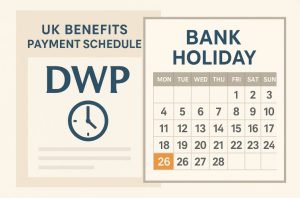

The Department for Work and Pensions (DWP) has announced that many UK benefit claimants will receive their payments earlier than expected in August 2025 due to the summer bank holiday.

This adjustment applies to a wide range of benefits and is part of routine changes that help avoid delays during non-working days.

Alongside this, significant updates around Universal Credit migration and child benefit deadlines require urgent attention from recipients. Here’s everything you need to know about these important changes.

Why Are August 2025 Benefit Payments Being Made Early by the DWP?

The Department for Work and Pensions (DWP) and HM Revenue & Customs (HMRC) have announced that several benefit payments will arrive earlier than usual in August 2025 due to the summer bank holiday.

The UK government policy ensures that when a scheduled payment date falls on a non-working day, such as a weekend or bank holiday, payments are processed on the last working day before that date.

For many benefit claimants, these early payments can be vital in managing household expenses. The August bank holiday, falling on Monday 25 August, triggers the early release of funds for a range of benefits.

This schedule adjustment has been consistently followed in previous years and applies again for 2025. It helps ensure that no one is left without essential financial support during periods when banks and public offices are closed.

What Are the Key Dates for Early Benefit Payments in August 2025?

Many claimants who are due to receive benefits around the August bank holiday will see changes in their payment dates. The DWP and HMRC have provided clear guidance on which days will be affected.

The following table outlines the adjusted payment schedule:

| Original Payment Date | Revised Payment Date |

| Saturday 23 August 2025 | Friday 22 August 2025 |

| Sunday 24 August 2025 | Friday 22 August 2025 |

| Monday 25 August 2025 | Friday 22 August 2025 |

These changes help avoid delays caused by the closure of banks and government offices during the bank holiday weekend. Claimants are advised to check their bank accounts in advance and contact the DWP or HMRC immediately if the payment is not received as scheduled.

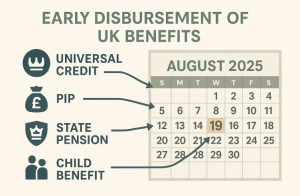

Which Benefits Will Be Paid Early This August?

Several key benefits are scheduled to be paid early, covering support for various groups including families, pensioners, and those with disabilities. This change applies to both regular and one-off payments due over the holiday period.

The affected benefits include:

- Universal Credit

- Child Benefit

- State Pension

- Personal Independence Payment (PIP)

- Attendance Allowance

- Carer’s Allowance

- Disability Living Allowance (DLA)

- Income Support

- Jobseeker’s Allowance (JSA)

- Pension Credit

The following table provides a breakdown of which government body administers each benefit:

| Benefit | Administered By |

| Universal Credit | DWP |

| State Pension | DWP |

| Personal Independence Payment | DWP |

| Attendance Allowance | DWP |

| Carer’s Allowance | DWP |

| Disability Living Allowance | DWP |

| Income Support | DWP |

| Jobseeker’s Allowance | DWP |

| Pension Credit | DWP |

| Child Benefit | HMRC |

Claimants of any of the above benefits should ensure their bank details are up to date and watch for the earlier payment in the week leading up to the August bank holiday.

How Will the Bank Holidays Later This Year Affect Your Payments?

Bank holidays are known to cause shifts in the usual benefit payment dates, and the same will apply later in 2025. As with the August changes, payments scheduled on a non-working day will be processed earlier to ensure no delay in access to crucial financial support.

Payment Changes for Christmas and Boxing Day 2025

The last two bank holidays of the year fall in December and could impact millions of claimants across the UK. These changes help people plan ahead during the most financially demanding time of year.

- Thursday 25 December 2025 (Christmas Day): Payments will be made on Wednesday 24 December

- Friday 26 December 2025 (Boxing Day): Payments will also be made on Wednesday 24 December

Since both holidays fall on a Thursday and Friday, the government has ensured payments are advanced to Wednesday to avoid delays over the extended festive weekend.

Impact on Households

Receiving early payments during the holiday season can offer much-needed flexibility:

- Families can budget for increased seasonal expenses

- Pensioners and carers can prepare in advance for any festive disruptions

- Claimants can avoid financial stress during bank closures

It’s important for recipients to keep track of these adjusted dates and check their bank accounts accordingly.

What You Should Do?

To avoid issues with missed or delayed payments around the holidays:

- Review your expected payment schedule by mid-December

- Make sure your banking information is up to date with the DWP or HMRC

- Contact your benefit provider promptly if your payment does not arrive

Advanced planning can help avoid unnecessary stress during the year-end holidays, especially for households heavily reliant on benefit income.

Why Are Households Being Asked to Move to Universal Credit in August 2025?

The Department for Work and Pensions (DWP) is continuing its long-planned migration process from legacy benefits to Universal Credit, and August 2025 is a significant phase in this transition. This change affects hundreds of thousands of claimants across the UK.

What Is Managed Migration?

Managed migration is the term used for the structured transition from legacy benefits to Universal Credit. Unlike natural migration, which happens when a claimant’s circumstances change, managed migration involves the DWP sending letters to households to notify them of the need to move.

Once a migration notice is issued, claimants have three months to apply for Universal Credit. If they fail to act within this period, their current benefit payments may stop entirely.

Which Benefits Are Being Replaced?

The following legacy benefits are being gradually phased out:

- Working Tax Credit

- Child Tax Credit

- Income Support

- Housing Benefit

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

These benefits are being consolidated under Universal Credit to simplify the welfare system and ensure that people can manage their claims more efficiently through one single monthly payment.

Key Deadlines and What Claimants Should Expect

In August 2025, thousands of households will receive migration letters informing them they must switch to Universal Credit. These letters include:

- The deadline by which you must claim Universal Credit

- Details of the benefits currently received

- Guidance on how to transition without payment gaps

Failure to apply within the given timeframe can result in termination of current benefit support. Therefore, it’s vital to respond quickly.

Support Available During the Migration Process

To support those moving to Universal Credit, the DWP may offer:

- Transitional protection to ensure that no one is worse off immediately after the switch

- Help to Claim services through Citizens Advice or Jobcentre Plus

- Online support and helplines for technical or eligibility queries

Many households have already made the move, but the DWP continues to expand the rollout in phases, focusing on different claimant groups. Those receiving income-related ESA are among the groups expected to receive migration letters during this period.

Who Needs to Take Urgent Action on Their ESA or Other Legacy Benefits?

Income-related Employment and Support Allowance (ESA) recipients are among the last to be moved onto Universal Credit. The DWP had initially delayed their migration due to the complexity of their cases, but the process is now actively underway.

The ESA provides support to people unable to work due to illness or disability. Claimants still receiving ESA will need to take action soon, especially if they receive a migration notice from the DWP.

Those who do not transition within the three-month deadline risk losing payments. The government has confirmed that new applications for ESA are now only accepted in very limited cases and usually in conjunction with a Universal Credit claim.

What Should Parents Know About the August Child Benefit Deadline?

Each year, HMRC reminds parents that child benefit payments stop automatically on 31 August following a child’s 16th birthday unless the parent confirms that the child will continue in approved education or training.

The letter from HMRC will ask parents to update their child’s education status. If no action is taken, payments will end, which could mean a substantial financial loss for the household.

Current payment rates are:

- £26.05 per week for the eldest or only child

- £17.25 per week for each additional child

To maintain eligibility, the child must be enrolled in an approved form of education or training that continues beyond the age of 16. Parents are urged to respond before the deadline to avoid any disruption.

Which Educational and Training Courses Qualify for Continued Child Benefit?

Eligibility for continued child benefit depends on the type of education or training your child is involved in. HMRC provides clear guidance on what qualifies:

Approved Education Includes

- A Levels or Scottish Highers

- NVQs up to Level 3

- T Levels

- International Baccalaureate

- Home education (if it began before age 16 or is approved by a local authority)

Unpaid Training Programs That Qualify Include

- In Wales: Foundation Apprenticeships, Traineeships, Jobs Growth Wales+

- In Northern Ireland: Training for Success, Skills for Life and Work, PEACEPLUS Youth Programme

- In Scotland: Employability Fund, No One Left Behind

To continue receiving child benefit, the education must involve more than 12 hours per week of supervised study or training. HMRC requires parents to confirm these details by the end of August to avoid any lapse in payments.

How Can Parents Claim or Renew Their Child Benefit in 2025?

Claiming child benefit or renewing your existing claim can be done easily through the GOV.UK website or the official HMRC app. Parents should apply as soon as their child is born or as soon as educational details are available.

Key details about claiming child benefit:

- Applications can be backdated for up to 3 months

- Payments are made every four weeks

- Claimants who choose to opt out of payments can still receive National Insurance credits, which help build entitlement to the state pension

This makes it beneficial for stay-at-home parents or those with low income to register even if they do not receive the actual payments.

Conclusion

With early benefit payments confirmed for August 2025, it’s essential for claimants to stay informed and prepared. Understanding how bank holidays impact payment dates, keeping up with Universal Credit migration, and meeting child benefit deadlines can help avoid financial disruptions.

Whether you’re receiving ESA, PIP, Universal Credit, or child benefit, taking timely action is crucial. Check your payment schedule, review any official letters, and follow up with the DWP or HMRC if needed to ensure continued support and peace of mind.

FAQs

What is managed migration to Universal Credit?

Managed migration refers to the process by which existing legacy benefit claimants are transferred to Universal Credit. The DWP issues a notice with a three-month deadline for claimants to make the switch.

How do I know if I’m affected by early benefit payments in August 2025?

If your usual payment date falls on or around the August bank holiday (25 August), you will likely receive your payment early on 22 August.

Can I choose to remain on legacy benefits instead of moving to Universal Credit?

No, once you receive your migration notice, you must transition to Universal Credit within three months or risk losing your existing benefits.

Will the payment amount change if it’s paid early?

No, early payments do not change the amount. They are issued earlier due to non-working days but cover the same benefit period.

Is child benefit affected by bank holidays too?

Yes. If your scheduled child benefit payment date falls on a bank holiday, HMRC will process it earlier. For August, it will arrive on 22 August.

What if I miss the child benefit renewal deadline on 31 August?

Your payments will automatically stop. You can reapply later, but there may be a delay in reinstating the benefit.

Can child benefit be paid for apprenticeships?

Yes, provided the apprenticeship is unpaid and on the approved training list recognised by HMRC, you can still receive child benefit until your child turns 19.

Source – https://www.thesun.co.uk/money/35947970/universal-credit-benefit-changes-august/