residency and age requirements

Pension Credit can also grant access to other benefits such as free NHS dental treatment, housing benefit, and a free TV licence for those over 75.

Can You Pay Voluntary National Insurance Contributions To Qualify Later?

People who do not have enough NI years may pay voluntary contributions to improve their State Pension entitlement.

These are Class 3 contributions and must usually be paid within six tax years of the gap year.

| Voluntary Contribution Type | Eligibility | Purpose |

| Class 3 | Most individuals without gaps | Boost State Pension or qualify |

| Class 2 | Self-employed or working abroad | Sometimes cheaper, if eligible |

Before making payments, individuals should:

- Check if the extra contributions will increase their pension

- Review their full National Insurance record via gov.uk

- Get personalised advice from HMRC or an independent financial advisor

What Happens If You’re Living Abroad And Haven’t Paid National Insurance?

UK nationals or residents who have moved abroad may still be eligible for a State Pension if they made enough National Insurance contributions before emigrating.

The UK has agreements with certain countries, including those in the European Economic Area (EEA), allowing people to combine contribution periods to meet eligibility requirements.

Points to note for pensioners abroad:

- Some countries do not qualify for annual pension increases

- Individuals must apply to the International Pension Centre

- Time spent contributing to foreign pension systems may count under reciprocal agreements

It is essential to understand the specific agreements between the UK and the destination country when planning retirement abroad.

How Can You Check Your State Pension Forecast And NI Record?

The Government provides a digital tool where individuals can view their National Insurance history and estimate their State Pension. This forecast includes:

- How much pension one is likely to receive

- When they can start claiming it

- Any gaps in contributions

- Options to pay voluntary contributions

To use the service, visit Check Your State Pension Forecast. It requires a Government Gateway login or verification through GOV.UK.

What Support Is Available For Pensioners With No NI Contributions?

For individuals who do not qualify for any form of State Pension, the UK provides additional support schemes designed to alleviate financial hardship. These schemes are needs-based and do not rely on NI history.

Examples include:

- Pension Credit, which can provide a guaranteed income

- Council Tax Reduction, depending on income and savings

- Housing Benefit, for those who rent their home

- Attendance Allowance, for pensioners needing care or support

These programmes are available through local councils or the Department for Work and Pensions. Eligibility depends on factors like income, residency, health conditions, and savings.

Conclusion

While paying National Insurance is the standard route to accessing the UK State Pension, it is not the only way.

Certain state benefits may entitle you to NI credits, and voluntary contributions can help fill in the gaps.

If you’ve never paid NI and don’t qualify for the pension, Pension Credit and other support schemes are available to ensure a basic income during retirement.

It’s crucial to check your National Insurance record early and explore your options to avoid financial uncertainty later in life.

FAQs about Pensions and National Insurance in the UK

Can I get the State Pension if I’ve only worked part-time?

Yes, as long as your earnings met the National Insurance threshold or you received NI credits from benefits, you may accumulate qualifying years even with part-time work.

What happens if I have gaps in my National Insurance record?

Gaps can reduce your pension amount. You may fill these gaps with voluntary contributions, provided they fall within the allowed timeframe (usually the last six years).

Is the State Pension taxed?

Yes, if your total income from all sources exceeds the personal allowance (£12,570 for 2025/26), your State Pension will be subject to income tax.

Can housewives or stay-at-home parents get a State Pension?

Yes, stay-at-home parents may receive NI credits if they claimed Child Benefit for children under 12, which can count towards their pension.

What if I’ve lived and worked in multiple countries?

You may be able to combine contributions from different countries under reciprocal agreements to qualify for a UK pension. Contact HMRC for detailed guidance.

Does the State Pension increase each year?

Yes, under the “triple lock” system, it increases annually by the highest of inflation, average earnings growth, or 2.5%. However, this may not apply if you live abroad.

Can I receive any pension benefits without having a National Insurance number?

A National Insurance number is required to build a NI record. If you’ve never had one, it’s unlikely you’ve made any qualifying contributions or received NI credits.