Understanding whether the State Pension is taxed at source is essential for anyone planning their retirement income in the UK.

With changes to pension rules and income tax thresholds in 2025, knowing how HMRC handles tax collection on State Pension and other retirement income is more important than ever.

This guide explains how tax is applied, when it’s collected, and what other income can affect your tax position so you can manage your finances with confidence.

What Is The State Pension And How Is It Paid?

The State Pension is a government-provided regular income for individuals who have reached State Pension age and have met the minimum requirement of National Insurance contributions. The two main types of State Pension are:

- Basic State Pension: For individuals who reached State Pension age before 6 April 2016

- New State Pension: For those who reached State Pension age on or after 6 April 2016

Payments are typically made every four weeks directly into the pensioner’s bank account. The amount depends on the number of qualifying years of National Insurance contributions.

The State Pension forms a core part of retirement income and interacts with other personal or occupational pensions when it comes to taxation.

Do You Have To Pay Tax On The State Pension In 2025?

Yes, you may need to pay tax on the State Pension in 2025 depending on your overall annual income.

Tax is payable if your total income exceeds the standard Personal Allowance, which remains at £12,570 for the 2025/26 tax year.

The income considered for tax purposes includes more than just your State Pension. It also covers:

- Additional State Pension (if you were eligible before 2016)

- Private pensions such as workplace or personal pensions

- Earnings from employment or self-employment

- Taxable state benefits like Carer’s Allowance or Jobseeker’s Allowance

- Savings and investments

- Rental income

If your total income exceeds your Personal Allowance, only the amount above the threshold will be taxed.

How Is Tax On State Pension Collected At Source?

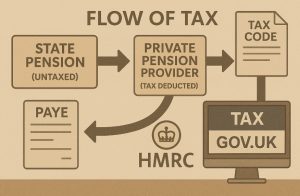

Although many forms of income in the UK are taxed automatically through the Pay As You Earn (PAYE) system, the State Pension is an exception it is not taxed at source.

This means that when the Department for Work and Pensions (DWP) issues State Pension payments, they are paid gross (without tax deducted). This can sometimes cause confusion for pensioners who assume that tax has already been taken care of.

Since the State Pension is a taxable benefit, HM Revenue and Customs (HMRC) must ensure that any income tax owed is collected through alternative means.

This process varies depending on whether the individual has other income streams, such as private or occupational pensions.

When There Is Additional Income?

If you also receive a private or workplace pension alongside the State Pension, HMRC will typically assign a tax code to one of your other pension providers.

This tax code is adjusted to account for the untaxed State Pension amount. The provider then uses PAYE to deduct the total income tax owed this includes tax due on both the private pension and the State Pension.

For example:

- You receive £10,000 in State Pension and £8,000 from a private pension

- Your total income is £18,000, above the Personal Allowance (£12,570)

- HMRC tells the private pension provider to deduct tax as if you’re earning £18,000

- The provider will deduct the tax due on the £5,430 above your Personal Allowance

This system ensures that your tax obligations are fulfilled even though the DWP does not deduct tax directly from your State Pension payments.

When There Is No Other Income?

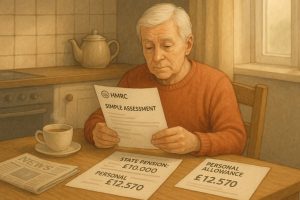

If the State Pension is your only source of income and it exceeds your Personal Allowance, HMRC will send you a Simple Assessment.

This is a straightforward tax bill that outlines how much tax you owe and how to pay it. You don’t need to complete a Self Assessment tax return unless you have other untaxed income or more complex financial affairs.

This ensures that all pensioners, regardless of how many income sources they have, are taxed fairly and in accordance with HMRC regulations.

What Other Income Affects State Pension Taxation?

The amount of tax you pay on your State Pension is determined not just by the pension itself, but by your total taxable income.

While the State Pension is always taxable, you will only pay tax if your combined annual income goes above your Personal Allowance, which is set at £12,570 for the 2025/26 tax year.

Common Sources of Additional Income

Several other income streams could push your total earnings beyond this threshold:

- Private pensions: Any payments from workplace, personal, or occupational pensions are fully taxable.

- Earnings from employment: Many pensioners continue part-time or freelance work after reaching pension age. All employment income is taxable.

- Self-employment income: Profits from any business activity must be declared and are taxed through the Self Assessment process.

- Taxable state benefits: Some benefits like Carer’s Allowance or Jobseeker’s Allowance count as taxable income.

- Investment income: Dividends, interest from savings accounts (above the Personal Savings Allowance), and capital gains can contribute to your taxable income.

- Rental income: Profits from letting property are also added to your total income and taxed accordingly.

Combined Income and Tax Calculation

HMRC assesses all these income streams together to determine if tax is owed. If the total annual income, including the State Pension, surpasses the Personal Allowance, tax is applied to the excess.

Depending on the total amount, you may also move into a higher tax bracket, resulting in more tax being due on part of your income.

For instance, suppose your income breakdown is as follows:

- State Pension: £9,000

- Private Pension: £6,000

- Employment Income: £5,000

- Total: £20,000

In this scenario, your taxable income would be £7,430 (£20,000 – £12,570), and tax would be calculated accordingly, typically at 20% unless higher thresholds are met.

Importance of Reporting All Income

Failing to report all income streams can result in underpaid tax, penalties, or future tax arrears. HMRC uses your tax code to estimate tax due, but it is based on the income sources they are aware of.

If you have savings interest, part-time work, or any other income, you must inform HMRC so they can update your tax code or issue a tax return request.

By keeping accurate records and understanding how various income sources interact with your State Pension, you can avoid unexpected tax bills and ensure compliance with HMRC regulations.

What Happens If State Pension Is Your Only Income?

If you only receive the State Pension and your total income remains below the Personal Allowance, you will not have to pay tax.

However, if your State Pension exceeds the threshold, HMRC will issue a Simple Assessment tax bill. This outlines the amount of tax due and how to pay it.

The key points to remember are:

- Tax is not deducted automatically from the State Pension

- HMRC will calculate your liability based on 52 weeks of payments

- If you exceed the allowance, you will receive a bill without needing to complete a full tax return

How Are Private Pensions And State Pension Taxed Together?

When a person receives both a private pension and the State Pension, HMRC usually selects the private pension provider to act as the tax collector for both income sources. This is how the system works:

- HMRC issues a tax code to the provider that reflects your overall income

- Tax is deducted by the provider using PAYE

- You receive your State Pension tax-free, but the tax owed on it is recovered from your private pension

This ensures that tax is collected even though the State Pension itself is not taxed at source.

What Is The Role Of Tax Codes In Pension Taxation?

Tax codes are critical in determining how much tax should be deducted from your income. A tax code tells your pension provider or employer how much of your income is tax-free and how much to tax.

Common codes include:

- 1257L: The standard tax code for most people

- BR: All income is taxed at the basic rate (used when you have more than one income source)

- K codes: Indicate untaxed income that exceeds your Personal Allowance

If you have more than one pension or a combination of pension and employment, you may have multiple tax codes.

If any tax code is incorrect, it can lead to either underpayment or overpayment. HMRC allows individuals to request a correction if needed.

When Do You Receive A Simple Assessment Or Self Assessment?

If your State Pension is your only income and it exceeds the Personal Allowance, HMRC will send you a Simple Assessment. This is a tax bill that doesn’t require you to complete a Self Assessment return.

However, you may need to fill out a Self Assessment if:

- You have self-employment income

- You receive rental income or investment income

- You receive untaxed income from multiple sources

This process involves submitting detailed income and expense information annually to HMRC.

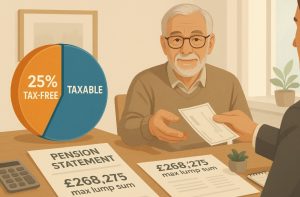

Can You Take Part Of Your Pension As A Tax-Free Lump Sum?

Yes, individuals can usually take up to 25% of their pension pot as a tax-free lump sum. This applies to most personal and workplace pensions.

The maximum allowable tax-free lump sum in 2025 is £268,275, though this may be higher if you have a protected allowance.

The rest of your pension, when taken as income, is subject to tax based on your overall income level.

Here’s how this works:

| Pension Pot Value | Tax-Free Lump Sum (25%) | Taxable Amount |

| £60,000 | £15,000 | £45,000 |

| £100,000 | £25,000 | £75,000 |

| £200,000 | £50,000 | £150,000 |

The taxable amount is added to your annual income, which could push you into a higher tax bracket.

How Do Small Pot And Trivial Commutation Lump Sums Affect Taxation?

Small pension pots and trivial commutation rules allow individuals to withdraw entire pension amounts under specific conditions.

Small Pot Lump Sums:

- Applies to pensions worth up to £10,000

- 25% is tax-free, and the remainder is taxed

- You can withdraw from up to three personal pensions and unlimited workplace pensions

Trivial Commutation Lump Sum:

- Applies if your total private pension savings are less than £30,000

- 25% of the total is tax-free

- Must withdraw all funds within 12 months of the first payment

- Each pension must be valued on the same day within a three-month window

This flexibility is helpful for people with small pensions who wish to simplify their retirement income.

What Happens If You Work Or Are Self-Employed While Receiving A Pension?

It is possible to receive your pension while continuing to work. In this case, your employment income is combined with your pension to determine your total taxable income.

If employed:

- Your employer will deduct tax via PAYE

- Your tax code will reflect your combined income

If self-employed:

- You must complete a Self Assessment tax return

- Report your self-employment earnings and pension income

- Pay tax on the combined amount based on current tax bands

Here is a simplified look at how total income might be taxed:

| Income Source | Annual Amount | Tax Applied? |

| State Pension | £10,000 | No (within allowance) |

| Employment Income | £8,000 | Yes |

| Total Income | £18,000 | £5,430 taxable |

In the example above, the total income exceeds the Personal Allowance, so tax would be due on the difference.

How Is Your Pension Taxed If You Move Abroad?

If you move abroad, taxation on your pension depends on your residency status and whether the country you reside in has a Double Taxation Agreement (DTA) with the UK.

You will usually pay UK tax if:

- You receive a UK pension from a UK provider

- You are still considered a UK tax resident

However, under a DTA, you might only have to pay tax in one country. It is essential to:

- Notify HMRC of your move

- Check if your new country has a DTA with the UK

- Contact local tax authorities for clarity on reporting obligations

Failure to manage your tax status correctly could result in being taxed twice or missing obligations.

What Is The Tax Implication Of Unauthorised Pension Payments?

An unauthorised payment is any pension withdrawal made outside the government’s tax rules. These payments are heavily penalised with a tax rate of up to 55%.

Examples of unauthorised payments include:

- Accessing pension funds before the age of 55 (unless under special conditions)

- Receiving a trivial commutation lump sum that exceeds the £30,000 limit

- Receiving pension payments after death if not structured correctly

Some companies offer schemes promising early access to pension funds. These are often scams and result in unauthorised payments and penalties.

Individuals should always verify any pension withdrawal plan with a regulated financial adviser or HMRC.

Conclusion

While the State Pension itself is not taxed at source, the tax implications depend heavily on your overall income.

In 2025, many pensioners will find that tax is collected through other income streams or via assessment by HMRC.

Knowing your entitlements, tax codes, and allowances ensures you avoid unnecessary bills or underpayments.

By understanding how the system works, you can make informed decisions and better manage your pension income for a secure retirement.

FAQs about State Pension Taxation in 2025

Do pensioners need to fill in a Self Assessment tax return?

Only if they have self-employment income, complex investments, or additional untaxed income. Most pensioners don’t need to unless instructed by HMRC.

Is the new State Pension always taxable?

Yes, it counts as taxable income but is not taxed at source unless combined with other income.

What happens if HMRC miscalculates my tax?

You can request a tax code correction or refund through HMRC services. Always check your P60.

Can I avoid tax by deferring my State Pension?

Deferring may increase your payments later, but the larger amount will still be taxable.

Are inherited pensions taxable?

Yes, but the tax rules depend on whether the person died before or after age 75 and the type of pension.

Will taking too much from my pension put me in a higher tax band?

Yes. Large withdrawals can push you into a higher tax bracket, increasing your tax bill.

Can pension providers make mistakes with tax deductions?

It’s possible. Always review your statements and contact your provider or HMRC if something seems incorrect.