Understanding the ESA Support Group rates for 2025 is essential for individuals in the UK who rely on Employment and Support Allowance due to long-term illness or disability.

With annual updates issued by the Department for Work and Pensions, it’s important to stay informed about the latest payment figures, eligibility requirements, and how these benefits interact with other financial support.

This guide outlines the current rates, recent changes, and the rules affecting ESA claimants in the coming year.

What Are the Current ESA Support Group Rates for 2025?

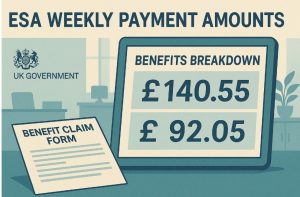

In 2025, individuals placed in the ESA Support Group by the Department for Work and Pensions (DWP) are entitled to:

- Up to £140.55 per week for those in the Support Group

- Up to £92.05 per week for those in the Work-Related Activity Group

These amounts apply after the Work Capability Assessment has been completed and the claimant has been placed in one of the two groups. The 2025 uprating reflects adjustments for inflation, aiming to provide claimants with additional financial support amid rising living costs.

Claimants under assessment for ESA will receive the assessment rate during the initial 13 weeks:

| Age Group | Weekly Assessment Rate |

| Under 25 | Up to £72.90 |

| 25 and over | Up to £92.05 |

If the assessment takes longer than 13 weeks, the claimant will continue to receive the assessment rate until a final decision is made. Any shortfall due will be backdated.

Who Is Eligible for ESA Support Group in 2025?

Eligibility for ESA in 2025 depends on the type of ESA being claimed and the claimant’s individual circumstances.

New Style ESA

This is available to those who have paid or been credited with sufficient Class 1 National Insurance contributions over the past two to three years. Claimants must:

- Be aged between 16 and State Pension age

- Have a health condition or disability affecting work ability

- Not be receiving Statutory Sick Pay or Jobseeker’s Allowance

- Provide medical evidence, usually a ‘fit note’ from a GP

Income-Related ESA

While no longer open to new claims, existing recipients will continue receiving payments if they remain eligible. Income-related ESA is means-tested and depends on:

- Household income

- Partner’s income

- Savings over £6,000 (which may reduce entitlement)

All ESA applicants must undergo a Work Capability Assessment (WCA) unless exempt. Those who are terminally ill or in the final months of life are placed directly into the Support Group.

How Often Are ESA Payments Made and When Will They Be Received?

ESA is paid directly into the claimant’s bank account every two weeks. The payment date is fixed and communicated at the start of the claim. However, payments may arrive earlier if the scheduled date falls on a bank holiday.

It is important for claimants to ensure their bank details are up to date with DWP. Any discrepancies may result in delayed payments or errors in transfer.

What Has Changed in ESA Payments in 2025?

The 2025 updates to ESA payments were published by the DWP as part of their annual benefits uprating.

Key changes include:

- The Support Group rate increased from the previous year

- Adjusted pension thresholds impacting New Style ESA calculations

- Continuation of entitlement to Class 1 National Insurance credits

The benefit cap does not apply to claimants in the ESA Support Group. This ensures those with long-term health needs are not affected by total benefit limits.

How Can Someone Apply for ESA in the UK in 2025?

The process for applying for ESA depends on whether the claimant is applying for New Style ESA (which is open to new applications) or is continuing an existing income-related ESA claim.

Application Steps

- Submit an application online via GOV.UK or by calling the ESA helpline

- Provide required information, including personal identification, income details, and medical evidence

- Await the Work Capability Assessment invitation and complete the assessment

- Receive a decision letter from DWP confirming eligibility and group placement

Claimants may continue receiving the assessment rate until the WCA is completed and their group is determined.

Can ESA Support Group Payments Be Backdated?

Yes, payments may be backdated if there is a delay in assessment or if the claim is processed late. Once the 13-week assessment period is completed and a decision is made, the difference between the assessment rate and the Support Group rate is paid retroactively from the 14th week.

Example: Private Pension Income and ESA Reduction

If a claimant receives a private pension, this may reduce their ESA amount. The DWP rules specify that half of any private pension income over £85 per week is deducted from New Style ESA.

| Weekly Private Pension | Amount Over £85 | ESA Deduction (50%) |

| £100 | £15 | £7.50 |

| £120 | £35 | £17.50 |

| £140 | £55 | £27.50 |

High private pension income can reduce ESA payments to zero, though National Insurance credits will still be awarded.

How Is ESA Different for Mental Health Conditions?

Mental health conditions are increasingly recognised by the Department for Work and Pensions (DWP) as serious and potentially long-term barriers to employment.

Claimants with mental health difficulties such as depression, anxiety, bipolar disorder, schizophrenia, or post-traumatic stress disorder (PTSD) are assessed differently in some parts of the Work Capability Assessment (WCA).

The WCA has a distinct set of descriptors and scoring criteria designed to measure how mental health affects an individual’s ability to perform daily activities, engage in work-related tasks, and maintain social interactions.

The assessment considers both psychological and behavioural challenges, ensuring that claimants with non-visible or fluctuating conditions are evaluated fairly.

Key Differences in Assessment for Mental Health Conditions:

- Social Engagement: Evaluates the ability to initiate and sustain personal interaction, including difficulties with social anxiety or emotional instability.

- Coping with Change: Determines whether the claimant can adapt to new situations or changes in routine without significant distress.

- Awareness of Hazards: Considers whether a person can identify and avoid danger (e.g. self-harm risks or harm to others).

- Daily Living Activities: Looks at whether the claimant can manage personal hygiene, prepare food, or handle finances due to cognitive impairment or emotional distress.

- Communication: Examines whether the person can express themselves or understand others, particularly where communication difficulties stem from mental health.

These assessment criteria often require supporting evidence from a GP, psychiatrist, or mental health support worker. Claimants may also be asked to provide recent care plans, medical history, or letters from community mental health teams.

Those who are unable to work due to the severity or nature of their condition are usually placed in the Support Group, which comes with no requirement to attend job interviews or undertake work-related activity. This group also benefits from a higher ESA payment and additional support components.

In some cases, mental health claimants may initially be placed in the Work-Related Activity Group (WRAG) if the DWP believes they could return to work with support. However, many appeals have resulted in reassignment to the Support Group once further evidence of mental health impact is provided.

What Additional Support Is Available Alongside ESA?

ESA claimants, especially those in the Support Group, may be eligible for a range of additional benefits and premiums that provide financial support beyond the standard ESA rate. These are particularly helpful for individuals who are severely ill, disabled, or managing long-term health conditions.

Premiums Available with Income-Related ESA

For those on income-related ESA (now closed to new claims but still active for many), the following premiums may apply:

- Enhanced Disability Premium: Automatically added for Support Group members. This premium recognises the additional costs faced by people with serious or lifelong disabilities.

- Severe Disability Premium: Available if the claimant lives alone (or only with other disabled adults) and receives a qualifying disability benefit such as Personal Independence Payment (PIP) at the daily living rate.

These premiums are included in the weekly ESA payment and do not need to be applied for separately unless there is a change in circumstances.

Budgeting Loan

Claimants who have been on income-related ESA for at least six months can apply for a Budgeting Loan. This government-provided loan is interest-free and can help with essential one-off expenses such as:

- Home repairs

- Furniture

- Clothing

- Travel costs

- Advance rent payments

Repayments are automatically deducted from future benefit payments.

Interaction with Universal Credit

Some individuals may also be eligible for Universal Credit, either instead of ESA or alongside New Style ESA. This is especially relevant if housing support is needed, as Universal Credit covers rent costs, whereas ESA does not.

- If a claimant transitions from income-related ESA to Universal Credit, the DWP provides two weeks of continued ESA payments to bridge the gap. This does not need to be repaid and does not reduce the Universal Credit entitlement.

- ESA claimants who receive New Style ESA only will not have their housing costs covered by that benefit and may need to apply separately for support via Universal Credit.

Local Authority and Additional Support

ESA claimants may also qualify for:

- Housing Benefit (for those not yet moved to Universal Credit)

- Council Tax Reduction via their local authority

- Free prescriptions and dental care, depending on income and eligibility

- Support from charities and local welfare schemes, especially for individuals in financial crisis or facing homelessness

These sources of support vary by region and are often means-tested, so it’s advisable for claimants to use an official benefits calculator or speak to a welfare adviser.

Conclusion: What Should You Know About ESA Support Group in 2025?

In 2025, ESA Support Group claimants in the UK receive up to £140.55 per week, with updated policies from the DWP designed to better reflect the cost of living.

Eligibility rules remain stringent, especially around health assessments and income limits. Understanding how ESA interacts with other benefits, premiums, and Universal Credit is vital for maximising support.

For full details and the latest updates, visit the official DWP website or speak to a benefits adviser.

FAQs About ESA Support Group Rates and Rules in 2025

What is the difference between New Style ESA and income-related ESA?

New Style ESA is based on National Insurance contributions, while income-related ESA considers household income and savings. New claims are only accepted for New Style ESA.

How long does it take to get assessed for ESA?

The assessment period usually lasts 13 weeks, during which claimants receive the assessment rate. Delays can happen, but payments will be backdated once the assessment concludes.

Can ESA be claimed alongside Universal Credit?

Yes, New Style ESA can be claimed alongside Universal Credit, although income from ESA may reduce the Universal Credit payment.

Do ESA payments increase every year?

ESA rates are typically increased each year in line with inflation through the benefits uprating announced by the government.

Will my ESA stop if I start part-time work?

You may still receive ESA while working under the permitted work rules, but it depends on hours worked and income earned.

Are there different ESA rates for people under 25?

Yes. During the assessment phase, individuals under 25 receive up to £72.90 per week, compared to £92.05 for those 25 and over.

How can I challenge an ESA decision?

You can request a mandatory reconsideration and, if unsuccessful, appeal to the Social Security and Child Support Tribunal.

Related Articles: