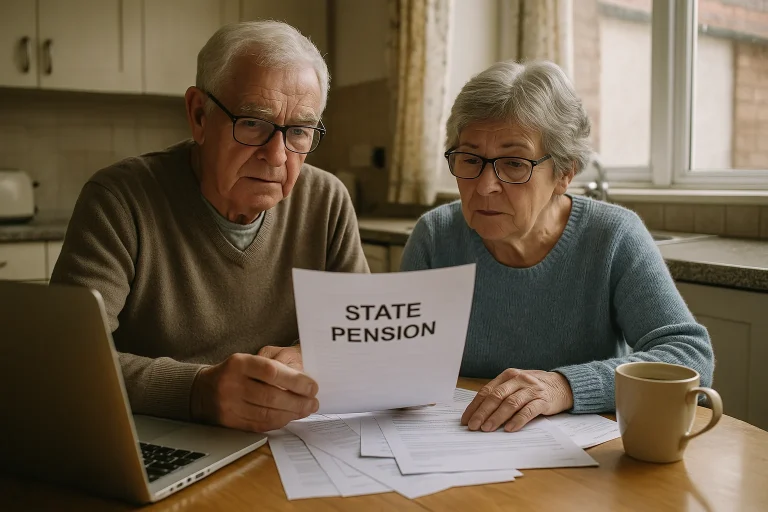

The UK State Pension is a vital source of income for millions of retirees, and understanding how it is maintained is essential.

One of the key mechanisms that helps preserve its value over time is the triple lock. Introduced to safeguard pensioners from inflation and economic fluctuation, it ensures annual increases to pension payments.

This article explores what the triple lock pension is, when it was introduced, and how it continues to shape retirement income across the UK.

What Is The UK State Pension And Who Is Eligible For It?

The UK State Pension is a government-backed payment that offers a foundation of income to individuals who have reached retirement age.

In the 2025/26 tax year, the full new State Pension pays £230.25 per week, amounting to £11,973 annually. It is distributed every four weeks and is designed to provide financial support during retirement.

Eligibility for the State Pension is based on an individual’s National Insurance (NI) contributions. The following conditions generally apply:

- To receive the full amount, a person must have at least 35 qualifying years of NI contributions or credits.

- A minimum of 10 years is required to receive any State Pension at all.

Individuals who reached State Pension age before 6 April 2016 fall under the older system, which offers a maximum basic State Pension of £176.45 per week. This older system may also include an Additional State Pension component based on earnings and NI history.

What Is The Triple Lock Pension And How Does It Work?

The triple lock pension is a safeguard mechanism used by the UK government to determine how much the State Pension increases each year.

It was introduced in April 2011 with the primary objective of protecting the value of pensions against economic fluctuations, particularly inflation.

The policy ensures that pensioners do not see a real-term decrease in their income and allows them to maintain a basic standard of living in retirement.

The mechanism works by guaranteeing that the State Pension will rise every financial year by the highest of the following three measures:

- Consumer Prices Index (CPI) Inflation: This is the rate at which the cost of goods and services increases across the economy. It’s measured annually based on the CPI in the previous September. If prices are rising sharply, this ensures that the pension keeps pace with the rising cost of living.

- Average Earnings Growth: This figure is calculated using the Office for National Statistics data on average UK wage growth between May and July of the previous year. It ensures that pensioners’ income reflects changes in general earnings levels and national productivity.

- A Fixed Rate of 2.5%: If both CPI inflation and average earnings growth fall below 2.5%, the State Pension is still guaranteed to increase by this minimum amount. This clause protects pensioners during periods of low inflation or stagnant wage growth.

The triple lock applies to both the basic State Pension (for those who reached retirement age before April 2016) and the new State Pension (for those who reach retirement age on or after 6 April 2016).

However, the policy does not extend to all components of pension income. For example, the Additional State Pension (sometimes called SERPS or State Second Pension) and any extra earned through deferral are only increased in line with CPI.

Each autumn, the UK government announces which of the three metrics is highest and confirms the percentage increase to be applied the following April. This increase is applied automatically to all eligible recipients and requires no action from pensioners.

This system has played a significant role in improving pensioner incomes. For instance, if we compare figures over the last few years:

- In 2023, the triple lock triggered a 1% rise based on high inflation.

- In 2024, wage growth was the highest measure at 5%, prompting that year’s increase.

- In 2025, wage growth again led the increase at 1%, resulting in the new State Pension reaching £230.25 per week.

The triple lock’s structure is simple in principle but powerful in effect. It has created a predictable and transparent method for increasing pensions, giving retirees more certainty and confidence in their retirement planning.

When Was The Triple Lock Introduced And Why?

The triple lock was introduced in April 2011 by the Conservative–Liberal Democrat coalition government. The policy was designed to ensure that pensions would not lose value over time due to inflation or fall behind earnings growth in the economy.

Prior to 2011, pension uprating mechanisms had limitations. Between 1980 and 2010, the State Pension typically rose in line with prices, which often meant pensioners experienced a gradual decline in real income.

The triple lock was established to prevent that trend from continuing and to help pensioners maintain a more secure standard of living in retirement.

The introduction of the triple lock marked a shift in the UK government’s approach to retirement income policy. It demonstrated a commitment to ensuring that pension increases kept pace with both economic performance and the cost of living.

How Has The Triple Lock Affected Pensioner Incomes Over Time?

Since its implementation, the triple lock has significantly increased the value of the State Pension. In the 2022/23 tax year, the full new State Pension was £185.15 per week.

By 2025/26, that amount had risen to £230.25 per week. This represents an increase of more than 24 percent in just three years.

This rise has consistently outpaced inflation during several years, allowing pensioners to retain more purchasing power.

For individuals who depend primarily on the State Pension, this consistent growth has provided more financial certainty and improved standards of living.

To illustrate the effect of the triple lock, consider the following data on State Pension rates:

| Tax Year | Full New State Pension (Weekly) | Year-on-Year Increase |

| 2022/23 | £185.15 | 3.1% |

| 2023/24 | £203.85 | 10.1% |

| 2024/25 | £221.20 | 8.5% |

| 2025/26 | £230.25 | 4.1% |

These figures reflect the triple lock’s role in strengthening the real value of the State Pension. Pensioners have seen more substantial increases than they would have under inflation-only uprating.

Does The Triple Lock Apply To Everyone Receiving A Pension?

The triple lock does not apply to every form of State Pension or to every pensioner in the same way. While most people receiving the new or basic State Pension in the UK benefit from the triple lock, there are notable exceptions.

The following groups are not fully covered:

- Recipients of the Additional State Pension: This portion of pension, relevant to those who retired before April 2016, increases only in line with CPI.

- Pensioners who have deferred their pension: Any extra amount gained from deferral is also adjusted using CPI only.

For pensioners living overseas, whether they receive the annual increase depends on their country of residence.

Only certain countries have reciprocal arrangements with the UK that allow pension increases to be passed on.

Pensioners in countries without such agreements do not benefit from triple lock increases and may have their pension payments frozen at the rate they first received them.

No action is required from pensioners to receive the increase. The Department for Work and Pensions (DWP) applies the relevant increase automatically each April.

Will The Triple Lock Continue In The Future?

The future of the triple lock remains a point of substantial debate in UK political and economic circles. While the policy has proven beneficial for pensioners, its long-term sustainability is increasingly being questioned due to its cost implications and the ageing demographic profile of the population.

Maintaining the triple lock means that pensions grow faster than most other forms of public spending. According to official estimates, the triple lock has added billions to the UK’s pension bill each year. For example:

- The 1% increase in 2023 led to an additional annual expenditure of over £11 billion.

- The rise in 2024 and 2025, though slightly lower, still placed considerable strain on the public purse.

The Office for Budget Responsibility (OBR) has projected that State Pension spending could rise from just over 5% of GDP in 2025 to 8% of GDP by 2072/73, depending on economic and demographic trends. This would represent one of the largest single expenditures by the UK government.

Several factors influence the sustainability of the triple lock:

Demographic Pressures

The UK’s population is ageing. Life expectancy has increased over the past few decades, and people are spending more years in retirement.

As a result, more individuals are drawing from the State Pension for longer periods, increasing the total cost.

Taxpayer Burden

The rising cost of pensions must be funded by current taxpayers. Without significant economic growth or tax reforms, the financial pressure on the working-age population will intensify, raising questions of intergenerational fairness.

Public Finances And Policy Priorities

Given limited government resources, maintaining the triple lock could mean reduced investment in other critical areas such as education, health, or infrastructure. Balancing public expectations with fiscal responsibility is a growing challenge for policymakers.

Political Considerations

Despite the concerns, political parties have so far been reluctant to make changes. The triple lock is highly popular among older voters, who also have higher voter turnout rates.

In the 2024 general election campaigns, all major parties reaffirmed their commitment to the triple lock, at least for the duration of the current Parliament.

However, many economists and think tanks have suggested alternatives, such as:

- Switching to a double lock: Removing the 2.5% guaranteed increase while keeping CPI and earnings growth as benchmarks

- Indexing pensions only to inflation: Returning to the pre-2011 system where pensions rose in line with CPI alone

- Linking increases to median earnings rather than average earnings: Reducing sensitivity to outliers in high-income brackets

There is also discussion around raising the State Pension age more rapidly. The government has already planned to increase it to 67 by 2028 and to 68 between 2044 and 2046. Future administrations could bring those dates forward or tie them more directly to life expectancy data.

While the triple lock remains in place, its continuation is not guaranteed. The combination of economic pressures, changing demographics, and shifting policy priorities may lead to reforms in the next decade.

Any changes would likely be phased in gradually, given the importance of the State Pension as a foundation of retirement income for millions.

Projected Fiscal Impact Of The Triple Lock Increases

The following table presents a simplified estimate of the annual increases in the full new State Pension and the corresponding rise in public spending between 2022 and 2027.

These figures are modelled using known increase percentages and publicly available budget data, offering a snapshot of the growing cost implications of maintaining the triple lock.

| Tax Year | Full New State Pension (Weekly) | Annual Pension Amount | Annual Increase (%) | Estimated Additional Government Cost | % of UK GDP on State Pensions |

| 2022–23 | £185.15 | £9,627.80 | 3.1% | £4.5 billion | 4.8% |

| 2023–24 | £203.85 | £10,599.20 | 10.1% | £11 billion | 5.0% |

| 2024–25 | £221.20 | £11,502.40 | 8.5% | £9 billion | 5.05% |

| 2025–26 | £230.25 | £11,973.00 | 4.1% | £6 billion | 5.06% |

| 2026–27* | £236.01 (estimated) | £12,272.52 (estimated) | 2.5% (assumed) | £3.5 billion (est.) | 5.02% (projected) |

| 2027–28* | £244.27 (estimated) | £12,721.92 (estimated) | 3.5% (assumed) | £4.8 billion (est.) | 5.10% (projected) |

*Figures for 2026–28 are estimated using assumed triple lock scenarios and inflation/wage projections.

These figures show how even modest increases in the State Pension, when applied nationally, result in billions of pounds in additional spending.

Over time, as the number of retirees grows, so too will the fiscal burden unless policies are adjusted or economic growth significantly outpaces spending.

What Could The State Pension Amount Be In The Coming Decades?

Future increases to the State Pension depend on economic conditions and policy decisions. However, projections can be made based on different assumed annual increases.

The following table models the full new State Pension from 2025 to 2055, assuming annual increases of 2.5%, 3.5%, and 4.5%.

| Tax Year | 2.5% Annual Increase | 3.5% Annual Increase | 4.5% Annual Increase |

| 2025–26 | £11,973.00 | £11,973.00 | £11,973.00 |

| 2035–36 | £15,326.45 | £16,889.10 | £18,593.70 |

| 2045–46 | £19,619.15 | £23,823.74 | £28,875.45 |

| 2054–55 | £24,501.64 | £32,469.32 | £42,911.67 |

These forecasts illustrate the long-term impact of compounding increases. Even at the minimum 2.5% annual growth, the State Pension would rise by more than £12,500 over the next 30 years.

Is The Triple Lock Sustainable For Future Generations?

The sustainability of the triple lock depends largely on demographic trends and economic performance. The UK’s population is ageing, with a growing proportion reaching retirement age each year. This increases the financial pressure on the State Pension system.

According to the Office for Budget Responsibility, pension-related spending could rise to around 8 percent of GDP by 2072. This would represent a substantial burden on taxpayers, especially if economic growth remains modest.

To offset rising costs, the government has implemented staged increases in the State Pension age:

- From 66 to 67 between April 2026 and April 2028

- From 67 to 68 between April 2044 and April 2046

Future increases in the pension age or modifications to the triple lock policy cannot be ruled out. Some proposals suggest shifting to a “double lock” system, removing the guaranteed 2.5% element to save money while still maintaining some form of protection against inflation and earnings stagnation.

The balance between providing pensioners with security and maintaining fiscal responsibility will continue to shape policy discussions in the years ahead.

How Does The Triple Lock Compare To Previous Systems?

Prior to the introduction of the triple lock in 2011, the State Pension was typically uprated using either inflation or wage growth, but not both.

Between 1980 and 2010, the pension was mostly linked to inflation, which resulted in a decline in its value compared to average earnings.

The triple lock policy marked a significant improvement in pensioner income protection. It not only stabilised the real value of the State Pension but also allowed it to grow in line with national prosperity.

The guaranteed minimum increase of 2.5% helped shield pensioners from periods of low inflation or wage stagnation.

Compared to previous systems, the triple lock has been more generous but also more expensive. It has become a politically sensitive topic due to its growing cost and impact on public spending priorities.

Conclusion

The triple lock pension has played a crucial role in maintaining the real-term value of the UK State Pension since its introduction in 2011.

While it has significantly improved pensioner incomes, its long-term sustainability remains a key concern for policymakers.

As the population ages and pension costs rise, the future of the triple lock continues to be a subject of political and economic debate. Understanding how it works is essential for anyone planning their retirement in the UK.

Frequently Asked Questions about the Triple Lock Pension

How does the triple lock pension protect against inflation?

The triple lock includes inflation as one of its key measures. If inflation is the highest of the three criteria (CPI, wage growth, or 2.5%), the State Pension increases accordingly. This ensures that retirees do not lose purchasing power.

Can the government remove the triple lock?

Yes, the triple lock is not legally binding. While political parties currently support it, any future government could replace or remove it by passing new legislation or altering policy priorities.

Do all pensioners benefit from the triple lock equally?

No. Pensioners who receive the Additional State Pension or deferred pension amounts see increases linked to CPI only. Overseas pensioners may also miss out depending on where they live.

Will future generations receive a State Pension?

While there is no guarantee, the State Pension is expected to continue. However, eligibility ages may rise, and the method of uprating (such as the triple lock) may be revised to manage costs.

How can I check my State Pension forecast?

You can check your forecast on the UK Government’s official website (GOV.UK) using your National Insurance number. This tool shows your projected pension amount and your current NI contribution record.

What is the difference between the basic and new State Pension?

The basic State Pension applies to those who reached retirement age before 6 April 2016. The new State Pension applies to those who reach pension age after this date. The new system simplifies payments and generally offers a higher base amount.

Does deferring the State Pension affect triple lock increases?

Yes. If you defer your State Pension, the extra amount you earn is not subject to the triple lock. It increases in line with CPI only.

Related Articles: