The DWP CMS GB 2012 Scheme plays a crucial role in ensuring that separated parents in the UK meet their financial responsibilities toward their children.

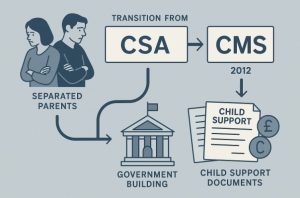

Introduced to replace earlier child maintenance schemes, it aims to provide a more efficient and accurate system for assessing, collecting, and enforcing child support payments.

Managed by the Department for Work and Pensions through the Child Maintenance Service, the scheme focuses on improving compliance, supporting families, and ensuring children receive the support they are entitled to.

What is the DWP CMS GB 2012 Scheme?

The DWP CMS GB 2012 scheme was introduced to replace the 1993 and 2003 child maintenance schemes previously managed by the Child Support Agency (CSA).

The Child Maintenance Service (CMS), part of the Child Maintenance Group (CMG) within the Department for Work and Pensions (DWP), administers the 2012 scheme and manages client funds.

This statutory scheme ensures that non-resident parents contribute financially to the upbringing of their children, even if the parents are separated or divorced.

The CMS 2012 system handles both new maintenance assessments and historic arrears transferred from earlier schemes.

The CMS aims to support separated parents in setting up either private family-based arrangements or using the statutory scheme when collaboration is not possible.

How Does the Child Maintenance System Work in the UK?

Parents are encouraged to make private arrangements first. If this is not possible, they can apply to the CMS.

Before doing so, they must contact the Child Maintenance Options service, which provides impartial advice.

The CMS provides two service types:

- Direct Pay: CMS calculates the amount to be paid, but payments are managed privately between parents without CMS intervention beyond the calculation.

- Collect and Pay: CMS collects the payments from the paying parent and transfers them to the receiving parent. This is used where the paying parent is unwilling or has previously failed to pay.

The choice between these services depends on the ability of parents to cooperate. The CMS encourages Direct Pay where feasible to reduce administrative overheads and costs.

Who is Responsible for Paying Child Maintenance?

The responsibility for financially supporting a child rests with both parents. The parent who does not have the main day-to-day care of the child is classed as the paying parent (PP).

The parent with main care is the receiving parent (RP). The CMS ensures the PP contributes a fair amount based on their income and circumstances.

Parents must first consider private agreements before turning to the CMS. The statutory scheme is particularly important when one parent refuses to contribute voluntarily.

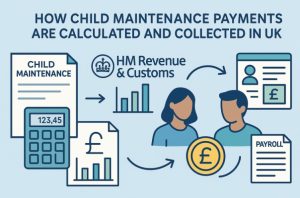

How Are Child Maintenance Payments Calculated and Collected?

Child maintenance calculations are primarily based on the paying parent’s gross income, as reported by HMRC.

The CMS also considers the number of children involved, the number of nights the child stays with the paying parent, and whether the paying parent supports other children.

Maintenance payments are reviewed annually but can be reassessed sooner if there’s a significant change in circumstances.

For parents using the Collect and Pay service, charges apply:

- The paying parent pays an additional 20% on top of the maintenance amount

- The receiving parent has 4% deducted from the maintenance they receive

Table 1: Key Differences Between Direct Pay and Collect and Pay

| Feature | Direct Pay | Collect and Pay |

| Who handles payments | Parents manage directly | CMS collects and distributes |

| Charges applied | No charges | 20% to PP, 4% from RP |

| When it’s used | When parents cooperate | When PP fails to pay voluntarily |

| Enforcement tools available | Not applicable | Full range of CMS enforcement |

What Happened to Old CSA Arrears and Cases?

By December 2018, all active cases under the CSA schemes (1993 and 2003) were closed. Parents were required to set up new arrangements or reapply under the 2012 scheme. Outstanding arrears from the CSA were either written off or considered for collection through representation, depending on criteria established through public consultation.

The historic arrears were transferred to the CMS system but continue to be reported separately for clarity and auditing purposes. This streamlined system helps CMS focus on current and collectable maintenance.

How Did the CMS GB 2012 Scheme Adapt During the COVID-19 Pandemic?

The COVID-19 pandemic posed unprecedented challenges for the UK’s public services, including the Child Maintenance Service (CMS).

As part of the Department for Work and Pensions (DWP), the CMS had to rapidly adjust its operations to continue supporting separated families while addressing national emergency demands.

To manage the surge in Universal Credit claims at the start of the pandemic, the DWP redeployed approximately 1,500 CMS staff to frontline services.

This resulted in a temporary move to a “minimum service model” for the CMS, which prioritised essential functions while suspending or easing certain aspects of service delivery.

Key Adjustments Made by the CMS

During the minimum service period, the CMS implemented a range of temporary changes aimed at maintaining operations and easing the burden on affected families:

- Applications moved online only: To reduce the strain on telephone services and prioritise critical support, all new CMS applications had to be made online. This shift accelerated the digital transformation of the service and encouraged the use of online tools.

- Acceptance of verbal evidence: For changes in circumstances, the CMS began accepting verbal confirmations from clients, allowing for quicker processing and reducing the need for physical document submissions.

- Enforcement actions were paused: During the early months of the pandemic, all enforcement activities—including court applications, deductions, and agent referrals—were temporarily suspended. This was done to avoid placing additional pressure on paying parents facing financial hardship.

- CSA case closures on representation were paused: Arrears-only cases from the previous CSA schemes, which were under final stages of closure through the representation process, were also temporarily halted.

- Revised calculation timeframes: The CMS reduced the income change reassessment period from 12 weeks to just 2 weeks. This measure was designed to help paying parents who had experienced a sudden drop in income and could no longer afford their previously calculated maintenance levels.

- Employer-related enforcement easements: While Deduction from Earnings Orders (DEOs) continued to be imposed where necessary, the CMS did not pursue businesses that were unable to implement deductions due to their own COVID-19 disruptions or furloughing staff.

- Guidance on online reporting: Parents were encouraged to report changes to their circumstances via the CMS online account portal. This reduced demand on phone lines and promoted greater use of digital self-service.

These changes allowed the CMS to maintain essential services and ensure ongoing support to families despite reduced staffing and wider pressures on the welfare system.

Recovery and Reinforcement Post-Easements

By July 2020, the CMS began restoring its core services. Most redeployed staff returned to CMS duties by September 2020, and a structured recovery phase was implemented. This included:

- Reinstating paused enforcement activities: Between September and December 2020, CMS reviewed all cases that had gone into arrears during the minimum service period. Enforcement actions resumed, and court hearings were successfully secured for 95% of delayed cases.

- Reacting to non-payment trends: The CMS prioritised reviewing non-paying cases to bring them back into compliance. Adjustments to maintenance balances and scheduling were made where necessary to reflect missed or incorrect payments.

- Reintroducing enforcement agents: Cases that had been referred to enforcement agents prior to the pause were actively progressed. The CMS also initiated new referrals to resume full collections.

- Performance restoration: By January 2021, enforcement-related collections had recovered to pre-pandemic levels. Collection figures remained strong, with sustained efforts by caseworkers to secure payments and re-establish compliance.

Strategic Lessons and Long-Term Changes

The pandemic experience highlighted the importance of a flexible and digital-first service model.

Several of the temporary measures tested during the crisis influenced the CMS’s longer-term transformation strategy. For example:

- Increased reliance on digital tools, including the “My Child Maintenance Case” portal

- More streamlined communication through SMS and online notifications

- Consideration of more responsive calculation adjustments based on real-time income changes

CMS has committed to building on the successful aspects of its pandemic response to deliver a more modern, efficient and user-friendly service.

The department also continues to monitor the long-term impact of COVID-19 on child maintenance compliance and collection trends, especially as economic conditions evolve post-pandemic.

What Enforcement Powers Does the CMS Have?

The Child Maintenance Service (CMS), operating under the Department for Work and Pensions (DWP), holds a wide range of enforcement powers to ensure that paying parents (PPs) meet their financial obligations under the statutory child maintenance system.

These powers are a crucial part of the DWP CMS GB 2012 Scheme, especially for cases managed through the Collect and Pay service, where non-compliance is more common.

Enforcement action becomes necessary when a paying parent either refuses or fails to make the required child maintenance payments.

In Direct Pay arrangements, action is only taken if the receiving parent (RP) reports missed or late payments. In Collect and Pay cases, enforcement is automatic if the paying parent does not pay as scheduled.

The CMS enforcement framework is designed to escalate depending on the level of non-compliance, starting with administrative methods and progressing to legal interventions if necessary.

Administrative Enforcement Powers

Administrative actions are used as the first line of enforcement, as they do not require court approval and can be implemented relatively quickly.

Deduction from Earnings Orders (DEOs)

- CMS can instruct an employer to deduct maintenance directly from the paying parent’s salary.

- The employer is legally obligated to comply, and failure to do so can result in court action against the employer.

- DEOs are commonly used and provide a consistent method for recovering maintenance from employed individuals.

Deduction Orders from Bank or Building Society Accounts

- CMS can withdraw funds directly from a paying parent’s personal, business, or joint account.

- Two types of orders can be used:

- Regular Deduction Orders (RDOs): Fixed amounts taken at regular intervals.

- Lump Sum Deduction Orders (LSDOs): A one-off amount taken to clear arrears.

- These orders are particularly useful for self-employed or irregular income earners.

Deduction from Benefits

- If the paying parent is receiving certain benefits, CMS can request a fixed amount to be deducted from those benefits.

- This method ensures minimum payments are still being made even when the paying parent has no employment income.

Legal Enforcement Powers

When administrative actions fail or are not suitable, CMS has the authority to escalate enforcement through the courts. These legal powers are more serious and are used in cases of persistent or wilful non-payment.

Liability Orders

- CMS can apply to the Magistrates’ Court or County Court to obtain a liability order, which legally confirms the debt and gives CMS access to more advanced enforcement options.

- Once granted, liability orders open the door to more forceful actions like seizure of assets.

Referral to Enforcement Agents (Bailiffs)

- Once a liability order is obtained, CMS can refer the case to court-appointed enforcement agents.

- These agents have the authority to visit the paying parent’s home, seize goods and assets, and sell them to recover the debt.

Charging Orders and Orders for Sale

- A charging order can be placed against the paying parent’s property, effectively securing the debt against it.

- If the debt remains unpaid, CMS can apply for an order for sale, forcing the sale of the property to cover unpaid maintenance.

Disqualification from Holding a Driving Licence or Passport

- For cases of prolonged non-payment, CMS can apply to the courts to disqualify a paying parent from holding a UK driving licence or passport.

- These sanctions are intended to act as strong deterrents and are typically used when all other recovery efforts have failed.

Committal to Prison

- In extreme circumstances, CMS may request the court to impose a custodial sentence.

- This step is taken when all other enforcement avenues have been exhausted and the paying parent is found to be deliberately avoiding payments.

Role of the Financial Investigations Unit (FIU)

The CMS also works closely with the Financial Investigations Unit (FIU) to tackle complex cases involving financial manipulation or concealment. The FIU can:

- Conduct criminal investigations into deliberate non-disclosure of income or assets

- Analyse multiple income streams, especially for self-employed individuals or company directors

- Investigate failed DEOs to determine if employers are complicit or if PPs are manipulating employment status

- Prepare evidence for the Crown Prosecution Service (CPS) in cases where criminal charges may be pursued

This unit is particularly important for ensuring fairness in the system, preventing fraudulent avoidance, and maintaining public trust in the CMS.

Enforcement Trends and Effectiveness

The introduction of stronger enforcement powers under the 2012 scheme, including the ability to confiscate passports and driving licences, has significantly improved compliance rates.

CMS continues to embed a culture of “Total Enforcement,” ensuring that enforcement is considered at every stage of the case lifecycle.

Over recent years, enforcement actions have been a key contributor to maintaining and recovering unpaid maintenance. For example:

- Collections via enforcement activities returned to pre-pandemic levels by January 2021

- More than 50% of outstanding maintenance debt is currently being pursued through enforcement

- Legal tools have proven especially effective in high-debt or long-term non-compliance cases

Summary of Enforcement Options

| Enforcement Method | Requires Court Order | Applicable Circumstances |

| Deduction from Earnings Orders (DEO) | No | Employed PPs with regular income |

| Bank Account Deduction Orders | No | PPs with accessible financial assets |

| Deduction from Benefits | No | PPs on qualifying benefits |

| Liability Order | Yes | To access higher-level legal enforcement |

| Enforcement Agents (Bailiffs) | Yes | After a liability order is granted |

| Charging Orders/Orders for Sale | Yes | To secure debts against property |

| Driving Licence/Passport Confiscation | Yes | For severe, ongoing non-compliance |

| Imprisonment | Yes | Last resort after all other methods fail |

The range of enforcement powers available to the CMS demonstrates the seriousness with which the government views child maintenance compliance. These powers not only assist in recovering funds owed but also act as a significant deterrent to non-payment.

How Effective Is the CMS 2012 Scheme in Collecting Maintenance?

The CMS continues to improve its collection effectiveness. As of 31 March 2021, the service managed a total caseload of 548,000 cases, a 6% increase from the previous year. Among these:

- 263,300 were Collect and Pay cases

- 498,700 were Direct Pay arrangements

- 72% of Collect and Pay case groups were compliant, the highest since the scheme began

Estimated payments made during 2020/21 totalled £972.7 million, including voluntary payments and those processed through the CMS.

What is the Status of Unpaid Child Maintenance?

At the end of the 2020/21 financial year, unpaid child maintenance stood at £408.5 million. Although the absolute value of arrears has increased, the proportion of unpaid maintenance relative to the total raised has steadily decreased over time.

Table 2: Unpaid Maintenance as a Percentage of Total Raised

| Year | Unpaid Maintenance % |

| 2015 | 17.1% |

| 2016 | 13.3% |

| 2017 | 12.5% |

| 2018 | 12.1% |

| 2019 | 10.8% |

| 2020 | 9.9% |

| 2021 | 8.9% |

Of the total unpaid amount:

- 51% is under active enforcement

- 6.9% is under surveillance where recovery is not currently feasible

- The remainder includes scheduled payments, pending allocations, and new debts

The CMS maintains that most arrears are potentially recoverable and uses tools like employer deductions and benefit offsets to enforce compliance.

How Accurate Are CMS Assessments and Calculations?

The 2012 scheme introduced significant automation into the child maintenance calculation process. CMS interfaces directly with HMRC to verify incomes and reduces manual intervention. This has improved both speed and accuracy of assessments.

In 2020/21, the assessment accuracy was recorded at 99.4%, an improvement from 99.0% in the previous year. Factors contributing to this high accuracy include:

- Automated calculation processes

- Enhanced training for caseworkers

- Real-time management information and quality assurance

- Digital channels allowing parents to report changes efficiently

What Fees and Charges Are Associated with the CMS?

The CMS imposes several charges to cover administrative costs and encourage cooperation:

- A £20 application fee for entering the statutory scheme (waived in certain cases)

- A 20% collection fee charged to paying parents using Collect and Pay

- A 4% fee deducted from the receiving parent’s payment under Collect and Pay

During the 2020/21 financial year, the CMS collected £44.9 million in non-maintenance receipts, including fees and enforcement-related charges. These funds are transferred to the Secretary of State and reported in the DWP’s accounts.

How Does the CMS Ensure Data Protection and Information Security?

To comply with the General Data Protection Regulation (GDPR), the CMS has implemented strict policies on data retention and security. Case documentation is deleted 14 months after case closure, ensuring compliance with privacy regulations.

System changes have been introduced to support this policy while retaining essential accounting records for audit purposes. In 2020/21, 21 personal data breaches were reported to the ICO, 15 of which involved the CMS.

Internal communications, improved procedures, and staff training have strengthened the department’s ability to safeguard personal information and reduce the risk of breaches.

What Governance and Oversight Structures Support the Scheme?

The CMS is subject to financial governance and oversight by the DWP’s Principal Accounting Officer. Under the Government Resources and Accounts Act 2000, the DWP is required to publish a separate Client Funds Account for the CMS 2012 scheme.

Internal controls include:

- Financial audits conducted by the National Audit Office

- A fraud detection system using audit trails and monitored user activity

- Use of the Children Analytical Data Service (ChADS) to improve reporting and analysis

- Implementation of data strategies for better management and transparency

ChADS, expected to become fully operational in 2021/22, is designed to improve data visualisation and reduce manual reporting errors. This supports the CMS goal of delivering efficient, data-driven service to clients.

What Is the Future Outlook for the CMS GB 2012 Scheme?

The CMS has initiated a multi-year Transformation Programme aimed at improving service delivery, efficiency, and customer experience. Lessons learned from the pandemic have accelerated the shift to digital platforms.

Key initiatives include:

- Enhancement of online services like “My Child Maintenance Case”

- Expansion of self-service functionality for reporting changes and making payments

- Streamlined communication through secure online accounts, SMS, and email

- Increased automation to reduce manual interventions and improve accuracy

The focus remains on modernising the CMS while ensuring children benefit from reliable, consistent financial support from both parents.

Conclusion

The DWP CMS GB 2012 Scheme has significantly reformed child maintenance delivery in the UK. By focusing on compliance, digital transformation, and robust enforcement, it has improved both accuracy and efficiency.

Despite ongoing challenges such as unpaid maintenance and complex financial arrangements, the scheme has made substantial progress in ensuring that children receive the support they are entitled to. Continued enhancements and a commitment to transparency will be vital to its long-term success.

Frequently Asked Questions

What is the difference between Direct Pay and Collect and Pay?

Direct Pay allows parents to manage payments themselves after CMS calculates the amount. Collect and Pay involves CMS collecting and transferring payments, with added fees.

Can the CMS force a parent to pay child maintenance?

Yes, CMS has legal powers to enforce payments through wage deductions, bank orders, court actions, and asset seizures.

Are CMS decisions final, or can they be appealed?

CMS decisions can be reviewed and appealed through an internal reconsideration process and, if needed, through a tribunal.

What happens if a parent doesn’t pay under Direct Pay?

The receiving parent can request a switch to Collect and Pay, enabling CMS to enforce the payments.

Is there a fee to apply for the CMS?

Yes, there is a £20 application fee, although some applicants (e.g., victims of domestic abuse) may be exempt.

How does CMS use HMRC data?

CMS retrieves income details from HMRC to ensure accurate and up-to-date maintenance calculations.

What if the paying parent is self-employed?

CMS can still assess income using HMRC records and may involve the Financial Investigations Unit for complex earnings.