Understanding the structure of the UK’s state pension system can be complex, particularly when dealing with older schemes like the pre-1997 additional state pension.

Often referred to as part of the State Earnings-Related Pension Scheme (SERPS), this benefit was a crucial component of retirement income for many who worked between 1978 and 1997.

This article explains what the pre-97 additional state pension is, who qualifies for it, how it was calculated, and what it means for those approaching or already in retirement.

What Is the Pre 1997 Additional State Pension?

The pre-1997 additional state pension refers to the earnings-related component of the UK’s state pension that was accrued through the State Earnings-Related Pension Scheme (SERPS).

This scheme provided a financial supplement to the basic state pension, aiming to give workers a retirement income more closely aligned with their earnings during their working years.

Introduced in April 1978, SERPS allowed eligible individuals to accumulate additional pension benefits on top of the basic state pension. This scheme remained in place until 2002, but its structure changed in 1997.

Therefore, pensions built before that year fall under a specific set of rules, often referred to as the pre-1997 additional state pension.

This scheme was particularly relevant for individuals who had long working careers and consistently paid National Insurance (NI) contributions above a defined earnings threshold.

How Did the Additional State Pension Work Before 1997?

The system worked on the principle that the more an individual earned (above a set threshold), and the more NI they paid, the higher their additional pension entitlement would be.

Contributions were assessed on earnings between the Lower Earnings Limit (LEL) and the Upper Earnings Limit (UEL).

SERPS was designed to provide up to 25% of average earnings over a working life, above the LEL. The amount received depended on the number of qualifying years and the individual’s earnings during those years.

Not everyone who was working during that period built up SERPS. Many employees were part of occupational or personal pension schemes and chose to contract out of SERPS, reducing their NI contributions in exchange for a Guaranteed Minimum Pension (GMP) provided by their private pension.

Employees who remained contracted in continued to build entitlement to the additional state pension, which was later paid out by the government as part of their overall pension income.

Who Qualifies for the Pre 1997 Additional State Pension?

Eligibility for the pre-1997 additional pension depends primarily on:

- Having paid National Insurance contributions between 6 April 1978 and 5 April 1997

- Not having been contracted out of SERPS during those years

- Reaching State Pension Age before 6 April 2016, under the old system

Those who were contracted out had their additional pension entitlement replaced by a GMP through a workplace or personal pension scheme.

The Department for Work and Pensions (DWP) coordinated these arrangements to ensure pensioners received a minimum benefit equivalent to what they would have received under SERPS.

Contracted-in employees, particularly those in the public sector or without an employer-sponsored scheme, continued to build SERPS through their earnings-related contributions.

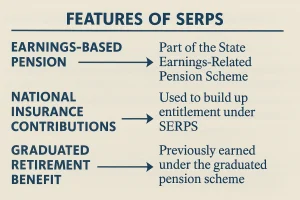

What Are the Key Features of the Pre-97 Additional Pension?

The pre-1997 additional state pension, earned through the State Earnings-Related Pension Scheme (SERPS), was a significant component of the UK’s retirement income system during its operational years.

Understanding its key features helps explain how it worked, how it differs from later pension schemes, and why it continues to impact pensions today.

1. Earnings-Related Structure

Unlike the basic state pension, which offered a flat-rate payment regardless of a person’s income during their working life, the additional state pension was linked directly to earnings.

The more an individual earned (above a certain threshold) and the more qualifying years they had, the greater the additional pension they accrued.

Only earnings between the Lower Earnings Limit (LEL) and Upper Earnings Limit (UEL) were counted. Earnings below the LEL didn’t qualify, while anything above the UEL was ignored for SERPS purposes. This design ensured that middle-income earners gained the most from the scheme.

2. National Insurance Contributions Dependent

Eligibility for SERPS and the resulting additional state pension required consistent National Insurance contributions. Individuals needed to be employed and making contributions throughout the qualifying years (1978 to 1997).

- Those who had gaps in employment or didn’t earn enough to trigger NI contributions may have limited or no entitlement.

- Self-employed individuals were not covered by SERPS during this period and could not build additional pension entitlement through the scheme.

3. Flexible and Proportional Accrual

The benefit accrued year by year, based on earnings and NI status. There was no minimum number of years required to qualify for a payment unlike the basic pension, which had stricter qualifying rules. Even a few years of eligible earnings could result in a small additional pension.

Over time, the scheme adjusted how much of a person’s average earnings were used in the calculation. Initially, SERPS was designed to provide up to 25% of revalued average earnings, though reforms later reduced this amount.

4. Inflation-Protected through Revaluation

To preserve its real value over time, the SERPS entitlement was revalued annually based on national average earnings. This revaluation ensured that a person’s pension built up in earlier years kept pace with increases in the cost of living and general wage growth.

- Revaluation before retirement adjusted accrued earnings to reflect their value in the year of retirement

- Indexation after retirement (the way pensions were increased annually) varied depending on the rules in place and whether the pension was paid by the state or through a contracted-out private scheme

This inflation protection was crucial for maintaining the long-term adequacy of the additional pension, especially for those who had built it up decades before retirement.

5. Graduated Retirement Benefit (GRB) Inclusion

Many individuals who qualified for the pre-97 additional pension also had entitlement under the Graduated Retirement Benefit (GRB). This earlier scheme operated between 1961 and 1975 and was based on graduated contributions.

While GRB was typically small in monetary terms, it is still paid today to those who contributed during that earlier period. The GRB is included as part of the overall state pension payment and appears as a separate line on pension statements.

6. Impact of Contracting Out

One of the most defining features of SERPS, especially in the pre-1997 era, was the option for individuals to contract out through an occupational or private pension scheme.

If an employee was contracted out:

- They and their employer paid reduced National Insurance contributions

- The government transferred the responsibility for the equivalent additional pension to the private pension provider

- The private scheme had to guarantee a minimum pension known as the Guaranteed Minimum Pension (GMP)

This feature significantly impacted how much state pension a person would eventually receive. Those who were contracted out did not get a SERPS payment from the state for the years they were opted out, although their private pension had to compensate for it.

7. Legacy Status and Ongoing Payments

Although SERPS has been replaced by the State Second Pension (S2P) in 2002 and later by the new State Pension in 2016, the pre-1997 additional pension is still paid out to pensioners today who built up entitlement during its active years.

- It remains a separate component of the total state pension payment

- It is factored into pension forecasts for those who reached State Pension Age before April 2016

- It may be adjusted due to equalisation requirements for contracted-out members, particularly women and men with differing entitlements

Understanding its features helps individuals interpret their pension breakdown and ensure they are receiving the correct amount based on their work history.

How Is the Pre 1997 Additional State Pension Calculated?

The calculation for the additional state pension earned under SERPS was based on an individual’s earnings between the LEL and UEL, over qualifying years. A percentage of the average earnings was then used to determine the pension.

Key factors in the calculation:

- The number of qualifying years between 1978 and 1997

- The annual earnings in those years, revalued in line with inflation

- The SERPS accrual rate, which started at 25%

Below is an example of how this might look in simplified terms:

Example Calculation of SERPS for Pre-1997

| Year | Annual Earnings | Earnings Above LEL | Revalued Earnings | Accrual Rate | Annual SERPS Accrued |

| 1985 | £12,000 | £9,000 | £18,500 | 25% | £4,625 |

| 1990 | £15,000 | £11,500 | £21,800 | 25% | £5,450 |

| 1995 | £17,000 | £13,500 | £24,600 | 25% | £6,150 |

Note: Values are for illustrative purposes only. Actual calculations are performed by the DWP based on specific historical earnings and national thresholds.

The final amount received in retirement would be the sum of these accruals over the qualifying period. The Department for Work and Pensions would apply revaluation factors to adjust earnings for inflation, ensuring that pensioners received a fair and current-value benefit.

What Happens If Someone Was Contracted Out?

Being contracted out meant that instead of contributing to SERPS, an employee and their employer contributed to a private or occupational pension scheme.

In return, the individual received a lower NI rate, and their pension scheme had to promise a minimum benefit called the Guaranteed Minimum Pension (GMP).

GMP was designed to replicate the value of the SERPS benefit the employee would have earned. However, GMP is:

- Paid by the private pension scheme, not the state

- Not paid in addition to SERPS but replaces it

- Subject to its own rules on increases and inflation linking

The GMP applied only for employment between 1978 and 1997. From 1997, schemes that contracted out had to meet a reference scheme test instead, and from 2002, SERPS was replaced by the State Second Pension (S2P).

Contracted-In vs Contracted-Out Summary

| Feature | Contracted-In (SERPS) | Contracted-Out (GMP) |

| NI Contributions | Full rate | Reduced rate |

| Pension Source | Paid by government | Paid by private scheme |

| Additional State Pension | Yes | No (GMP provided instead) |

| Inflation Linking | Revalued annually by DWP | Based on scheme rules |

| Coverage Period | 1978–1997 | 1978–1997 |

For individuals unsure of their status during this period, old payslips, pension statements, and a National Insurance record can help identify whether they were contracted out.

How Can Individuals Check Their Pre 97 Additional Pension Entitlement?

There are several ways to confirm entitlement to the pre-97 additional pension:

- Use the State Pension forecast service available at gov.uk

- Request a National Insurance contribution statement from HMRC

- Contact the Pension Service for help with historical records

- Review personal pension statements for GMP details if contracted out

It’s useful to have your National Insurance number and accurate employment history when requesting these details.

Why Is the Pre 1997 Pension Still Relevant Today?

Although the scheme is no longer active, it still plays a major role in the pension income of individuals who reached State Pension Age before 6 April 2016. Their state pension includes both:

- The basic state pension

- Any additional pension accrued through SERPS or other schemes like GRB

For those affected, the pre-97 pension could account for a significant portion of retirement income. Furthermore, pension schemes are still managing GMP liabilities, and legislative changes such as GMP equalisation continue to affect entitlements and scheme administration.

Understanding this legacy pension helps individuals properly estimate their total retirement income, especially if they are receiving payments from both state and private sources.

What Should Individuals Know About Claiming or Topping Up?

For individuals eligible under the old system, the claim process is automatic upon reaching State Pension Age. There is no need to apply separately for the additional state pension or SERPS it is included in the overall state pension calculation.

However, there are certain scenarios where reviewing your entitlement is beneficial:

- If you suspect missing National Insurance years, you can apply to pay voluntary Class 3 contributions

- Individuals affected by underpayment errors or GMP miscalculations may be entitled to corrections

- Topping up is not possible for pre-97 SERPS, but checking entitlements is important to avoid pension shortfalls

Anyone uncertain about their position should request a pension statement and consult with the Pension Service or a regulated pension adviser for clarity.

Conclusion

The pre-1997 additional state pension, while no longer active, remains a vital component of pension income for many UK retirees.

For those who paid into SERPS, or who received equivalent benefits via GMP, it can significantly increase retirement income.

Understanding its history, eligibility, and structure allows individuals to better manage and anticipate their retirement finances.

As pension reforms continue to evolve, historical entitlements like the pre-97 additional state pension play a lasting role in shaping today’s pension landscape.

FAQs About Pre 1997 Additional State Pension

What is the difference between SERPS and the Second State Pension?

SERPS was the initial earnings-related state pension scheme. It was replaced in 2002 by the State Second Pension (S2P), which offered more favourable accrual for low earners.

Can people who worked part-time before 1997 still qualify?

Yes, if their earnings exceeded the Lower Earnings Limit and they paid National Insurance, they could accrue additional state pension.

How do I know if I was contracted out?

You can check past payslips, pension statements, or request a record from HMRC or your pension provider to confirm if you were contracted out.

Are pre-1997 pensions taxable?

Yes, the pre-1997 additional state pension, like other pension income, is considered taxable and subject to income tax rules.

What is the Graduated Retirement Benefit?

The GRB was a forerunner to SERPS, active between 1961 and 1975. Individuals with earnings during this time may receive small additional pension amounts.

How do I contact the Pension Service for details?

You can contact them via the Gov.uk website, by phone, or by mail. The site also has tools for checking pension forecasts.

Can I increase my pre-97 additional pension today?

In most cases, no. However, voluntary NI contributions or corrections due to underpayments may apply for some individuals. It’s best to get a personalised pension forecast.