As part of a broader plan to ease the financial burden on vulnerable pensioners, the UK government has announced a new £2,300 pension bonus in 2025.

This one-off, tax-free payment aims to support retirees affected by rising living costs, particularly those who claimed their State Pension early or receive disability-related benefits.

Unlike traditional annual increases, this bonus is separate from the State Pension and is intended to provide immediate relief to eligible groups.

What Is the £2,300 Pension Bonus 2025 and Why Was It Introduced?

The UK Government has introduced a new pension initiative in 2025 that provides a one-time, tax-free payment of £2,300 to eligible pensioners.

The bonus is separate from the regular State Pension increases and is intended as direct financial relief for retirees who are particularly affected by the rising cost of living.

Unlike the triple lock mechanism, which adjusts pensions annually, this bonus offers immediate support. It has been introduced to offset growing costs in essential areas such as:

- Energy and utility bills

- Medical and healthcare services

- Housing and assisted living expenses

The initiative is part of a broader effort to ensure vulnerable pensioners are not left behind during ongoing economic challenges.

Who Is Eligible for the UK Pension Bonus in 2025?

Eligibility criteria for the pension bonus have been structured to target pensioners most at risk of financial hardship. The main qualifying groups include:

- Individuals who claimed their State Pension early (before reaching the full retirement age of 66)

- Recipients of disability or income-based benefits administered by the Department for Work and Pensions (DWP), such as:

- Pension Credit

- Attendance Allowance

- Disability Living Allowance (DLA)

Additionally, those facing unusually high living costs, particularly in relation to healthcare or housing, may also qualify. For example, pensioners who require ongoing in-home care or who reside in high-cost care homes fall into this category.

Who Is Not Eligible for the 2025 Pension Bonus?

While many retirees stand to benefit from the pension bonus, certain groups are excluded. These include:

- Individuals who have deferred their State Pension to receive higher payments later

- Pensioners with substantial private retirement income or savings who do not receive means-tested benefits

- People who have not yet started claiming their State Pension by the qualifying dates in early 2025

The rationale for these exclusions is to prioritise pensioners who rely solely on State support or have limited financial resources.

How and When Will the £2,300 Bonus Be Paid?

The payment process for the pension bonus is fully automated. Eligible pensioners do not need to apply. Instead, the Department for Work and Pensions will deposit the funds directly into the same account used for regular pension or benefit payments.

Payments will be made between April and June 2025. The bonus will appear on bank statements with the reference “DWP BONUS.”

To ensure receipt of the payment, pensioners are advised to:

- Confirm their eligibility based on current benefit entitlements

- Update their contact and banking information with DWP if necessary

- Monitor their bank statements between April and June

Here is a breakdown of how the bonus will be processed:

| Payment Detail | Information |

| Amount | £2,300 |

| Tax Status | Non-taxable |

| Delivery Method | Direct bank transfer |

| Timeline | April to June 2025 |

| Application Required | No |

| Bank Statement Reference | “DWP BONUS” |

| Affects Other Benefits | No impact |

What Does the £2,300 Pension Bonus Cover?

Though the bonus does not come with spending restrictions, the government has structured it to help offset key expenses faced by lower-income pensioners. These include:

- Heating and energy bills, especially during colder months

- Long-term medical treatments and prescription costs

- Housing-related expenses such as rent, maintenance, and assisted living

- Day-to-day essentials including groceries and transport

This flexibility allows pensioners to use the bonus where it’s needed most.

How Does This Bonus Fit into the UK Government’s Pension Strategy?

The £2,300 pension bonus introduced in 2025 is not a standalone measure. It is part of a wider strategy by the UK Government aimed at strengthening the country’s retirement and social support systems.

This initiative complements long-term policy mechanisms already in place, such as the triple lock and regional benefit enhancements, particularly in Scotland.

Triple Lock as the Foundation of Pension Growth

The triple lock system has been a cornerstone of pension policy in the UK since 2010. It ensures that the State Pension increases every year by the highest of:

- Inflation (Consumer Price Index)

- Average wage growth

- A minimum of 2.5%

In 2025, this formula resulted in a 4.1% increase, pushing the New State Pension to £230.30 per week, or approximately £12,016.75 annually.

While this annual adjustment maintains the purchasing power of pensioners over time, it may not be responsive enough to sharp or sudden cost increases. This is where the one-off bonus serves a critical purpose by providing immediate financial relief.

Addressing Inflation and Cost-of-Living Gaps

Despite the triple lock, many pensioners face shortfalls due to rapidly rising living costs. Essentials such as energy bills, food, transport, and healthcare have seen price surges in recent years.

The £2,300 bonus is designed to temporarily bridge that gap by delivering a large, untaxed sum without requiring a change in pension eligibility or benefit structure.

It particularly benefits those who:

- Are on fixed incomes with little or no private pension support

- Require long-term care or in-home assistance

- Face high housing or health-related expenses

This approach recognises that while the triple lock provides a general uplift, targeted support is still necessary to address acute financial pressures.

Pension Credit and Income-Based Support Expansion

Alongside the bonus, the Government is making changes to Pension Credit eligibility and entitlements in 2025.

These updates are intended to draw more pensioners into the support system, especially those who may not currently receive any income-based assistance but are just above the existing threshold.

Changes under review include:

- Raising the income limits for eligibility

- Adjusting the savings threshold

- Increasing awareness and simplifying the application process

The £2,300 bonus does not replace Pension Credit, but it aligns with this direction by ensuring low-income pensioners receive additional help automatically.

Regional Enhancements Through Scottish Benefits

In Scotland, the devolved government is implementing enhanced pension and disability-related support schemes. These initiatives include:

- Adult Disability Payment (ADP), replacing the UK-wide Personal Independence Payment

- Winter Heating Payment, tailored to Scotland’s climate and cost-of-living conditions

- Additional care grants for pensioners requiring ongoing assistance

These Scottish policies work in tandem with UK-wide support, reinforcing the importance of flexible and regionalised assistance. The £2,300 pension bonus fits within this wider framework by acknowledging that different segments of the population may need varied forms of relief.

A Shift Toward Targeted One-Off Payments

The introduction of the pension bonus marks a potential shift in how government support is delivered. Instead of relying solely on incremental annual increases, there is a growing emphasis on:

- Targeted relief for specific vulnerable groups

- One-off, high-value payments during economic stress

- Reducing bureaucracy by automating support through existing benefit systems

This model could become more common in future policy decisions, especially if inflationary pressures persist or economic instability continues.

By issuing support through existing systems without requiring applications, the Government ensures higher uptake and quicker distribution.

Positioning for Long-Term Reform

While the £2,300 bonus is a short-term solution, it signals the Government’s recognition that broader reforms may be necessary to keep pensioners financially secure in the future. This includes:

- Reevaluating the triple lock formula under extreme inflation

- Enhancing digital access to pension information and support

- Reviewing the balance between public and private retirement funding

In this context, the 2025 bonus is both a reactive and proactive tool—addressing immediate needs while providing a potential blueprint for future interventions.

What Are the Latest Updates on UK State Pension for 2025?

In addition to the bonus, several broader updates are being implemented for UK pensioners in 2025:

- Triple Lock Increase: The 4.1% rise in the New State Pension means eligible pensioners will receive £230.30 per week. Over the year, this amounts to just over £12,000.

- Basic State Pension Increase: Those who qualified before April 2016 will also see their payments increase, although to a slightly lower weekly rate.

- Expansion of Pension Credit: New thresholds are being introduced to allow more pensioners to qualify for this income supplement.

- Support in Scotland: New disability and care-related benefits are being administered by Social Security Scotland, tailored to local needs.

These changes aim to improve the financial resilience of pensioners in the face of increasing living expenses.

What Steps Should Pensioners Take to Ensure They Receive the Bonus?

Even though no application is necessary, pensioners should be proactive in making sure their information with DWP is current and accurate.

A few simple steps can help ensure payment is received without delay:

- Review current benefit entitlements to determine if you fall into a qualifying group

- Contact DWP to update banking and personal details if anything has changed recently

- Check bank accounts regularly between April and June 2025

- Retain any correspondence from DWP for reference

Staying informed and taking action where needed ensures the payment process runs smoothly.

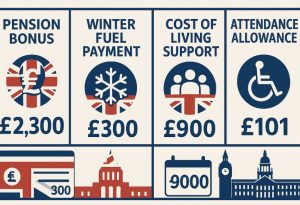

How Does the £2,300 Bonus Compare to Other Government Support?

When compared to other existing government support schemes, the £2,300 pension bonus stands out in both scale and simplicity. While several benefit programmes are already in place to help pensioners, many of them are means-tested, seasonal, or only apply to very specific circumstances.

Here’s a closer look at how the bonus compares with key support options currently available to retirees in the UK:

| Support Scheme | Amount | Frequency | Eligibility | Application Needed |

| £2,300 Pension Bonus | £2,300 | One-time | Early pensioners, benefit recipients | No |

| Winter Fuel Payment | £100–£300 | Annual | Aged 66+ | Usually automatic |

| Cost of Living Payments | Up to £900 | Phased | Low-income or benefit claimants | No (if eligible) |

| Attendance Allowance | £68.10–£101.75 | Weekly | Pensioners with care needs | Yes |

| Pension Credit | Varies | Monthly | Low-income pensioners | Yes |

The £2,300 bonus offers a unique combination of features:

- Size: It is one of the highest-value single payments offered to pensioners in recent years.

- Automatic Delivery: Unlike Attendance Allowance or Pension Credit, which require applications and sometimes face delays, the bonus is distributed automatically to eligible recipients.

- No Taxation: Many pensioners worry that extra support might increase their tax burden or affect means-tested benefits. This bonus is explicitly tax-free and does not count against any existing entitlements.

- Broad Targeting Within Vulnerable Groups: The scheme encompasses a wide spectrum of pensioners facing hardship, especially those on disability-related benefits or with high medical or housing costs.

Another important aspect is the psychological and financial assurance that comes with such payments. While benefits like the Winter Fuel Payment are seasonal and often calculated based on past needs, the pension bonus provides flexibility and autonomy.

Pensioners can use it based on their current needs, whether for health expenses, home repairs, outstanding debts, or simply to afford better quality food and services.

In terms of government planning, this bonus sets a precedent for future emergency financial responses, showing that pension policy can be responsive and targeted without being overly complex or exclusionary.

Conclusion

While the uk pension bonus 2025 is a welcome relief for many retirees, it is unlikely to be a complete solution for ongoing financial challenges.

The one-time nature of the payment means that long-term reforms will still be necessary, particularly for low-income pensioners without private retirement savings.

However, as part of a broader strategy that includes triple lock increases and enhanced benefits, the £2,300 bonus provides timely financial support when it is most needed.

It reaffirms the government’s recognition of pensioners’ financial struggles and serves as a critical step toward greater pensioner security in the UK.

FAQs

What is the difference between the pension bonus and the triple lock increase?

The pension bonus is a one-time, tax-free payment, while the triple lock increase is an annual adjustment to the State Pension based on inflation, wages, or a minimum of 2.5%.

Will receiving the bonus affect my Housing Benefit or Pension Credit?

No, the £2,300 bonus will not affect your eligibility for Housing Benefit, Pension Credit, or any other income-based benefits.

How can I check if I’m eligible for the pension bonus?

Eligibility depends on whether you claimed your pension early or receive certain DWP benefits like Attendance Allowance or Pension Credit. No application is required.

Can someone who lives in a care home receive the pension bonus?

Yes, provided they meet the eligibility criteria such as receiving qualifying benefits or being early pension claimants.

Will the bonus be taxed or reported on my self-assessment?

No, the bonus is completely tax-free and does not need to be reported for tax purposes.

What should I do if I haven’t received the bonus by the end of June?

Contact the Department for Work and Pensions directly to confirm your details and eligibility.

Is there a possibility of another pension bonus in the future?

While there’s no confirmed plan for future bonuses, similar measures could be introduced based on economic conditions and government budgets.