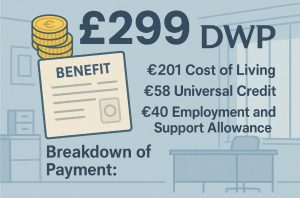

The DWP £299 Cost of Living Payment was part of the UK Government’s continued support for low-income households facing financial pressure.

As the final instalment in a series of targeted payments, it aimed to help eligible individuals manage essential expenses during challenging economic conditions.

This guide outlines who received the payment, the qualifying benefits, and the timeline of distribution, ensuring claimants understand their entitlements and how the DWP and HMRC administered these one-off financial support measures.

What Is the DWP £299 Cost of Living Payment?

The Department for Work and Pensions (DWP) introduced the £299 cost of living payment in early 2024. This was the third and final instalment of the 2023–2024 cost of living support package. It followed earlier payments of £301 and £300.

The £299 was paid automatically to eligible individuals who were receiving certain means-tested benefits or tax credits during a specified qualifying period.

The payment was designed to provide extra financial assistance in response to the ongoing impact of inflation, energy costs and general living expenses.

The £299 was not a recurring or ongoing payment. It was a one-off tax-free support measure that had no impact on benefit entitlements or future payments.

Who Was Eligible for the £299 Cost of Living Payment?

Eligibility for the £299 DWP cost of living payment was based on benefit status during the qualifying period.

To qualify, an individual had to be in receipt of one of the following benefits on any day between 13 November and 12 December 2023:

- Universal Credit

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Income Support

- Pension Credit

- Child Tax Credit

- Working Tax Credit

Those who were receiving contributory-based benefits, such as New Style ESA or New Style JSA, were not eligible unless they also received a qualifying low income benefit.

In cases of joint claims, such as for couples on Universal Credit, only one £299 payment was issued per eligible claim, not per person.

Some individuals were excluded due to a nil award status, where their benefit was reduced to £0 for the relevant period. This could occur due to an increase in income, a sanction, or savings above the allowable threshold.

When Was the £299 Payment Made by the DWP?

The Department for Work and Pensions issued the £299 payment between 6 February and 22 February 2024.

This applied to the majority of claimants who qualified through benefits like Universal Credit, Income Support, JSA, ESA or Pension Credit.

The exact date depended on the type of benefit and the specific timing of each claimant’s benefit assessment period.

Universal Credit recipients needed to have had an assessment period that ended between 13 November and 12 December 2023.

For claimants receiving only tax credits and not other DWP-administered benefits, the payment was made by HM Revenue & Customs (HMRC) slightly later, between 16 February and 22 February 2024.

How Was the £299 Payment Delivered to Eligible Claimants?

The payment was deposited automatically into the same bank account used for the recipient’s usual benefit or tax credit payments.

It required no application, and eligibility was assessed based on existing records held by DWP or HMRC.

Key features of the payment process included:

- Separate from regular benefit payments

- Displayed as “DWP COL” or “HMRC COLS” on bank statements

- Sent to one person per eligible claim in joint benefit claims

Claimants who had changed their bank details or had benefits awarded retrospectively could receive the payment at a later date. Payments were processed automatically once eligibility was confirmed.

Why Did Some People Not Receive the £299 Cost of Living Payment?

A number of scenarios may explain why some individuals did not receive the £299 cost of living payment, even if they believed they qualified.

Common reasons included:

- A nil award status due to income changes or sanctions

- Receiving only non-qualifying benefits such as New Style ESA

- Tax credit entitlement below £26 for the year

- Not being in receipt of the qualifying benefit during the eligibility window

- Administrative issues such as incorrect or outdated bank details

It was also common for those whose benefits were under review or granted after the qualifying period to receive delayed payments. In some cases, the payment was made weeks later once the status was updated.

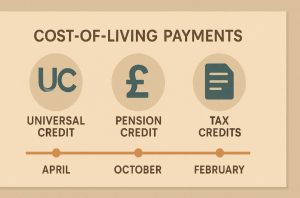

What Benefits Qualified for the £299 Payment and What Were the Timelines?

The eligibility and payment dates were clearly outlined by the DWP and HMRC across three benefit groups:

Universal Credit, income-based benefits, and tax credits. The following table shows a breakdown of the qualifying periods and payment windows.

Universal Credit Eligibility and Payment Dates

| Payment Amount | Assessment Period Ended | Payment Dates |

| £299 | 13 November – 12 December 2023 | 6 February – 22 February 2024 |

| £300 | 18 August – 17 September 2023 | 31 October – 19 November 2023 |

| £301 | 26 January – 25 February 2023 | 25 April – 17 May 2023 |

Universal Credit claimants had to be eligible for a payment in an assessment period that ended within the qualifying window to receive the relevant cost of living payment.

Income-Based Benefits and Tax Credits Eligibility

| Payment Amount | Benefit Eligibility Period | Payment Dates | Administered By |

| £299 | 13 November – 12 December 2023 | 6 – 22 February 2024 (DWP) | DWP / HMRC |

| £299 | 13 November – 12 December 2023 | 16 – 22 February 2024 (HMRC) | HMRC |

| £300 | 18 August – 17 September 2023 | 31 October – 19 November 2023 | DWP / HMRC |

| £301 | 26 January – 25 February 2023 | April – May 2023 | DWP / HMRC |

This structure was applied consistently across all qualifying payments, with different dates for DWP and HMRC depending on the recipient’s benefit source.

How Did Joint Claims and Overlapping Benefits Affect Eligibility?

For claimants receiving both tax credits and a qualifying low income benefit, the payment was usually made by DWP. Individuals could not receive multiple cost of living payments for the same period from both HMRC and DWP.

In joint claims, the payment was made once per eligible claim. For example, a couple claiming Universal Credit jointly received only one payment of £299, not two.

If both partners received qualifying benefits, the system defaulted to the primary benefit through which they were paid during the eligibility window.

What Other Cost of Living Payments Were Made in 2023–2024?

The £299 payment was part of a broader cost of living support package issued by the UK government across the 2023–2024 financial year.

This package was introduced to help households manage rising living costs, especially those caused by inflation, increased energy bills, and essential expenses.

The support was rolled out in phases, targeting different types of benefit claimants and groups with specific vulnerabilities.

The complete series of cost of living payments included three main instalments for those on low-income benefits or tax credits, as well as additional payments for people with disabilities and pensioners.

Main Cost of Living Payments for Low Income Households

Households on qualifying benefits received three separate one-off payments over the course of the year:

- £301 Payment (Spring 2023): Issued between 25 April and 17 May 2023 by the DWP for most eligible claimants. HMRC issued payments separately for those on tax credits. This was the first of the three-part support.

- £300 Payment (Autumn 2023): Paid between 31 October and 19 November 2023. To qualify, the claimant had to have received a qualifying benefit during the period 18 August to 17 September 2023.

- £299 Payment (Winter 2024): The final instalment, paid between 6 February and 22 February 2024 for most. The eligibility period was 13 November to 12 December 2023.

These payments were provided automatically, requiring no application process. They were tax-free and did not count towards income for benefit assessments.

Disability Cost of Living Payments

In addition to the main payments, the government also issued two separate £150 payments for individuals in receipt of qualifying disability benefits.

These were designed to assist with the additional living costs that disabled individuals often face, such as increased energy use and specialised care needs.

Eligible benefits included:

- Personal Independence Payment (PIP)

- Disability Living Allowance (DLA) for adults and children

- Attendance Allowance

- Armed Forces Independence Payment

- Constant Attendance Allowance

- Adult and Child Disability Payments in Scotland

The two payments were made as follows:

- First £150 payment: Between 20 September and early October 2022, based on eligibility as of 25 May 2022

- Second £150 payment: Between 20 June and 4 July 2023, based on eligibility as of 1 April 2023

These payments were made separately from other benefits and did not require a claim.

Pensioner Cost of Living Payments

Pensioner households eligible for the Winter Fuel Payment also received an additional Pensioner Cost of Living Payment, paid alongside their winter heating support.

The extra amount depended on the individual’s age and circumstances:

- £150 for most pensioners

- £300 for those meeting specific age or household criteria

The payments were made automatically in November and December, depending on when the Winter Fuel Payment was processed. The eligibility was based on age and receipt of the Winter Fuel Payment for the 2022–2023 or 2023–2024 winter seasons.

These payments were intended to help older people, many of whom are on fixed incomes, cope with heating costs and other seasonal expenses.

Summary of Support Issued in 2023–2024

The following overview captures the scope of the government’s cost of living support strategy during the 2023–2024 period:

- £301 + £300 + £299 for those on Universal Credit, Income Support, Pension Credit, and other low-income benefits

- £150 (x2) for people on qualifying disability benefits

- £150 or £300 Pensioner Cost of Living Payment with Winter Fuel Payment

These payments were non-repayable, non-taxable, and separate from standard benefits. They aimed to provide targeted financial assistance to groups most affected by cost pressures during the financial year.

Were There Conditions That Made Someone Ineligible Despite Being on Benefits?

Yes. Even individuals on qualifying benefits could be ruled ineligible if they experienced a “nil award” during the assessment period. This commonly occurred when:

- Their earnings exceeded the threshold

- They received multiple wage payments during one assessment period

- They were sanctioned under Universal Credit obligations

- Their or their partner’s capital exceeded the savings limit

However, there were exceptions. A person might still receive the payment if their benefits were reduced to £0 due to deductions, such as rent arrears, or if they were receiving hardship payments.

What About Disability and Pensioner Cost of Living Payments?

Two additional categories of support were available.

Disability Cost of Living Payments were available to those who were receiving the following benefits on the specified dates:

- Personal Independence Payment (PIP)

- Disability Living Allowance (DLA)

- Attendance Allowance

- Armed Forces Independence Payment

- Scottish Adult or Child Disability Payments

Pensioner Cost of Living Payments were issued with Winter Fuel Payments and were worth an additional £150 or £300 depending on age and household circumstances.

These payments were issued automatically based on existing benefit records, without the need for application.

Conclusion

The DWP £299 Cost of Living Payment provided essential support to millions of UK households during a time of rising financial pressure.

Issued between 6 and 22 February 2024, it was available to those receiving means-tested benefits or tax credits during the eligibility period in late 2023.

While it was the final scheduled payment in the cost of living support plan, there remains potential for future assistance depending on government decisions.

Those who believe they were eligible but did not receive the payment should contact the relevant department and verify their benefit status.

FAQs

What should I do if I didn’t receive the £299 payment but was eligible?

You should contact the office that pays your benefit or tax credits. You can also check your bank statement for a reference like DWP COL or HMRC COLS to confirm if it was deposited.

Can I still get the £299 payment if I was awarded benefits late?

Yes. If your benefits were awarded retroactively and you met the eligibility criteria during the qualifying period, you should still receive the payment automatically.

Does the £299 payment affect my benefits or tax credits?

No. It is a non-taxable payment and does not affect existing benefit entitlements or assessments.

How can I verify the date of my Universal Credit assessment period?

You can check your Universal Credit journal or login to your account on the GOV.UK Universal Credit portal to find your assessment dates.

Were people on Pension Credit also eligible for the £299 payment?

Yes. If they received a payment for any day between 13 November and 12 December 2023, they were eligible.

Was there a difference in payment dates for tax credit recipients?

Yes. HMRC typically paid tax credit recipients slightly later, between 16 and 22 February 2024, as opposed to DWP’s earlier window.

Are these cost of living payments likely to continue into 2025?

As of now, there are no confirmed plans for new cost of living payments in 2025. Future support will depend on new government policies and fiscal announcements.

Related Articles: