Are you receiving Universal Credit and wondering why your housing element is lower than expected? If you share your home with an adult who isn’t your partner, you could be affected by non dependant deductions.

These fixed reductions are applied by the DWP based on the assumption that other adults contribute to your rent.

Understanding who qualifies as a non-dependant, when deductions apply, and which exceptions exist is essential to managing your benefits and avoiding unexpected shortfalls.

What Are Non Dependant Deductions In Universal Credit?

Non dependant deductions refer to a fixed reduction applied to your Universal Credit housing element when an adult, other than your partner, lives in your home.

This deduction is based on the assumption by the Department for Work and Pensions (DWP) that adult household members contribute towards housing costs.

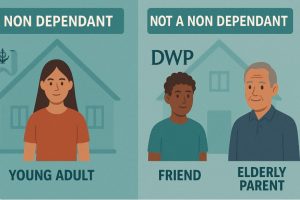

A non dependant is generally:

- An adult child

- A friend

- A relative who is not your partner or tenant

The deduction applies regardless of whether the person actually helps with the rent. Even if no financial support is offered, the DWP will still reduce your Universal Credit housing element, which could lead to a shortfall in your rent coverage.

This fixed-rate deduction is officially called a housing cost contribution. The amount is standardised and does not change based on the person’s income or whether they are helping you pay rent.

How Do Non Dependant Deductions Affect Your Universal Credit Housing Element?

Non dependant deductions can significantly reduce the amount of Universal Credit you receive towards your rent. Understanding how the deduction is applied and calculated helps you plan financially and avoid unexpected shortfalls.

Fixed Monthly Deduction Per Non Dependant

The Department for Work and Pensions (DWP) applies a flat-rate deduction for each adult non dependant in your home. This rate does not vary based on the person’s income, employment status, or whether they help pay the rent.

As of April 2025, the standard deduction is:

| Description | Amount (£) |

| Deduction Per Non Dependant Adult | £93.02 |

This deduction applies per adult. If you have more than one non dependant adult, each one will trigger an additional deduction.

Impact on Your UC Housing Element

Your Universal Credit housing element is intended to cover all or part of your rent. However, when deductions are made, the amount paid to you is reduced, meaning you must make up the difference yourself.

Example Calculation

Let’s say your total rent is £500 per month, and one adult non dependant lives with you:

| Item | Amount (£) |

| Monthly Rent | 500.00 |

| Non Dependant Deduction | -93.02 |

| UC Housing Element Paid | 406.98 |

If you had two adult non dependants living with you, the deduction would double to £186.04, and the housing element paid to you would be £313.96. This creates a larger shortfall, which must be covered from other income or contributions from the household.

No Consideration of Income or Willingness to Contribute

Universal Credit does not assess whether the non dependant is:

- Earning money

- Contributing to household expenses

- Willing or able to help with rent

The assumption is automatic, which can be especially challenging if the non dependant is unemployed or refuses to pay. In such cases, the full burden of the shortfall falls on the main claimant.

Risk of Rent Arrears

If the claimant cannot cover the rent difference caused by the deduction, it may result in:

- Late rent payments

- Accumulating rent arrears

- Potential eviction notices

To manage this, claimants are encouraged to speak with non dependants about contributing financially and to seek budgeting advice or apply for Discretionary Housing Payments through their local authority.

Who Is Considered A Non Dependant Adult By The DWP?

Knowing who qualifies as a non dependant adult under Universal Credit rules is critical. This determines whether the DWP will apply a housing cost contribution deduction to your Universal Credit claim.

Definition of a Non Dependant

A non dependant is an adult (aged 18 or over) who lives in your home but is not your partner. The DWP assumes that this person should contribute toward housing costs, and so applies a deduction from your housing element.

Common examples include:

- Adult children

- Siblings

- Cousins

- Long-term friends or other relatives

This applies whether or not the person has their own income or pays rent to you. Simply living in your home on a long-term basis is enough to trigger the deduction.

Who Does Not Count as a Non Dependant?

Not every adult in your home will count as a non-dependent. The DWP excludes certain categories from the deduction calculation.

You will not face a deduction for any of the following:

- Your partner: Whether in a joint or single claim, your partner is not considered a non dependant.

- A joint tenant: Someone named on the tenancy agreement alongside you is not classed as a non dependant.

- A lodger: Someone who pays rent to live in your home is classed differently, and their payment may be treated as income, not a non dependant contribution.

- A guest or short-term visitor: Friends or family visiting temporarily do not count.

- A sofa surfer: If someone is homeless and staying with you informally for a short time, they are not treated as a permanent member of your household.

- Your landlord: If your landlord lives in the property, their status does not count against your claim in this way.

Understanding these distinctions is important. If the DWP wrongly categorises someone as a non dependant, it could result in an unnecessary deduction, reducing your benefit unfairly.

Changes That May Trigger a New Deduction

You must report certain changes to the DWP, as they may result in a non dependant deduction being added or removed:

- A household member turns 18

- A friend or relative moves in permanently

- A temporary guest becomes a long-term resident

- Someone in your home stops being exempt (e.g. finishes full-time education)

Failure to report these changes can lead to overpayments, which the DWP may ask you to repay later. It may also result in underpayments if an exemption applies and you are still being deducted incorrectly.

When Does The DWP Not Apply A Non Dependant Deduction?

The DWP excludes certain categories of people and situations from the deduction rule. These exemptions help to ensure that vulnerable individuals or those not expected to contribute are not penalised.

No deduction should apply if:

- You are registered as blind or severely sight-impaired, and this has been confirmed by a qualified eye specialist

- The non-dependent receives qualifying disability benefits

- The non-dependent is under a specific age or in a particular situation

These exemptions apply to both individual and joint Universal Credit claims. If either partner qualifies, the deduction should not be made. It’s important to notify the DWP with medical proof or award letters as evidence.

How Do Disability Benefits Impact Universal Credit Deductions?

One of the most important exemptions involves disability-related benefits. If you or your non dependent receives certain benefits that indicate a care need, you may not be subject to the housing cost contribution.

The relevant disability benefits include:

- Personal Independence Payment (PIP) – Daily Living Component

- Disability Living Allowance (DLA) – Middle or High Rate Care Component

- Attendance Allowance

These benefits demonstrate that either the claimant or the non-dependant has additional living needs, making it unreasonable to assume they can contribute to rent. This exemption can significantly reduce your rent burden.

If you start receiving one of these benefits after submitting your claim, make sure to report the change to the DWP immediately to stop the deduction.

What Are Some Other Exceptions To Non Dependant Deductions?

In addition to disability-related exemptions, there are other personal circumstances where non dependent deductions do not apply. These scenarios are important for households with younger adults or those in temporary situations.

No deduction applies if the non-dependent:

- Is under 21 years old

- Is a full-time student under 21

- Is in prison or remand

- Is in the armed forces and away on operational duty

- Receives Carer’s Allowance

- Receives Pension Credit

- Is responsible for a child under 5 years old

This ensures that those not expected to contribute, either due to age, caregiving duties, or absence, do not unfairly reduce your benefit.

It is the claimant’s responsibility to inform the DWP of any changes to these conditions so that any deductions can be applied correctly or removed when appropriate.

How Can You Manage Rent Shortfalls Due To Non Dependant Deductions?

Since the deduction reduces the amount of housing support you receive, you will need to cover the shortfall. This can be particularly challenging for households with tight budgets.

To manage the rent gap, consider:

- Discussing the situation with the non-dependent and asking them to contribute regularly

- Reviewing your monthly budget and cutting non-essential expenses

- Seeking support from local housing organisations or Universal Credit advisors

Some local councils may offer Discretionary Housing Payments (DHP) to help cover the shortfall caused by deductions. These are not guaranteed but may be available in cases of financial hardship.

It is crucial to address the issue before it leads to rent arrears, which can affect your housing security and credit status.

What Should You Report To The DWP About Your Living Situation?

Keeping your Universal Credit claim up to date is essential for accurate housing cost assessments. You must report all relevant changes to your household to ensure you’re not being overpaid or underpaid.

You should notify the DWP if:

- Someone moves into or out of your home

- A non-dependent turns 18

- Someone in your household starts or stops claiming a disability benefit

- There is a change in the relationship between you and a non-dependent

- A non-dependent becomes responsible for a child or leaves the armed forces

Reporting these changes ensures that deductions are applied fairly. It also prevents the DWP from issuing overpayments that may be reclaimed later.

What Are The 2025 Non Dependant Deduction Rates?

The DWP sets a fixed deduction amount per non dependant adult, and this figure is typically updated annually in April.

| Deduction Type | Monthly Rate (2025) |

| Per Non Dependant Adult | £93.02 |

| Two Non-Dependants (example) | £186.04 |

| Three Non-Dependants (example) | £279.06 |

These deductions are not income-based, meaning they apply at the same rate regardless of the non-dependent’s earnings or employment status. This is different from other benefits like Housing Benefit, where income affects deductions.

Staying informed of the annual updates is important for budgeting and ensuring your Universal Credit award remains accurate.

Where Can You Get Help With Universal Credit Housing Contributions?

If you are struggling due to non dependant deductions or are unsure whether one should apply to you, several organisations can provide guidance.

You can contact:

- Citizens Advice: They offer benefits guidance across the UK and can help you appeal incorrect deductions.

- Shelter: They specialise in housing advice and can support you in avoiding rent arrears.

- Local Council Housing Teams: They may offer additional support through Discretionary Housing Payments or financial counselling.

Getting help early can prevent further complications, including eviction or serious debt.

Conclusion

Non dependant deductions in Universal Credit are intended to reflect the idea that adult household members should help contribute to the rent. However, the rules are nuanced, and various exceptions apply based on disability, age, and personal circumstances.

Understanding who counts as a non-dependant, the amount deducted, and when exemptions apply is essential to managing your Universal Credit effectively. Always keep the DWP informed of changes in your household to ensure your claim is accurate and avoid financial difficulties.

FAQs about Universal Credit Housing Deductions

What happens if a non dependant refuses to contribute to the rent?

You are still responsible for covering the rent, even if your non dependant doesn’t help. The DWP assumes they contribute, and your housing element will be reduced regardless.

Can non dependant deductions be backdated?

Yes, if the DWP finds that a non dependant was living with you previously, they can backdate deductions, potentially leading to overpayments you must repay.

Do deductions apply if my adult child is in college?

If your adult child is in full-time education and under 21, they typically don’t count as a non-dependent. If they are over 21, deductions may apply depending on their situation.

Will the deduction change if my rent goes up?

No, the deduction is a flat rate and does not vary based on your rent. The shortfall you must cover may increase, though, if your rent rises.

Can I appeal a non dependant deduction?

You can challenge or appeal if you believe the deduction is incorrect for example, if the person does not live with you or qualifies for an exemption.

How often are deduction rates updated?

DWP reviews deduction rates annually, usually in April. Keep an eye on official announcements for any changes.

What should I do if I think the DWP has made a mistake?

Contact Universal Credit directly, submit any relevant evidence, and ask for a mandatory reconsideration if necessary.

Related Articles: