Understanding how Employment and Support Allowance (ESA) works can be complex, especially when it comes to determining whether contribution-based ESA is means tested.

With various types of ESA available and changing benefit rules across the UK, it’s important for claimants to know what they’re entitled to.

This guide provides clear, up-to-date information on contribution-based ESA, including how it differs from income-related ESA, who qualifies, how much you can receive, and how it fits alongside other support like Universal Credit.

What Is Contribution-Based ESA and How Does It Work?

Contribution-based Employment and Support Allowance (ESA) is a UK benefit designed for individuals who are unable to work due to illness or disability.

It is determined solely by the individual’s National Insurance (NI) contributions over the previous two tax years.

Unlike income-related ESA, this type of benefit is not influenced by your income, savings, or household circumstances.

There are two primary phases of ESA:

- Assessment Phase: Lasts up to 13 weeks, during which you receive a basic payment while undergoing a Work Capability Assessment.

- Main Phase: Begins once the assessment is complete and you are placed into either the Support Group or the Work-Related Activity Group.

Contribution-based ESA is now more commonly referred to as New Style ESA when claimed alongside Universal Credit. Regardless of its name, it retains the same non-means-tested structure.

Is Contribution-Based ESA Means Tested in the UK?

Contribution-based ESA is not means-tested. This means eligibility and payment amounts are unaffected by:

- Personal or household income

- Capital or savings

- Partner’s earnings or employment

Your claim is assessed purely on your National Insurance contribution history. According to Marie Curie, this benefit ensures that individuals who have paid into the system through their employment history can access support without the scrutiny of a financial means test.

However, other conditions must still be met, such as undergoing the Work Capability Assessment and meeting residency requirements. Additionally, if you apply for other benefits like Universal Credit alongside ESA, those separate claims might include a means test.

Who Is Eligible for Contribution-Based ESA?

Eligibility for contribution-based Employment and Support Allowance (ESA) depends on a specific set of criteria that focuses on an individual’s work history, health status, and National Insurance (NI) record.

Unlike income-related benefits, your current financial situation, such as your income, partner’s earnings, or savings, does not affect your claim.

To be considered for contribution-based ESA, claimants must meet all of the following core requirements:

1. National Insurance Contributions

The most important eligibility factor is your National Insurance contributions. You must have paid or been credited with enough contributions in the two full tax years before the year in which you’re claiming. These must include:

- Contributions in Class 1 (usually paid through employment) or Class 2 (for self-employed individuals)

- At least 26 weeks of contributions at the lower earnings limit in one of the two tax years

- Sufficient earnings in both tax years that reach the minimum contribution threshold set by HMRC

Even if you were not employed during the relevant period, you may still qualify if you received NI credits due to unemployment, sickness, or caring responsibilities.

2. Inability to Work Due to Illness or Disability

ESA is intended for individuals who are unable to work or are limited in their ability to work due to a medical condition or disability. This must be verified through the Work Capability Assessment (WCA), a medical evaluation process that categorises you into:

- Work-Related Activity Group (WRAG): you are expected to take steps toward work

- Support Group: you are not expected to prepare for work due to the severity of your condition

In some cases, such as when the claimant is terminally ill (with a prognosis of less than six months), an expedited process known as the Special Rules for End of Life (SREL) may apply, bypassing some of the usual assessments.

3. Age Restrictions

To be eligible, you must be:

- Over 16 years old

- Below State Pension age at the time of your claim

If you reach State Pension age, you will no longer qualify for ESA and will instead be considered for pension-related benefits, such as State Pension or Pension Credit.

4. Not in Receipt of Statutory Sick Pay

You cannot claim contribution-based ESA at the same time as receiving Statutory Sick Pay (SSP) from your employer. ESA is usually claimed after SSP ends, often around 28 weeks of sickness absence. If you are still employed but nearing the end of your SSP entitlement, you can apply for ESA in preparation.

5. Residency Requirements

You must meet basic residency and immigration conditions to claim ESA:

- Be ordinarily resident in the UK

- Be habitually resident in the UK, Channel Islands, Isle of Man, or the Republic of Ireland

- Have the right to reside in the UK, particularly for non-UK nationals

Those with limited leave to remain or subject to immigration control may not be eligible.

6. Not in Full-Time Education (With Exceptions)

Generally, full-time students are not eligible for ESA unless they are:

- In receipt of Disability Living Allowance (DLA) or Personal Independence Payment (PIP)

- Part of a programme or course approved for people with disabilities

This rule ensures that support is prioritised for those who are not otherwise financially supported through education grants or loans.

7. Medical Evidence and Compliance

Claimants must:

- Provide a fit note (also called a Statement of Fitness for Work) from their GP when applying

- Fully participate in the assessment process and attend all scheduled medical evaluations, unless they have a qualifying exemption

Failure to comply with medical assessments or jobcentre requirements may result in your claim being refused, suspended, or terminated.

What’s the Difference Between Contribution-Based and Income-Related ESA?

Contribution-based and income-related ESA differ in terms of how eligibility is determined and how the benefit interacts with other income or support.

Here is a detailed comparison:

| Feature | Contribution-Based ESA | Income-Related ESA |

| Means-Tested | No | Yes |

| Based on National Insurance | Yes | No |

| Affected by Income or Savings | No | Yes |

| Availability for New Claims | Yes (as New Style ESA) | No (phased out by Universal Credit) |

| Taxable | Yes | No |

| Linked to Universal Credit | Can be claimed alongside UC | Replaced by UC |

Contribution-based ESA is largely unaffected by your current financial situation, while income-related ESA is designed to help individuals with low or no income. Since income-related ESA is being replaced by Universal Credit, most new claimants are steered towards New Style ESA (contribution-based) and UC.

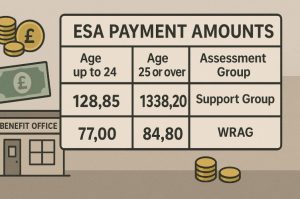

How Much Can You Receive on Contribution-Based ESA?

The payment structure for contribution-based ESA is split into two stages. In the initial stage, known as the assessment phase, payments are standard and not influenced by your Work Capability Assessment outcome. After assessment, payment levels differ depending on whether you are placed in the Support Group or Work-Related Activity Group.

| Claim Stage | Weekly Payment Amount (2025) |

| Assessment Phase – Under 25 | £71.70 |

| Assessment Phase – 25+ | £90.50 |

| Main Phase – WRAG | £113.55 |

| Main Phase – Support Group | £128.85 |

The Support Group receives higher payments due to the severity of conditions that exempt members from work-related activities. Also, payments in the Work-Related Activity Group are limited to a maximum of 365 days. In contrast, those in the Support Group may receive ESA for an indefinite period as long as they remain eligible.

Contribution-based ESA is a taxable benefit. If you have other income that pushes you above the tax-free allowance, it must be declared to HMRC.

Can You Claim Contribution-Based ESA While Working?

You may still be eligible to receive contribution-based ESA while working under certain conditions. This is known as permitted work. The Department for Work and Pensions allows you to work within specific limits without affecting your ESA entitlement.

Permitted work rules include:

- You can work up to 16 hours per week

- You can earn up to £167 per week (2025 limit)

- The work must be declared to the DWP

- The nature of the work must not contradict your ESA medical assessment findings

Common examples of permitted work include part-time voluntary roles or jobs with flexible hours that accommodate your medical condition. The goal is to allow ESA claimants to gradually explore work possibilities without losing support.

How Does Contribution-Based ESA Relate to Universal Credit?

Contribution-based Employment and Support Allowance (ESA) and Universal Credit (UC) are both part of the UK’s welfare support system, but they operate under different rules and serve distinct purposes.

Many claimants are understandably confused about how these two benefits interact, especially now that income-related ESA has been replaced by Universal Credit for most new claims.

To clarify, contribution-based ESA continues to be available as a standalone benefit for those with sufficient National Insurance contributions. However, it is now referred to as New Style ESA when claimed alongside Universal Credit.

What Is New Style ESA?

New Style ESA is essentially a rebranded version of contribution-based ESA. It is available to claimants who:

- Have a health condition or disability that affects their ability to work

- Have made enough National Insurance contributions in the last two to three tax years

- Are not entitled to or have completed their Statutory Sick Pay

New Style ESA is not affected by household income or savings, which makes it very different from Universal Credit. However, many individuals claim both benefits simultaneously, especially if they require additional financial support that ESA alone cannot provide.

Claiming ESA and Universal Credit Together

You can claim New Style ESA and Universal Credit at the same time, provided you meet the eligibility criteria for both. This is particularly common for people who:

- Have limited income or savings, meaning they qualify for Universal Credit

- Have paid sufficient National Insurance contributions, making them eligible for contribution-based ESA

- Need support with housing costs or children, which ESA does not cover

However, the interaction between these two benefits involves some important rules. While you can receive both, your ESA payments will be deducted from your Universal Credit amount.

For example, if your ESA entitlement is £113.55 per week, and your calculated Universal Credit award is £700 per month, your ESA amount (converted to a monthly equivalent) would be deducted from that Universal Credit total.

This prevents claimants from receiving a “double benefit” for the same purpose, while still ensuring they receive full support based on their circumstances.

Key Differences Between ESA and Universal Credit

It is essential to understand how ESA and Universal Credit differ in their structure and eligibility. Below is a table summarising the main differences:

| Feature | Contribution-Based ESA (New Style ESA) | Universal Credit |

| Means-Tested | No | Yes |

| Based on National Insurance | Yes | No |

| Affected by Partner’s Income | No | Yes |

| Paid Every | Two Weeks | One Month |

| Covers Housing and Child Costs | No | Yes |

| Taxable | Yes | No |

| Medical Assessment Required | Yes (Work Capability Assessment) | Yes (if claiming due to illness/disability) |

Understanding these distinctions is important, as many people mistakenly assume that New Style ESA and Universal Credit are interchangeable. In reality, they are two separate benefits, administered through different systems but often claimed together.

Transitions from Income-Related ESA to Universal Credit

For claimants who were previously receiving income-related ESA, there is an ongoing process of migration to Universal Credit. New claims for income-related ESA are no longer accepted. Instead, individuals are expected to claim Universal Credit and, if eligible, New Style ESA alongside it.

When a person transitions from income-related ESA to Universal Credit:

- They may receive a transitional protection payment to ensure they are not financially worse off

- Any ongoing ESA payments may stop, except for those eligible for contribution-based (New Style) ESA

- Housing Benefit and other income-related support may also be absorbed into their UC claim

The Department for Work and Pensions (DWP) usually notifies claimants in advance if they are required to move to Universal Credit. It is important to apply within the given timeframe to avoid losing entitlement.

Payment Structure and Administration

Another key distinction is how the payments are handled. New Style ESA is paid directly into your bank account every two weeks by the DWP. Universal Credit, on the other hand, is paid monthly and often includes amounts for other needs such as rent or children.

If you are claiming both, it is likely you will:

- Receive New Style ESA separately

- Receive a reduced Universal Credit payment (because the ESA is counted as income)

You will also need to report changes in your circumstances to both benefit services, especially if your health condition changes, your income varies, or you start or stop working.

Implications for Claimants

Claiming both New Style ESA and Universal Credit can provide more comprehensive support than either benefit on its own. However, it also requires more careful management, especially in reporting and understanding how one benefit affects the other.

Here are a few important takeaways for claimants:

- ESA can provide regular income support while you are too ill to work

- Universal Credit can top up your income and cover broader needs like housing and childcare

- You must apply for both separately, and understand that your ESA payments will reduce your UC entitlement

- Always keep your DWP Universal Credit journal updated if your ESA status changes

Being informed about how these benefits interact ensures that you can maximise your entitlement without unexpected deductions or delays.

What Is the Application and Assessment Process for ESA?

The process for applying for contribution-based ESA involves multiple stages and checks. It is important to submit accurate information and provide medical evidence when requested.

- Apply for ESA: This can be done online through the GOV.UK portal or by telephone.

- Initial Assessment Phase: You begin receiving basic ESA payments for up to 13 weeks.

- Work Capability Assessment (WCA):

- Completion of the ESA50 questionnaire

- Medical assessment, which may be in person, by phone, or video

- Outcome: You are placed in either the Work-Related Activity Group or Support Group

- Review and Appeals: If you disagree with the outcome, you can request a mandatory reconsideration and appeal to a tribunal

The Work Capability Assessment is the most critical stage and determines the long-term structure of your ESA payments.

What Other Benefits Can You Claim Alongside ESA?

While contribution-based ESA is a standalone benefit based on NI contributions, recipients may also be eligible for additional financial support. These extra benefits help cover living expenses, housing costs, and care needs.

Some of the common benefits that can be claimed in conjunction with ESA include:

- Personal Independence Payment (PIP): Provides support with daily living or mobility costs.

- Housing Benefit: Offered by local councils for rental support, though increasingly replaced by Universal Credit.

- Council Tax Reduction: A local authority scheme that reduces council tax bills.

- Support for Mortgage Interest (SMI): A loan to help pay the interest on your mortgage if you’re receiving a qualifying benefit.

Eligibility for these additional supports often depends on means-tested assessments, so even if ESA itself is not affected by savings or income, these other benefits might be.

What Are Common Misconceptions About Contribution-Based ESA?

Despite its long-standing presence in the UK benefits system, there are frequent misunderstandings about how contribution-based ESA works.

- “It’s only for low-income individuals”: Contribution-based ESA is not income-dependent and is instead tied to NI contributions.

- “You cannot work at all while claiming ESA”: Permitted work rules allow limited part-time work within strict income and hours limits.

- “Your partner’s income will stop your ESA”: Unlike income-related ESA or Universal Credit, your partner’s earnings do not impact your entitlement.

- “ESA is the same as Universal Credit”: ESA and UC are separate systems with different eligibility rules and purposes.

- “Savings will disqualify you”: Contribution-based ESA does not assess capital or savings.

Being informed about these distinctions helps claimants avoid confusion and make the most of their entitlement.

Conclusion

Contribution-based ESA is a valuable form of support for people who are unwell or disabled and have a qualifying National Insurance record. Crucially, it is not means-tested, which distinguishes it from other benefits.

Understanding the differences between ESA types, eligibility rules, and interaction with Universal Credit can help claimants make informed decisions and access the financial help they need.

If you’re unsure about your eligibility or benefit options, seek advice from the DWP or a benefits advisor.

FAQs About Contribution-Based ESA

How long can you stay on contribution-based ESA?

You can receive contribution-based ESA indefinitely if you are placed in the Support Group. If placed in the Work-Related Activity Group, it’s limited to 365 days.

Is contribution-based ESA affected by savings or assets?

No, it is not affected by your savings or other assets. It’s based solely on your National Insurance contribution record.

Can you get contribution-based ESA if your partner works?

Yes, your partner’s income or employment does not affect your claim, as the benefit is not means-tested.

Is ESA the same as Universal Credit?

No, they are separate benefits. ESA supports people with illness or disability, while Universal Credit covers a broader range of financial needs.

Can you receive both PIP and ESA?

Yes, you can claim both at the same time. PIP is for personal care or mobility needs and is not means-tested.

Do you need to attend medical assessments for ESA?

Yes, most claimants must undergo a Work Capability Assessment unless they qualify under special rules (such as terminal illness).

Is contribution-based ESA taxable?

Yes, contribution-based ESA is considered taxable income and must be declared if you’re completing a tax return.