Understanding how and when you receive your State Pension is a key part of planning your finances in retirement.

One of the most frequently asked questions is whether the UK State Pension is paid weekly or monthly.

While many assume a fixed schedule applies to all pensioners, the Department for Work and Pensions (DWP) provides some flexibility.

In this article, we’ll break down how the payment schedule works, how it can be changed, and what you need to know if you’re receiving or about to receive your pension.

What Is the Default Payment Frequency for the UK State Pension?

The State Pension in the UK is generally paid every four weeks. This is the standard payment cycle implemented by the Department for Work and Pensions (DWP) for most claimants.

A four-weekly payment schedule does not equate to a monthly payment. Instead, it results in 13 payments per year rather than 12.

This means the date of payment may change slightly each month, depending on the calendar.

This setup is designed to:

- Improve administrative efficiency

- Help recipients manage income on a predictable schedule

- Reduce the number of transactions processed by the DWP

For individuals receiving the basic or new State Pension, this four-week cycle begins shortly after the claimant reaches State Pension age or starts claiming.

Can You Choose to Receive Your State Pension Weekly Instead?

Weekly payment of the State Pension is available in specific cases. While not the default option, the DWP allows certain individuals to receive their pension weekly if needed.

This alternative is often offered to pensioners who are financially vulnerable or those who find budgeting easier with smaller, more frequent payments.

Weekly payments can be beneficial for managing household expenses, especially when the State Pension is a sole or primary source of income.

To be considered for weekly payments:

- You must contact the Pension Service directly

- Provide a valid reason for needing more frequent payments

- Be assessed for eligibility under DWP guidelines

This payment option may not be promoted widely, but it is available and can be requested by eligible pensioners.

How Do You Change the Frequency of Your State Pension Payments?

Changing how often you receive your State Pension is a straightforward process, but it requires direct communication with the Department for Work and Pensions (DWP). The DWP handles all State Pension payments and can assist with requests to switch from the default four-weekly cycle to a weekly one.

Eligibility to Change Payment Frequency

Not everyone will automatically qualify to switch to weekly payments. The DWP assesses each case individually, usually considering whether the claimant might benefit financially or practically from a more frequent payment cycle.

You may be eligible if you:

- Depend solely on the State Pension as your main source of income

- Have difficulty budgeting over a four-week period

- Have special financial circumstances that make weekly payments more suitable

In some cases, you might need to provide an explanation or documentation showing why weekly payments would help your financial management.

Steps to Request a Payment Frequency Change

The process of changing your payment frequency is handled entirely through the Pension Service. To make the request, follow these steps:

- Contact the Pension Service: Call the helpline on 0800 731 7898 (for calls within the UK) or use the textphone at 0800 731 7339 if you have hearing or speech difficulties.

- Provide Your Details: Be ready to share your National Insurance number, full name, and date of birth for identification purposes.

- Explain Your Request: Clearly state that you would like to change your State Pension payment schedule from four-weekly to weekly and explain your reason for the change.

- Confirm Your Bank Details: Double-check that your current account information is correct. Any discrepancy could delay the update to your payment schedule.

How Long the Change Takes?

Once your request has been received and approved, the DWP will process it within a few weeks. The updated payment frequency usually takes effect from your next payment cycle.

You will receive written confirmation outlining:

- The effective date of the change

- Your new payment schedule (weekly or four-weekly)

- The day of the week you will receive your payments

If your request is not approved, the DWP will explain the reasons and whether further action can be taken.

What to Expect After Changing Your Payment Schedule?

After switching to a weekly payment, your first few weeks may feel slightly different as your schedule adjusts. It is recommended to:

- Review your bank statements to ensure payments align with the new schedule

- Track your cash flow for the first month to adjust to the new rhythm

- Contact the Pension Service immediately if a payment appears to be missing or delayed

Keeping a record of all correspondence can also help resolve any potential disputes more efficiently.

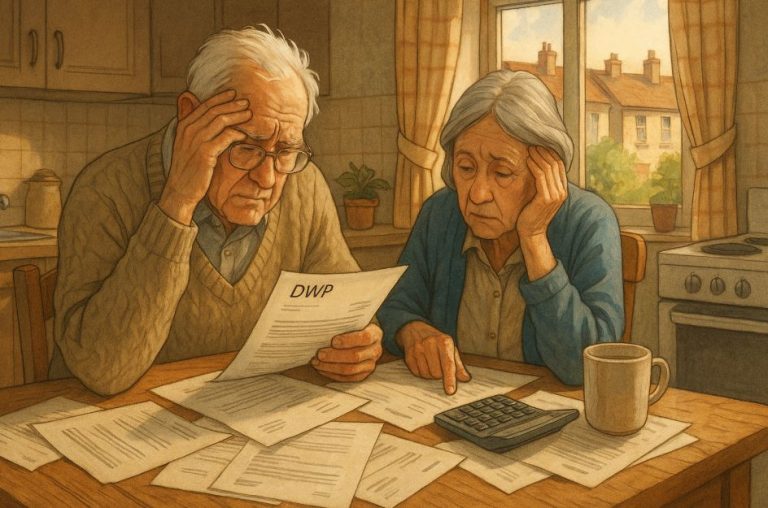

On Which Day Is the State Pension Paid into Your Bank Account?

The exact day your pension is paid depends on the final two digits of your National Insurance (NI) number. This schedule helps the DWP distribute payments evenly throughout the week and manage their systems efficiently.

The following table shows how payment days are allocated:

State Pension Payment Day Schedule

| Last Two Digits of NI Number | Payment Day |

| 00 to 19 | Monday |

| 20 to 39 | Tuesday |

| 40 to 59 | Wednesday |

| 60 to 79 | Thursday |

| 80 to 99 | Friday |

Payments are made directly into the bank account you specify during your State Pension claim process. While the payment day is fixed based on your NI number, the actual date may shift slightly due to weekends or bank holidays.

What Happens to Your State Pension If You Live Abroad?

Receiving the UK State Pension while living abroad is possible, but there are differences in how payments are handled compared to domestic claimants.

When living outside the UK, you can choose to be paid:

- Every four weeks

- Every 13 weeks

Payment is made in local currency, which means exchange rates can affect the exact amount you receive. Fluctuations in currency value may lead to variations in payment from one cycle to the next.

Bank charges and processing times may also vary depending on the country and the financial institution used.

It’s important to note that you may not receive the annual State Pension increases (commonly referred to as “uprating”) unless you live in:

- The European Economic Area (EEA)

- Switzerland

- Countries with a social security agreement with the UK

These factors should be considered carefully when planning to move or retire abroad.

Are State Pension Payments Made in Arrears or in Advance?

The UK State Pension is paid in arrears, meaning you are paid for the period that has just passed rather than the one ahead. This is a consistent practice across all forms of the State Pension.

For example, if your payment is due on a Tuesday, it covers the previous four weeks rather than the upcoming four weeks. This approach ensures that payments reflect actual entitlement and minimises overpayment risks.

When you first reach State Pension age and claim your entitlement, there may be a short delay before the first payment arrives. This allows the DWP to calculate the payment cycle based on your eligibility date and to align it with the National Insurance-based payment schedule.

Understanding that payments are made in arrears can help with budgeting during the transition from work or from other types of benefits.

Can Bank Holidays or Weekends Delay Your State Pension Payment?

If your pension payment is due on a weekend or UK bank holiday, the DWP processes your payment on the working day before the scheduled date.

This proactive system ensures that recipients do not experience delays in receiving funds. For example:

- If your payment is due on Monday (a bank holiday), the funds will typically arrive on the previous Friday.

- If your scheduled date falls on a Saturday or Sunday, payment will also be made on the Friday before.

Most UK banks process the payment on the same day it is issued. However, the exact time it becomes available in your account may depend on your bank’s internal processing schedule.

It’s advised to monitor your account before contacting the Pension Service if a payment does not appear on the expected day.

What Should You Do If Your Pension Payment Is Missing or Incorrect?

Occasionally, pensioners may experience delays, missing payments, or discrepancies in the amount received. While such issues are rare, they can occur due to banking delays, administrative errors, or public holidays. Understanding the correct procedure helps ensure the issue is resolved quickly.

Check Your Payment Schedule and Bank Account

Before contacting the Pension Service, confirm that the payment has genuinely been missed or is incorrect.

You should:

- Wait until the end of the scheduled payment day, as banks may process deposits at different times.

- Log in to your online banking or contact your branch to check whether the payment is pending.

- Verify that the payment date corresponds to your assigned schedule based on your National Insurance number.

If you recently changed your bank account, ensure you informed the Pension Service of the update to avoid funds being sent to the old account.

Contact the Pension Service Immediately

If the payment is still missing after these checks, contact the Pension Service as soon as possible.

You can reach them through:

- Telephone: 0800 731 7898 (Monday to Friday, 8 am to 6 pm)

- Textphone: 0800 731 7339

- Relay UK Service: If you use a text relay service, dial 18001 followed by 0800 731 7898

When speaking to an advisor, be prepared to provide:

- Your full name and address

- National Insurance number

- Details of the missing or incorrect payment (including expected date and amount)

- Updated bank details if they have changed recently

The DWP can trace the transaction, confirm whether it was processed, and issue a replacement payment if necessary.

Common Reasons for Payment Issues

Understanding what causes payment problems can help prevent them in the future. Common reasons include:

- Bank holidays that move payment dates forward

- Incorrect bank account details on file with the DWP

- Changes to personal information not yet updated in the system

- Administrative delays during the first payment after a change in status

- Technical banking errors or closed accounts

If your case involves a bank account error, you may also need to contact your financial institution directly for assistance.

How Long It Takes to Resolve Missing or Incorrect Payments?

Most issues are resolved within a few working days after reporting them. The DWP will investigate, trace the payment, and reissue funds if required.

However, in more complex situations, such as incorrect bank details or international payments, it can take longer.

You may receive written confirmation once the problem has been corrected.

Keeping records of the date and time of your call, along with the name of the DWP representative you spoke to, can help track progress effectively.

Preventing Future Payment Problems

To reduce the likelihood of future issues, pensioners should:

- Notify the DWP immediately of any change in bank account or address

- Keep personal and financial records up to date

- Check pension payment dates when bank holidays occur

- Review account statements regularly to ensure accurate deposits

These simple steps ensure smooth and consistent receipt of your State Pension without unnecessary disruptions.

Comparison of Weekly vs. Four-Weekly State Pension Payments

| Feature | Weekly Payment | Four-Weekly Payment |

| Frequency | Every 7 days | Every 28 days |

| Total Annual Payments | 52 payments | 13 payments |

| Helps with Budgeting | Yes, for some individuals | Suitable for most pensioners |

| Default Option by DWP | No | Yes |

| Requires Special Request | Yes | No |

This comparison can help you decide which payment frequency best fits your personal financial needs. Both options result in the same total annual income.

Conclusion

Choosing between weekly and four-weekly State Pension payments depends on your personal financial situation.

Weekly payments might suit pensioners who need regular income to manage household expenses, while four-weekly payments could benefit those comfortable budgeting over longer periods.

Both options provide the same total annual income. The choice is mostly about cash flow preferences and ease of financial planning.

If you believe that switching your payment frequency would make managing your finances easier, don’t hesitate to contact the Pension Service and request a change.

Frequently Asked Questions

How do I contact the Pension Service to change my payment schedule?

You can call the Pension Service on 0800 731 7898 or use the textphone on 0800 731 7339. Provide your National Insurance number and reason for requesting the change.

Will choosing weekly payments affect how much State Pension I receive?

No, the total annual amount you receive remains the same. Weekly payments simply split your entitlement into smaller, more frequent amounts.

Can I get my State Pension on a specific day of the week?

The day you receive your State Pension is determined by the last two digits of your National Insurance number. You cannot choose a specific day outside of this system.

What if I miss a State Pension payment?

If your payment hasn’t arrived by the end of the day it’s due, contact your bank first. If it’s not there, call the Pension Service to report the issue.

Are there any benefits to receiving State Pension weekly?

Weekly payments can help those on tight budgets manage cash flow more easily, offering more frequent access to funds. However, it requires approval from the DWP.

Can I have my State Pension paid into a joint account?

Yes, you can have your pension paid into a joint account, as long as you are one of the named account holders.

Does my payment day change if I move house or switch banks?

Changing banks won’t affect your payment day, but it’s essential to inform the Pension Service to avoid payment delays. Moving house also doesn’t affect payment frequency or day.