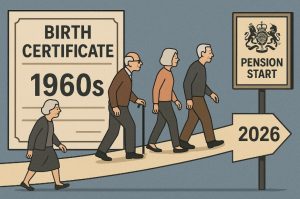

With major reforms ahead, the UK State Pension age is set to rise from 66 to 67 between 2026 and 2028. This scheduled increase will affect millions approaching retirement, particularly those born in the early 1960s.

As part of long-term pension sustainability measures under the Pensions Act 2014, understanding these changes is essential for effective retirement planning.

This article outlines the key dates, timelines, and what individuals need to know to stay prepared and avoid missed opportunities.

What Is the 2026 UK State Pension Age Increase and Why Is It Happening?

The State Pension age (SPA) in the United Kingdom is undergoing a scheduled increase from 66 to 67 between 2026 and 2028. This change affects people born on or after 6 April 1960.

The policy reflects the government’s response to growing financial pressures caused by longer life expectancies and an ageing population.

Raising the SPA is a strategic measure designed to keep the pension system sustainable and equitable. It ensures that the working-age population can continue to support those in retirement without placing an excessive burden on public funds.

The government uses a framework of reviews, legislation, and demographic data to inform the timing and scale of these increases.

How Has the State Pension Age Changed Over the Years?

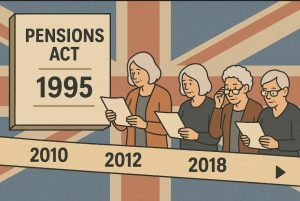

Since its introduction, the UK State Pension age has evolved significantly. Originally, women were eligible to claim their pension at 60 and men at 65. Reforms implemented in various Pensions Acts have gradually equalised and then increased these ages.

The Pensions Act 1995 laid the foundation for bringing women’s pension age in line with men’s, raising it from 60 to 65. The Pensions Act 2011 accelerated this transition and included a phased rise for both men and women to 66. The increase from 66 to 67, which begins in 2026, was legislated under the Pensions Act 2014.

These changes have been introduced in response to the need for a more sustainable pension model. Rising life expectancy has meant that people are spending longer in retirement, which places increasing pressure on public finances.

What Does the Pensions Act 2014 Say About Future Increases?

The Pensions Act 2014 sets out the legal structure for managing future changes to the State Pension age. One of the main features of this act is the requirement for the government to review the SPA every five years. These reviews take into account various factors, including:

- Average life expectancy across the population

- Labour market conditions

- The ratio of working-age people to retirees

- Financial sustainability of the State Pension system

A key principle guiding these reviews is that individuals should spend no more than a third of their adult life in retirement. Based on this calculation, the SPA may be adjusted over time to ensure it reflects the demographic realities facing the country.

The act also confirmed that the increase from 66 to 67 would take place between 2026 and 2028. It is expected that the rise from 67 to 68 could occur earlier than originally scheduled, possibly as early as the mid-2030s.

When Will People Born Between 1960 and 1961 Reach Pension Age?

Individuals born between April 1960 and March 1961 will be the first to experience the changes implemented in 2026. Rather than receiving their State Pension at a fixed age of 66, these individuals will qualify at staggered intervals based on their birth month.

This gradual shift aims to ensure a smooth transition and spread the financial impact over a broader population base. The approach provides people with adequate time to prepare for retirement and adjust their financial plans accordingly.

Here is a detailed breakdown of the new pension ages for this group:

| Date of Birth | State Pension Age |

| 6 April 1960 – 5 May 1960 | 66 years and 1 month |

| 6 May 1960 – 5 June 1960 | 66 years and 2 months |

| 6 June 1960 – 5 July 1960 | 66 years and 3 months |

| 6 July 1960 – 5 August 1960 | 66 years and 4 months |

| 6 August 1960 – 5 September 1960 | 66 years and 5 months |

| 6 September 1960 – 5 October 1960 | 66 years and 6 months |

| 6 October 1960 – 5 November 1960 | 66 years and 7 months |

| 6 November 1960 – 5 December 1960 | 66 years and 8 months |

| 6 December 1960 – 5 January 1961 | 66 years and 9 months |

| 6 January 1961 – 5 February 1961 | 66 years and 10 months |

| 6 February 1961 – 5 March 1961 | 66 years and 11 months |

| 6 March 1961 – 5 April 1977 | 67 years |

This format continues until the SPA reaches 67 for all individuals born after 5 March 1961.

What Is the Latest Timetable for the State Pension Age Changes?

The State Pension age in the UK has undergone a series of changes over the years, influenced by a combination of legislative reforms, demographic shifts, and fiscal sustainability needs. These increases have been introduced in phases under various Acts of Parliament to ensure a smooth transition and fairness across different age groups.

Women’s State Pension Age under the Pensions Act 1995

The Pensions Act 1995 introduced the first major change by gradually increasing women’s State Pension age from 60 to 65 between 2010 and 2020. This schedule was based on specific birth dates and aimed to bring parity between men and women in pension eligibility.

Women’s State Pension age under the Pensions Act 1995:

| Date of Birth | Date State Pension Age Reached |

| 6 April 1950 – 5 May 1950 | 6 May 2010 |

| 6 May 1950 – 5 June 1950 | 6 July 2010 |

| 6 June 1950 – 5 July 1950 | 6 September 2010 |

| 6 July 1950 – 5 August 1950 | 6 November 2010 |

| 6 August 1950 – 5 September 1950 | 6 January 2011 |

| 6 September 1950 – 5 October 1950 | 6 March 2011 |

| 6 October 1950 – 5 November 1950 | 6 May 2011 |

| 6 November 1950 – 5 December 1950 | 6 July 2011 |

| 6 December 1950 – 5 January 1951 | 6 September 2011 |

| 6 January 1951 – 5 February 1951 | 6 November 2011 |

| 6 February 1951 – 5 March 1951 | 6 January 2012 |

| 6 March 1951 – 5 April 1951 | 6 March 2012 |

| 6 April 1951 – 5 May 1951 | 6 May 2012 |

| 6 May 1951 – 5 June 1951 | 6 July 2012 |

| 6 June 1951 – 5 July 1951 | 6 September 2012 |

| 6 July 1951 – 5 August 1951 | 6 November 2012 |

| 6 August 1951 – 5 September 1951 | 6 January 2013 |

| 6 September 1951 – 5 October 1951 | 6 March 2013 |

| 6 October 1951 – 5 November 1951 | 6 May 2013 |

| 6 November 1951 – 5 December 1951 | 6 July 2013 |

| 6 December 1951 – 5 January 1952 | 6 September 2013 |

| 6 January 1952 – 5 February 1952 | 6 November 2013 |

| 6 February 1952 – 5 March 1952 | 6 January 2014 |

| 6 March 1952 – 5 April 1952 | 6 March 2014 |

| 6 April 1952 – 5 May 1952 | 6 May 2014 |

| 6 May 1952 – 5 June 1952 | 6 July 2014 |

| 6 June 1952 – 5 July 1952 | 6 September 2014 |

| 6 July 1952 – 5 August 1952 | 6 November 2014 |

| 6 August 1952 – 5 September 1952 | 6 January 2015 |

| 6 September 1952 – 5 October 1952 | 6 March 2015 |

| 6 October 1952 – 5 November 1952 | 6 May 2015 |

| 6 November 1952 – 5 December 1952 | 6 July 2015 |

| 6 December 1952 – 5 January 1953 | 6 September 2015 |

| 6 January 1953 – 5 February 1953 | 6 November 2015 |

| 6 February 1953 – 5 March 1953 | 6 January 2016 |

| 6 March 1953 – 5 April 1953 | 6 March 2016 |

Changes under the Pensions Act 2011

The Pensions Act 2011 accelerated the changes to the State Pension age. It brought forward the date by which women’s pension age would reach 65 and extended the increase to 66 for both men and women. This phase was implemented between 2016 and 2018.

Women’s State Pension age under the Pensions Act 2011:

| Date of Birth | Date State Pension Age Reached |

| 6 April 1953 – 5 May 1953 | 6 July 2016 |

| 6 May 1953 – 5 June 1953 | 6 November 2016 |

| 6 June 1953 – 5 July 1953 | 6 March 2017 |

| 6 July 1953 – 5 August 1953 | 6 July 2017 |

| 6 August 1953 – 5 September 1953 | 6 November 2017 |

| 6 September 1953 – 5 October 1953 | 6 March 2018 |

| 6 October 1953 – 5 November 1953 | 6 July 2018 |

| 6 November 1953 – 5 December 1953 | 6 November 2018 |

Increase from 65 to 66 under the Pensions Act Timetable

From December 2018 to October 2020, the State Pension age increased from 65 to 66. This applied to both men and women, and eligibility was determined by exact birth dates.

Increase in State Pension age from 65 to 66, men and women:

| Date of Birth | Date State Pension Age Reached |

| 6 December 1953 – 5 January 1954 | 6 March 2019 |

| 6 January 1954 – 5 February 1954 | 6 May 2019 |

| 6 February 1954 – 5 March 1954 | 6 July 2019 |

| 6 March 1954 – 5 April 1954 | 6 September 2019 |

| 6 April 1954 – 5 May 1954 | 6 November 2019 |

| 6 May 1954 – 5 June 1954 | 6 January 2020 |

| 6 June 1954 – 5 July 1954 | 6 March 2020 |

| 6 July 1954 – 5 August 1954 | 6 May 2020 |

| 6 August 1954 – 5 September 1954 | 6 July 2020 |

| 6 September 1954 – 5 October 1954 | 6 September 2020 |

| 6 October 1954 – 5 April 1960 | 66th birthday |

Increase from 66 to 67 under the Pensions Act 2014

The Pensions Act 2014 brought forward the increase in the SPA to 67 by eight years. This means the change will now occur between 2026 and 2028. The SPA will no longer change on a single date but will vary depending on the month of birth.

Increase in State Pension age from 66 to 67, men and women:

| Date of Birth | State Pension Age |

| 6 April 1960 – 5 May 1960 | 66 years and 1 month |

| 6 May 1960 – 5 June 1960 | 66 years and 2 months |

| 6 June 1960 – 5 July 1960 | 66 years and 3 months |

| 6 July 1960 – 5 August 1960 | 66 years and 4 months |

| 6 August 1960 – 5 September 1960 | 66 years and 5 months |

| 6 September 1960 – 5 October 1960 | 66 years and 6 months |

| 6 October 1960 – 5 November 1960 | 66 years and 7 months |

| 6 November 1960 – 5 December 1960 | 66 years and 8 months |

| 6 December 1960 – 5 January 1961 | 66 years and 9 months |

| 6 January 1961 – 5 February 1961 | 66 years and 10 months |

| 6 February 1961 – 5 March 1961 | 66 years and 11 months |

| 6 March 1961 – 5 April 1977 | 67 years |

Note: People born after 5 April 1969 but before 6 April 1977 were already set to retire at 67 under the Pensions Act 2007.

Increase from 67 to 68 under the Pensions Act 2007

The final scheduled increase under current legislation is from 67 to 68. According to the Pensions Act 2007, this transition will occur between 2044 and 2046 unless brought forward by future reviews.

Increase in State Pension age from 67 to 68, men and women:

| Date of Birth | Date State Pension Age Reached |

| 6 April 1977 – 5 May 1977 | 6 May 2044 |

| 6 May 1977 – 5 June 1977 | 6 July 2044 |

| 6 June 1977 – 5 July 1977 | 6 September 2044 |

| 6 July 1977 – 5 August 1977 | 6 November 2044 |

| 6 August 1977 – 5 September 1977 | 6 January 2045 |

| 6 September 1977 – 5 October 1977 | 6 March 2045 |

| 6 October 1977 – 5 November 1977 | 6 May 2045 |

| 6 November 1977 – 5 December 1977 | 6 July 2045 |

| 6 December 1977 – 5 January 1978 | 6 September 2045 |

| 6 January 1978 – 5 February 1978 | 6 November 2045 |

| 6 February 1978 – 5 March 1978 | 6 January 2046 |

| 6 March 1978 – 5 April 1978 | 6 March 2046 |

| 6 April 1978 onwards | 68th birthday |

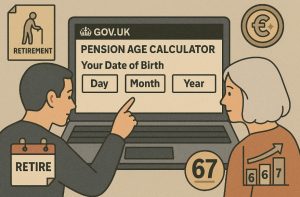

How Can You Use the State Pension Age Calculator?

The UK government provides an official online State Pension age calculator through the Gov.uk website. This tool allows individuals to input their date of birth and gender to receive an accurate SPA according to current legislation.

It’s especially useful for those born in periods of transition, such as the 1960–1961 cohort.

The calculator provides:

- Your exact pension age

- The date you can claim your pension

- Eligibility guidance based on updated legislation

This resource is essential for retirement planning, particularly for those unsure about the effects of the 2026 changes.

What Are the Key Deadlines and Birth Dates to Know in 2026?

Knowing the exact timing of the SPA increase helps individuals make better financial and lifestyle decisions. The shift in 2026 will not affect everyone at once but will be rolled out month by month.

Important birth date milestones include:

- Individuals born in April 1960 will reach SPA in May 2026

- Those born in July 1960 will qualify in November 2026

- People born in December 1960 will receive their pension in September 2027

Each month during this period represents a gradual adjustment in the SPA. Those planning for retirement during these years should consider:

- When they can start receiving State Pension

- The impact of the delay on their private or workplace pension plans

- Whether to adjust savings strategies or consider part-time work

How Will the Pension Age Increase Affect Retirement Planning?

The rise in State Pension age has far-reaching implications. For individuals approaching retirement, the delay in accessing their State Pension may necessitate changes in financial planning. Some may have to extend their working lives or draw down on private savings earlier than expected.

The following should be considered:

- Review your pension forecast and National Insurance contributions

- Check eligibility for other retirement benefits or tax reliefs

- Consult with a financial adviser if you’re unsure about income sufficiency

- Consider flexible retirement options, including part-time work

While the government offers a safety net through the State Pension, individuals increasingly bear the responsibility for ensuring financial readiness for retirement. This includes understanding when they can access funds and whether those funds will be enough to cover living costs.Conclusion

Conclusion

The UK State Pension age increase in 2026 marks a significant milestone in pension reform. With changes affecting those born from April 1960 onward, it’s vital to stay informed about your exact retirement age and plan accordingly.

As future reviews may bring further adjustments, using tools like the State Pension calculator and seeking financial advice can help ensure a secure retirement.

Understanding these changes today can make a meaningful difference in tomorrow’s financial stability and retirement readiness.

FAQs About the UK State Pension Age Increase

What year will the UK State Pension age rise to 67?

The UK State Pension age will rise to 67 between 2026 and 2028, starting with people born in April 1960.

Can I still retire at 66 in 2026?

Only those born before 6 April 1960 can retire at 66 in 2026. Others will face an increased SPA, depending on their birth month.

Will the State Pension age rise again after 2028?

Yes, there is a proposed increase to 68 between 2044 and 2046, although this may be brought forward pending review.

How do I find out my exact State Pension age?

You can use the State Pension age calculator on the Gov.uk website to find your SPA based on your date of birth and gender.

Is the increase in State Pension age automatic?

Yes, it is legislated and phased based on Acts of Parliament, which means the change happens automatically unless future legislation reverses it.

How will the increase affect people born in the 1960s?

People born between April 1960 and March 1961 will reach SPA at 66 years and 1 to 11 months instead of a fixed 66.

What can I do if I can’t work until my new SPA?

Options include applying for early retirement (with private pensions), seeking disability or welfare benefits, or part-time work to bridge the gap.

Related Articles: