When your child approaches adulthood, it brings significant changes, emotionally and financially.

One of the most important financial considerations for UK parents is knowing when child benefit stops and what steps to take next.

In this guide, we’ll explore how child benefit works in the UK once your child turns 18, how to handle continued education or training, and what other benefits or obligations you may face.

What Is the Age Limit for Child Benefit in the UK?

Child Benefit in the UK is designed to provide financial support to parents or guardians of children.

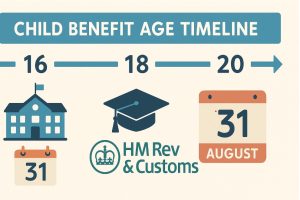

Normally, payments stop on 31 August following your child’s 16th birthday, unless they continue in approved education or training. If they do, Child Benefit can continue until they turn 20.

Approved education includes:

- Full-time non-advanced education such as A-levels, NVQs up to Level 3, or Scottish Highers

- Unpaid government-approved training schemes

- Home education started before age 16 and continued after

Education that doesn’t qualify includes university degree courses or any full-time paid work.

This benefit is managed by HM Revenue and Customs (HMRC), which monitors eligibility and manages changes in circumstances.

It’s vital for parents to stay informed about the age rules and respond promptly to HMRC notifications, particularly when the child nears 16 or 18 years of age.

Does Child Benefit Automatically Stop When a Child Turns 18?

Child Benefit does not automatically stop when your child turns 18. If your child remains in approved education or training, it can continue until the age of 20.

HMRC usually contacts the claimant shortly before the child’s 16th birthday to ask whether the child will continue in education or training.

You must complete the relevant form or respond online. If HMRC doesn’t receive confirmation, payments will stop after 31 August following the child’s 16th birthday.

Common reasons Child Benefit might stop at 18:

- The child leaves education or training

- They start full-time work over 24 hours per week

- They receive income-based benefits such as Universal Credit or Jobseeker’s Allowance

Can You Still Claim Child Benefit If Your Child Is in Full-Time Education?

If your child continues in full-time education or approved training, you may still receive Child Benefit up to their 20th birthday.

This includes:

- A-levels or equivalent

- T-levels

- Scottish Highers

- BTECs (up to Level 3)

- Some unpaid apprenticeship or training programmes

To continue receiving payments, you must inform HMRC by:

- Responding to the form sent before your child turns 16

- Updating your Child Benefit account online via GOV.UK

- Calling the HMRC helpline if online access is not possible

You will need details like your Child Benefit number, your child’s course name, and the educational institution name.

What Happens to Child Benefit Payments After GCSEs and A-Levels?

The transition periods after GCSEs and A-levels are crucial milestones for both students and parents. For families receiving Child Benefit, it’s important to understand how these education transitions affect your entitlement.

When your child finishes their GCSEs at 16, Child Benefit continues until 31 August following their exams. However, if your child is enrolled in an approved course that begins in the new academic year, your payments can continue uninterrupted.

Approved education includes A-levels, T-levels, BTECs (up to Level 3), NVQs, and other similar qualifications. The course must be full-time and not advanced (i.e. not university-level).

If your child decides not to continue in education or training, then Child Benefit will stop on 31 August after their 16th birthday.

This cut-off ensures that families aren’t receiving payments for children who are no longer in education or qualifying training. However, there’s a built-in safeguard for parents in this situation known as the extension period.

20-Week Extension Period

This extension can apply if your child:

- Has left education or training after 16

- Is under 18 years old

- Has registered with an approved body such as a careers service or Connexions

During this 20-week period, you may continue receiving Child Benefit if your child is actively seeking work, waiting to begin an apprenticeship, or considering their next steps.

This grace period helps ease the transition from education into the workforce or further training without the immediate loss of income.

After A-levels, if your child completes their final year and chooses not to go into further non-advanced education or training, your entitlement to Child Benefit will usually stop at the end of that academic year. However, if they enrol in a qualifying course in the same year, the benefit can continue.

Scenarios That Affect Post-A-Level Child Benefit

| Child’s Next Step | Child Benefit Eligibility |

| Enrols in university (degree-level study) | No – Higher education not eligible |

| Begins an unpaid, government-approved apprenticeship | Yes – Must meet training criteria |

| Enters full-time employment (over 24 hours/week) | No – Considered financially independent |

| Registers with a local careers or support service | Yes – 20-week extension may apply |

| Starts a gap year with no education/training | No – Not eligible without registration |

It’s essential to track your child’s next steps closely and communicate with HMRC to avoid unexpected stoppages or overpayments.

How Do You Inform HMRC That Your Child Is Continuing Education?

To continue receiving Child Benefit once your child turns 16, you must inform HMRC if they remain in approved education or training. HMRC does not assume continued education and will require confirmation from you.

Around your child’s 16th birthday, HMRC will send you a Child Benefit extension form or a notice asking for details about your child’s future educational plans.

If you fail to respond or don’t submit the necessary information, Child Benefit will automatically stop on 31 August following your child’s 16th birthday.

Reporting Methods

There are several ways to notify HMRC, each with its own advantages:

1. Online via GOV.UK

This is the fastest and most convenient option.

Steps to follow:

- Sign in using your Government Gateway account

- Provide your National Insurance number, Child Benefit reference number, and child’s full name.

- Enter the name of your child’s school or college, course name, and expected end date.

- Submit the form and receive an on-screen confirmation (take a screenshot or photo for your records).

This method ensures an immediate digital trail and quicker processing times. Most updates are confirmed within a few working days.

2. By Post

If you prefer not to use the online system or don’t have internet access, you can write to HMRC directly.

Include in your letter:

- “Change of circumstance” clearly written at the top

- Your Child Benefit number

- Your child’s full name and date of birth

- Details of the course and the educational institution

- Course start and expected end date

Post it to:

HM Revenue and Customs – Child Benefit Office

PO Box 1

Newcastle Upon Tyne

NE88 1AA

United Kingdom

It is advised to request proof of postage from the Post Office in case HMRC disputes the date you sent it.

3. By Phone

If you’re near the 1-month deadline or need urgent assistance, calling HMRC is the most direct method.

- Phone number: 0300 200 3100

- Relay UK service is available for those who are hearing or speech impaired

Make a note of:

- The date and time of your call

- The name of the representative you spoke with

- The office location (e.g., Belfast, Birmingham)

This information will be useful if you need to follow up or make a complaint.

Required Information for All Methods

Regardless of how you report, make sure you have the following ready:

- Child Benefit reference number

- Child’s full name and date of birth

- Name and address of the school or training provider

- Full name of the course

- Expected course end date

Timely notification is crucial. If you inform HMRC late, you risk:

- Temporary loss of payments

- Overpayments you may need to return

- Delays in processing any new benefits that depend on Child Benefit status

Once HMRC processes your update, you’ll receive a confirmation letter. If you don’t receive a response within 30 days, follow up with a call to ensure your record is up to date.

Is There a Grace Period After a Child Turns 18?

Yes. If your child leaves approved education or training and registers with a recognised body such as a careers or training service, you may qualify for a 20-week extension period.

Conditions include:

- The child must be under 18 when leaving education

- Must register with a government-approved body

- Must not be working over 24 hours or claiming benefits

This extension offers a temporary financial buffer for families whose children are transitioning into apprenticeships, training or employment.

Are There Other Benefits Available After Child Benefit Ends?

When Child Benefit ends, families might be eligible for alternative support depending on their income and circumstances. These benefits are not automatic and must be applied for separately.

Table: Alternative Benefits After Child Benefit Ends

| Benefit Type | Who It Applies To | Key Requirements |

| Universal Credit | Low-income families or single parents | Means-tested, may include child element |

| Child Tax Credit | Existing claimants only (before 2018) | No new applications allowed |

| Carer’s Allowance | Parents caring for a disabled young adult | Must provide 35+ hours of care per week |

| Education Maintenance Allowance (EMA) | Some UK regions | Regional policy applies |

These benefits may require additional evidence such as household income, disability details, or proof of education.

What If There Are Changes in My Child’s Circumstances?

Receiving Child Benefit comes with the responsibility of keeping HMRC updated about any significant changes in your family’s circumstances.

These changes could relate not only to your child but also to you or your partner. Some may affect your eligibility or trigger a tax charge, while others may not influence your payments directly but still require reporting.

Failure to notify HMRC of such changes can lead to overpayments, underpayments, or even penalties. Understanding what to report and when is crucial to ensure compliance and avoid unnecessary financial complications.

Changes Related to You or Your Partner

Certain life events or financial changes involving you or your partner may not alter your Child Benefit amount but must still be reported to HMRC.

These include:

- Getting married or entering into a civil partnership

- A new partner moving in with you

- Receiving payments from a local authority or other organisation for looking after a child

While these events won’t usually change your benefit rate, they might affect your eligibility depending on your household income or who is responsible for the child.

High Income and the Child Benefit Tax Charge

If you or your partner begins earning £60,000 or more per year, HMRC must be informed immediately. This income threshold triggers the High Income Child Benefit Tax Charge (HICBC), which reduces the financial benefit of claiming.

How the Tax Charge Works:

- The person with the higher income (not necessarily the claimant) is responsible for paying the tax charge

- The charge increases gradually from £60,000 to £80,000

- At £80,000 income or more, the charge effectively cancels out the value of Child Benefit

Despite the tax charge, many families choose to continue claiming for administrative and long-term benefit reasons, especially if one partner is a non-earner or earns below the National Insurance contribution threshold.

If One of You Isn’t Working or Earns Below £123 per Week:

- Continue claiming Child Benefit to protect your National Insurance contributions

- These contributions count towards your State Pension and ensure your child receives a National Insurance number automatically at age 16

- You can request HMRC to stop paying the benefit while keeping the claim active to avoid the tax charge

In cases where the claim is under the higher earner’s name, you can contact HMRC to transfer the claim to the lower earner to optimise your benefit.

Separation or Divorce

If you separate or divorce, you need to decide who will continue receiving Child Benefit. Usually, it’s the person the child lives with most of the time.

What to Do:

- If your ex-partner will claim, you must end your claim and your ex must make a new one immediately

- If both parties want to claim, HMRC will decide based on who the child lives with the most

HMRC’s decision is final, and there’s no right to appeal. To ensure a fair outcome, provide as much accurate information as possible. For help with complex situations, contact your nearest Citizens Advice office.

Changes to Your Living Arrangements

You must notify HMRC if you:

- Move house (this alone won’t stop your Child Benefit if the child still lives with you)

- Enter prison for more than 8 weeks

- Go abroad for more than 8 weeks

Temporary Stays Abroad:

- You can continue receiving Child Benefit for up to 8 weeks abroad

- In cases of medical treatment or bereavement overseas, the limit extends to 12 weeks

- If you plan to stay abroad for over a year, Child Benefit will stop from the date you leave the UK

Notification must be made before departure or within one month of leaving the UK.

Immigration Status and Right to Reside

Your eligibility for Child Benefit depends heavily on your immigration status and whether you have the right to reside in the UK. You can only claim Child Benefit if your status allows access to public funds.

You Can Claim Child Benefit If You Have:

- British or Irish citizenship

- Settled status under the EU Settlement Scheme

- Indefinite leave to remain (unless granted under an adult dependent relative visa)

- Refugee status or humanitarian protection

- Right of abode

If you have pre-settled status, you must also demonstrate a valid right to reside to be eligible for Child Benefit.

While Awaiting a Decision from the EU Settlement Scheme:

You can still claim public funds, but like with pre-settled status, you must also prove that you have the right to reside.

For other types of immigration status, eligibility varies. It’s advisable to check directly with HMRC or use official resources like GOV.UK to confirm whether your specific status qualifies for public fund access.

What Should You Do If Child Benefit Stops Unexpectedly?

It can be both stressful and confusing if your Child Benefit payments suddenly stop without explanation, especially if you rely on this income as part of your family budget.

However, there are specific steps you can take to understand why the payment was halted and how to resolve the issue as quickly as possible.

Step 1: Check Your Communication from HMRC

The first thing to do is check whether HMRC has sent you any letters or requests for information. It’s common for Child Benefit to stop if you failed to respond to a letter asking whether your child is continuing in approved education or training.

If you received such a letter but didn’t complete and return the form, the benefit will automatically stop, usually on 31 August following your child’s 16th birthday. Reinstating it may be possible, but you’ll need to act quickly.

Step 2: Contact HMRC Directly

If you’re unsure why the payments have stopped or need immediate clarification, contact HMRC by phone or online. Calling is usually the fastest way to get an answer.

HMRC Child Benefit Helpline:

- Telephone: 0300 200 3100

- Relay UK (for speech or hearing impaired): 18001 0300 200 3100

- Monday to Friday, 8am to 6pm

When calling, keep the following details ready:

- Your National Insurance number

- Child Benefit reference number

- Your child’s full name and date of birth

Make a note of the:

- Date and time of your call

- Name of the HMRC representative you spoke to

- Office location (e.g., Newcastle, Birmingham)

These records will be helpful in case you need to follow up or submit a complaint later.

Step 3: Report Changes or Missing Information

If the stoppage is due to missing information, such as a failure to confirm your child’s educational status, you can usually resolve the issue by updating your details through:

- The UK online Child Benefit portal

- Sending a written notification by post

- Calling the helpline directly

You may be asked to provide:

- Confirmation of your child’s current course and institution

- Proof of enrolment or a letter from the school or college

- Expected end date of the course

HMRC will usually confirm receipt of your update. It’s advisable to take a screenshot of the confirmation if you submit online, or obtain proof of postage if sending a letter.

Step 4: Understand the Consequences of Overpayment

If HMRC determines that you continued to receive payments when your child no longer qualified, you may be asked to repay some or all of that amount.

This is known as an overpayment. It is still important to report the change, even if it happened more than a month ago. Late notification is better than none, and early engagement can help reduce repayment obligations or penalties.

Step 5: What If You Disagree With the Decision?

If your benefit has stopped and you believe this is an error, you can request a mandatory reconsideration. This is a formal process where HMRC will review the decision based on any new evidence or clarification you provide.

You must:

- Submit the request in writing or by phone

- Explain why you believe the decision was incorrect

- Include supporting documentation where possible

HMRC will then send you a written response confirming the outcome of the review.

Step 6: Check for Knock-on Effects

If your Child Benefit has stopped, it might affect other linked benefits, especially Housing Benefit or Universal Credit. For example, if your child had their own bedroom, your Housing Benefit may be reduced under the bedroom tax rules once they are no longer considered a dependent.

Notify your local council immediately about any changes to your Child Benefit status so they can adjust your Housing Benefit or Council Tax support accordingly.

Conclusion: What Should Parents Expect When Child Benefit Ends?

When your child turns 18, your Child Benefit payments may continue, but only if they remain in approved education or training. Parents need to be proactive in reporting changes to HMRC, maintaining proper records, and planning for the financial transition.

Timely action ensures that you remain compliant and possibly eligible for other support mechanisms. Understanding the rules and your obligations will help avoid costly overpayments or unexpected payment stops.

Frequently Asked Questions (FAQs)

What happens if I forget to tell HMRC my child left school?

Failure to report could result in overpayments. You’ll be expected to pay it back and may face penalties.

Can my child receive Child Benefit in their own name after 18?

No, Child Benefit is always paid to a parent or guardian, not the child, even if they are over 18.

Does Child Benefit count as income for Universal Credit?

No, Child Benefit is non-taxable and does not count as income when applying for Universal Credit.

Can I restart Child Benefit if my child re-enrols in education after leaving?

If your child re-enrols within a short time frame and meets eligibility, you can reapply. It’s subject to HMRC approval.

Will I still get Child Benefit if my child is on an unpaid apprenticeship?

Only certain government-recognised apprenticeships qualify. It must be unpaid and less than 24 hours of work weekly.

Do I need to report if my partner moves in with me?

Yes. While it may not affect Child Benefit amounts, HMRC must be informed of all household changes.

How long does HMRC take to process Child Benefit changes?

Usually within 30 days. If you don’t receive a confirmation letter, contact HMRC directly.