The state pension triple lock has long been seen as a safeguard for retirees, ensuring their income keeps pace with inflation and wage growth.

However, in April, around seven million pensioners are expected to miss out on the full 5% increase due to the structure of the older pension system.

With only parts of their pension qualifying for the triple lock, and frozen tax thresholds pulling more into taxation, many face growing financial pressure despite rising pension figures.

What Is The Triple Lock And How Does It Impact State Pensions?

The triple lock is a government commitment to increase the state pension each year by the highest of three measures: inflation, average wage growth, or 2.5 percent.

Since its introduction in 2011, this policy has been seen as a safeguard to ensure pensioners’ incomes keep up with the cost of living and wider economic changes.

Each year, the Department for Work and Pensions (DWP) applies the triple lock formula to both the new state pension and the basic state pension.

The new state pension is applicable to those who reached retirement age on or after 6 April 2016, while the old state pension applies to those who retired earlier and includes extra elements like the State Earnings-Related Pension Scheme (SERPS) or the State Second Pension.

This year, with average wage growth exceeding inflation and the minimum 2.5 percent figure, the expected pension increase from April will be based on earnings data. The result is a 5 percent uplift for eligible components of the state pension.

Why Are Seven Million Pensioners Excluded From The Full Triple Lock Uplift?

Approximately seven million pensioners will not benefit from the full 5 percent uplift. This group includes individuals who receive the old state pension and supplementary income through SERPS or the state second pension, neither of which are covered by the triple lock.

Instead, these additional pension components are only increased in line with inflation, currently at 3.8 percent.

This selective application creates a disparity in pension uprating and leads to lower overall increases for many older pensioners.

For example:

- The basic state pension under the old system will increase by 5 percent

- The additional earnings-related pension components like SERPS will increase by only 3.8 percent

This structural difference means pensioners with identical contribution records but retiring in different years could receive different income increases.

How Much Is The New State Pension Increasing By In April?

The new state pension is currently £11,973 per year. From April, it is set to rise by 5 percent to £12,572, a £599 annual increase. This change reflects wage growth, which is the highest of the three triple lock criteria this year.

For those on the old system, the basic state pension will rise from £9,175 to £9,634. However, as the additional components are only linked to inflation, the combined increase is often lower than for recipients of the full new state pension.

Below is a breakdown of expected increases:

| Pension Type | 2023–24 Annual Amount | 2024–25 Projected Amount | Increase (%) |

| New State Pension | £11,973 | £12,572 | 5.0% |

| Basic State Pension | £9,175 | £9,634 | 5.0% |

| SERPS / State Second Pension | Varies | +3.8% based on inflation | 3.8% |

The difference may appear small in numerical terms, but it significantly affects pensioners on low to moderate incomes, especially in the context of ongoing inflation and rising living costs.

What Financial Impact Will The Triple Lock Disparity Have On Pensioners?

The financial impact of this disparity is notable, particularly for pensioners who retired before 2016 and depend on a combination of basic pension and earnings-related additions.

Key issues include:

- Pensioners on the new state pension receive a consistent, inflation-proofed income aligned with wage growth

- Older pensioners experience partial increases across their pension components, leading to lower overall income growth

- The system unintentionally penalises those who contributed for longer but retired earlier

Steve Webb, a former pensions minister and now partner at LCP (Lane Clark & Peacock), has raised concerns that the existing structure leaves many older pensioners worse off. He noted that “millions of older pensioners will miss out,” despite their decades of contributions, simply due to the split system in place.

This policy inconsistency can also erode confidence in the long-term fairness of the UK pension system, especially among individuals close to retirement who may now be unsure how their income will be adjusted in the future.

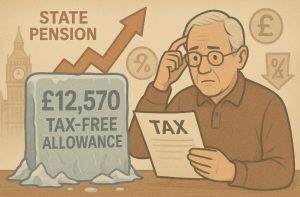

Will Frozen Tax Thresholds Mean Pensioners Pay More Tax?

In addition to the inequality in pension increases, pensioners face another challenge. The personal allowance for income tax is frozen at £12,570 until 2028.

With the new state pension rising to £12,572, pensioners receiving only state pension income may find themselves just over the threshold and liable to pay income tax.

This means:

- A basic rate taxpayer would pay 20 percent on £2 of income, which equals 40p

- Pensioners with private pensions or additional income could pay even more

- For many, this will be their first experience of paying income tax in retirement

This tax development reflects what experts call fiscal drag, where more individuals are pulled into the tax net not through increases in tax rates, but through rising incomes combined with frozen allowances.

Financial professionals are warning that this is:

- A silent tax rise affecting vulnerable groups

- Causing confusion among those unaware that pension increases could result in tax obligations

- Likely to continue affecting growing numbers of pensioners through 2028

What Are Experts Saying About Fiscal Drag And Stealth Taxes?

Industry voices have become increasingly vocal about the implications of fiscal drag on pensioners. Many argue that the government is engaging in stealth taxation by allowing tax thresholds to remain static while income levels rise.

Adam Cole, from the wealth management firm Quilter, stated that the situation is a “textbook example of fiscal drag,” pointing out that many pensioners with no other income are now facing unexpected tax bills.

Helen Morrissey of Hargreaves Lansdown noted that even a modest 4 percent increase in future years would likely push the state pension above the tax-free threshold.

If current trends continue, the full new state pension will breach the personal allowance permanently by the 2027–28 financial year.

Lisa Picardo from PensionBee remarked that the policy undermines the public’s trust in the pension system.

She highlighted the contradiction where the government increases pensions with one hand but reduces their real value through frozen tax thresholds.

Some key observations from experts:

- Fiscal drag is an indirect method of increasing tax revenue without public debate

- Pensioners are being taxed on what they believe is a basic entitlement

- The policy could lead to growing financial pressure and confusion for pensioners

Could The Triple Lock Policy Be Reformed In The Future?

The triple lock is widely supported by pensioner groups and political parties, but its financial sustainability remains under scrutiny. In the 2023–24 fiscal year, the state pension cost the UK government £125 billion, a figure that continues to rise due to demographic changes.

There is a growing argument for reform, with calls to:

- Reassess how tax-free thresholds are calculated

- Ensure fairness between older and newer pensioners

- Simplify pension uprating rules to avoid confusion

Steve Webb has emphasised the need for a review of the tax-free personal allowance, particularly for pensioners. He argued that if the state pension is the minimum income needed to live on, it is contradictory to tax it.

Possible directions for reform include:

- Indexing the personal allowance to the state pension to avoid automatic taxation

- Extending triple lock protections to all state pension components

- Introducing a simplified flat-rate pension system for all pensioners, regardless of retirement date

Below is a look at how pension taxation could evolve if current policies continue:

| Year | Projected Full New State Pension | Personal Allowance | Income Tax Liability |

| 2024–25 | £12,572 | £12,570 | £2 taxable |

| 2025–26 | £13,075 (projected 4% rise) | £12,570 | £505 taxable |

| 2027–28 | £13,598 (projected) | £12,570 | £1,028 taxable |

As these figures show, even pensioners with no additional income could see hundreds of pounds of their state pension subjected to tax over the next few years unless policy changes are made.

How Can Pensioners Check Their Eligibility And Protect Their Income?

Understanding your pension rights and income structure is key to avoiding surprises. The Department for Work and Pensions (DWP) offers online tools and support for pensioners to check and manage their entitlements.

Pensioners should:

- Use the state pension forecast tool on the gov.uk website

- Check National Insurance contributions to ensure eligibility

- Explore whether they qualify for Pension Credit, which offers extra income support

For those at risk of crossing the tax threshold, it may be helpful to:

- Review other sources of income, including private pensions

- Speak with a financial adviser about tax planning

- Ensure all available tax reliefs or allowances are claimed

Pensioners facing financial hardship should also explore local authority support schemes, such as:

- Council Tax Reduction

- Housing Benefit

- Cold Weather and Winter Fuel Payments

Access to accurate and timely information is essential to navigating the increasingly complex pension and tax environment facing the UK’s retired population.

Conclusion

The triple lock was introduced to protect pensioners from financial decline, but it has now become a controversial policy, especially given the uneven application across different types of pensions.

Millions of pensioners will see only a partial uplift to their income this year, due to outdated distinctions in the pension system.

At the same time, increasing numbers are being dragged into taxation due to frozen thresholds, a process that many view as unfair and misleading.

If the triple lock is to remain a cornerstone of pension policy, it must be accompanied by a more transparent and equitable taxation system, as well as a reassessment of eligibility and pension structure fairness. Only then can trust in the system be restored.

Frequently Asked Questions (FAQs)

What is the difference between the old and new state pension schemes?

The old state pension includes a basic amount plus additional earnings-based components such as SERPS, while the new scheme is a flat-rate payment introduced in 2016 for people reaching pension age after that date.

Why doesn’t SERPS qualify for the triple lock?

SERPS and similar earnings-related pensions are only increased in line with inflation, unlike the basic state pension which benefits from the triple lock mechanism.

How does the frozen personal allowance affect pensioners?

With the personal allowance fixed at £12,570, increases in the state pension can push income above the threshold, resulting in unexpected income tax liabilities for some pensioners.

Is there a risk the triple lock will be removed in future?

While the triple lock remains government policy, its long-term future is uncertain due to rising costs and growing political debate about its fairness and affordability.

Can pensioners get advice about their state pension?

Yes, the DWP offers online tools and telephone support. Independent organisations like Citizens Advice also offer free assistance to help pensioners understand their entitlements.

How can pensioners avoid unexpected tax bills?

By monitoring total income (including state and private pensions), claiming all available allowances, and consulting a financial advisor, pensioners can manage their tax obligations more effectively.

Are there benefits available for pensioners on low incomes?

Yes. Pension Credit, Housing Benefit, and the Winter Fuel Payment are available to qualifying pensioners. These can help offset some of the rising living costs and tax burdens.